On April 3, 2023, OPEC published a press release saying that a number of countries, both members of this cartel and those participating in the extended OPEC+ format, decided to cut oil production. This was unexpected for the market as OPEC+ managed to keep things in secret until the official publication. Previously, media usually did receive some information about the forthcoming decisions. Alternatively, numerous officials would openly state that the possibility of altering the crude production volumes was under consideration. Moreover, public statements intended OPEC+ willingness to influence the market by changing the quotas have traditionally been an independent instrument of manipulating the oil market. Such moves are known as “verbal intervention.” Yet, OPEC+ has scrapped the trick this time, realizing that its effect is too short-lived, whereas the goal of oil-exporting nations is wielding at least mid-term influence on the market.

The volumes to be reduced, as announced by the OPEC+ member states, were also quite unexpected. On April 3, they declared their intention to cut production by 1.16 million bpd starting in May 2023, but if we take into account Russia’s announced cut by 500 thousand bpd from March 2023, the total reduction of global supply will be close to 1.66 million bpd. These are significant volumes on a global scale. At present, the market is close to equilibrium in terms of demand and supply, so the 1.66 mln cut in crude oil production may tip the scale towards the deficit, which will affect the prices.

Russia benefits greatly from the decision of OPEC+ to cut production. It is important for Russia to monetize our hydrocarbons profitably, which is why Russia is trying to reduce the discount on its oil. Moscow shows that, to achieve this goal, it is ready to reduce production and export volumes. This is a clear signal to the buyers of Russian crude: let’s negotiate a reduction of the discount—otherwise, with a decrease in production, a deficit will emerge, and all the crude will become more expensive globally. Other OPEC+ countries simply want to balance the oil market in order to keep prices high.

From political perspectives, the OPEC+ decision to cut production is also beneficial. After the February statement of Mr. Novak regarding Russia’s intention to cut oil production, many critics interpreted it as a forced measure. They say the sanctions are doing their job, and Russia can no longer produce enough oil without Western technologies, trying to disguise the actual drop in production as a planned voluntary reduction. Following this logic, other producers also face problems, which is, surely, not true. Furthermore, Russia can present the OPEC+ decision in the information space as a proof that the country is not in isolation, as the Collective West struggles to prove.

Western political circles and the media believe that OPEC+ decisions are directed against them, denying OPEC+ members the right to pursue their own legitimate economic interests and instigating a conflict instead, especially between the U.S. and Arab oil-producing countries—above all, Saudi Arabia. Indeed, the decision by a number of OPEC+ states is negative for the U.S. economy, but their motivation has nothing to do with a desire to hurt Western nations as they just want to retain their own revenues.

On April 3, 2023, OPEC published a press release saying that a number of countries, both members of this cartel and those participating in the extended OPEC+ format, decided to cut oil production. This was unexpected for the market as OPEC+ managed to keep things in secret until the official publication. Previously, media usually did receive some information about the forthcoming decisions. Alternatively, numerous officials would openly state that the possibility of altering the crude production volumes was under consideration. Moreover, public statements intended OPEC+ willingness to influence the market by changing the quotas have traditionally been an independent instrument of manipulating the oil market. Such moves are known as “verbal intervention.” Yet, OPEC+ has scrapped the trick this time, realizing that its effect is too short-lived, whereas the goal of oil-exporting nations is wielding at least mid-term influence on the market.

The volumes to be reduced, as announced by the OPEC+ member states, were also quite unexpected. On April 3, they declared their intention to cut production by 1.16 million bpd starting in May 2023, but if we take into account Russia’s announced cut by 500 thousand bpd from March 2023, the total reduction of global supply will be close to 1.66 million bpd. These are significant volumes on a global scale. At present, the market is close to equilibrium in terms of demand and supply, so the 1.66 mln cut in crude oil production may tip the scale towards the deficit, which will affect the prices.

Early in April, it was also announced by the countries willing to comply with the OPEC+ quotas that they would make extra cuts voluntarily, which might unbalance the market even further. The fact of the matter is that many parties to the agreement, for their own internal reasons, cannot produce as much oil as they are permitted as per OPEC+ quotas. By the way, since 2021, Russia has been one of those producers. Yet, it was the states actually fulfilling the quotas that announced the reduction in April 2023.

|

Country

|

Production Cuts, thousand bpd

|

|

Saudi Arabia

|

500

|

|

Iraq

|

211

|

|

UAE

|

144

|

|

Kuwait

|

128

|

|

Kazakhstan

|

78

|

|

Algeria

|

48

|

|

Oman

|

40

|

|

Gabon

|

8

|

|

Total

|

1,157

|

Source: OPEC

One important pattern is worthy of note. Previously, OPEC+ generally cut production quotas proportionally for all parties to the agreement. This meant that the actual supply reduction was less than the declared curtailment of quotas as some countries do not produce as much as they are allowed under quotas. For such countries, quota cuts simply result in narrowing the gap between their actual production and the allowed “cap.” In the April decision, the OPEC+ countries formally proceed from the quotas—however,since they mostly reached the cap in their production, the gap between the declared and the real reduction will be tiny.

Russia, for its part, declared a reduction starting in March 2023 without reference to the existing quotas but to the average level of production in February. This means that Russia intends to cut real production by 500 thousand barrels rather than virtual quotas. Another factor that made the decision of the oil-producing countries even more significant was the long-term nature of the measures taken. The OPEC+ member states declared that the cut would last till the end of 2023. Russia immediately followed suit by declaring that it would also prolong its voluntary cut of production till the year’s end in an bid to strengthen the effect on the market (earlier, the end date for the voluntary cut had not been determined), on the one hand, and to get in sync with its OPEC+ partners acting as a “united front”, on the other hand. The latter factor is important for Russia in terms of OPEC+ political posturing.

The development amps up the announced decision to cut production volumes. Immediately after the OPEC+ participants announced production adjustments, the commodity exchange saw a surge of oil prices. But this was a psychological response of the market, as other countries plan to start the actual reduction in May.

Russian interests

Russia benefits greatly from the decision of OPEC+ to cut production. Back in February 2023, Deputy Prime Minister Alexander Novak, who is in charge of the energy sector, announced the decision of the national leadership to voluntarily reduce production by 500 thousand bpd. That is, Russia would have cut oil production anyway. But the fact that OPEC+ partners are now joining this thrust means that concerted action will have a much greater impact on the market, keeping oil prices at a high level. Russia has its own reasons for the decision to cut production. The country’s leadership is trying to demonstrate to the main buyers of Russian oil—primarily India, China and Turkey—that maintaining pre-sanction oil exports is not an end in itself. It is important for Russia to monetize our hydrocarbons profitably, which is why Russia is trying to reduce the discount on its oil. Moscow shows that, to achieve this goal, it is ready to reduce production and export volumes. This is a clear signal to the buyers of Russian crude: let’s negotiate a reduction of the discount—otherwise, with a decrease in production, a deficit will emerge, and all the crude will become more expensive globally. Other OPEC+ countries simply want to balance the oil market in order to keep prices high.

General benefits also exist. Under a joint cut in production, the demand for tankers will diminish, and hence the cost of transportation. The point is that the global oil market had become inefficient by early 2023, as all exporters were affected by an increase in their transportation leg. Russia now has to redirect its crude to Asian markets, while producers from the Middle East had to replace Russia and redirect their crude to Europe. It turns out that more tankers are needed to transport the same amount of crude. As a result, the cost of oil tanker freight has markedly increased. Lower export volumes as a result of the OPEC+ decision will alleviate this problem, leaving oil companies, including Russian, with more money from the sale of hydrocarbons. Russia’s budget will also benefit from higher oil prices. Even with the discount accounted for, Russian oil prices may rise, which will generate more revenue from the export duty and MET.

From political perspectives, the OPEC+ decision to cut production is also beneficial. After the February statement of Mr. Novak regarding Russia’s intention to cut oil production, many critics interpreted it as a forced measure. They say the sanctions are doing their job, and Russia can no longer produce enough oil without Western technologies, trying to disguise the actual drop in production as a planned voluntary reduction. Following this logic, other producers also face problems, which is, surely, not true. Furthermore, Russia can present the OPEC+ decision in the information space as a proof that the country is not in isolation, as the Collective West struggles to prove. We cooperate and implement joint programs with many states, OPEC+ members being just one example.

Geopolitical dimension

Western media and decision-makers criticized the decision of the OPEC+ countries to reduce oil production volumes. This is a real economic risk for them, since both the U.S. and the EU are net importers of oil. The share of the oil cost in a liter of fuel is very high in the West, so a rise in oil prices quickly leads to an increase in prices on the fuel market for the end consumer. This generates discontent among citizens, as they take more and more money out of their pockets when they fuel their cars. Consequently, support for incumbent politicians is waning. For the U.S., this is extremely relevant in connection with the actual beginning of the presidential campaign. On the other hand, the rising cost of fuel spins up inflation, as the cost of delivery is built into the cost of goods. Western media also accuse the Arab nations of helping the Russian economy by these cuts in production.

Such accusations expose the real problem. Western nations do not want to listen to explanations of OPEC+ member states as to why they decided to reduce oil production. Such a conflict of interests makes itself felt on a regular basis. A telling incident occurred on October 5, 2022, at an OPEC+ press conference after the decision to cut production quotas by 2 million bpd was announced. At the time, Saudi Energy Minister Abdulaziz bin Salman refused to talk to a Reuters reporter. It turned out that the minister had previously given a 30-minute interview for Reuters explaining the reasons for the OPEC+ decision. The editors, however, did not publish the text of the conversation, having replaced it with an article saying that Saudi Arabia and Russia are allegedly colluding as they seek to push oil prices above USD 100 per barrel.

This shows that Western political circles and the media believe that OPEC+ decisions are directed against them, denying OPEC+ members the right to pursue their own legitimate economic interests and instigating a conflict instead, especially between the U.S. and Arab oil-producing countries—above all, Saudi Arabia. Indeed, the decision by a number of OPEC+ states is negative for the U.S. economy, but their motivation has nothing to do with a desire to hurt Western nations as they just want to retain their own revenues. The decision was made in response to the U.S. and the EU policies, whereby the Fed and the ECB, respectively, keep raising the interest rates. This leads to a slowdown in their economies, which means a lower demand for oil. In addition, when the U.S. Fed raises interest rates, money supply shrinks so that less money enters the stock market. That means traders close fewer deals, not buying oil futures, among other things. When demand falls, so does the price of oil futures. Both the U.S. and the European Union never look back on the interests of the oil producing nations as they push down oil prices using monetary instruments. The latest increase of the FRS rate took place on March 23, 2023, that is, a week and a half before the OPEC+ decision to cut the production of crude. So, the oil producers immediately reacted to the U.S. policies. They are eager to keep oil prices from falling rather than hiking them above USD 100 per barrel. Apparently, unless the OPEC+ states decided to cut production, oil prices, given the pressure of monetary factors (rising rates of the Fed and the ECB), could have dropped to USD 60-70 per barrel.

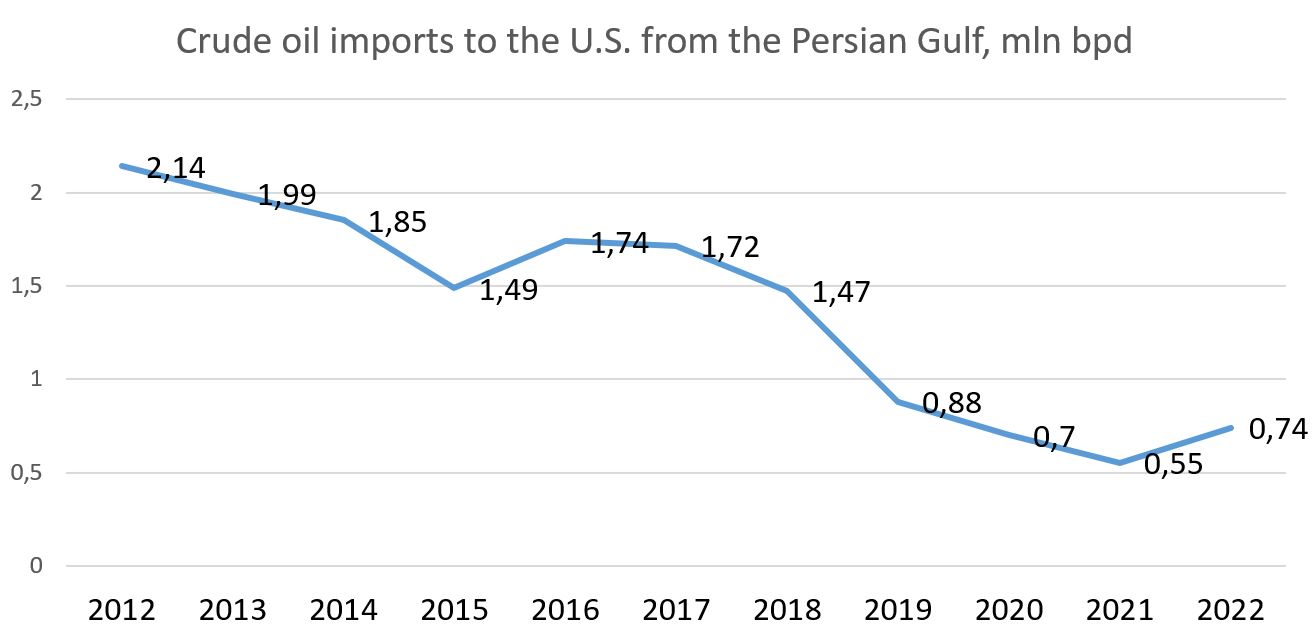

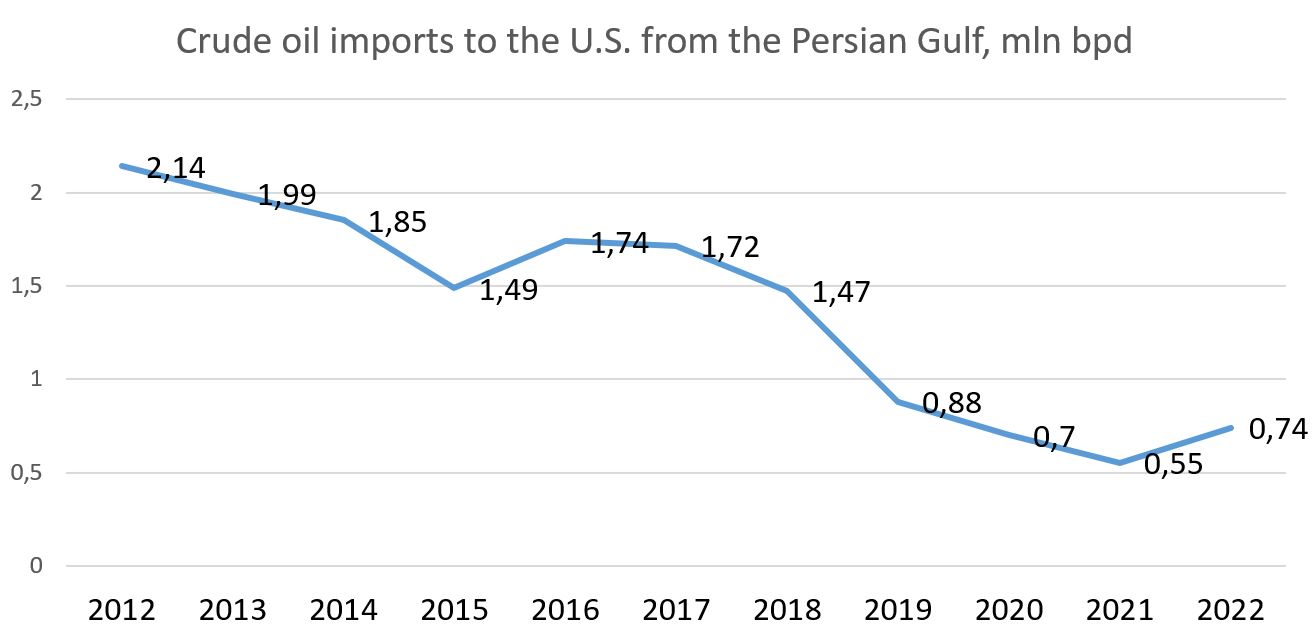

No doubt, there is a certain political implication of the decision made by some OPEC+ countries to cut oil production. It lies in the fact that relations between the U.S. and Arab oil-exporting countries have been cooling of late. The point is that, thanks to the “shale revolution in the U.S.,” oil production has significantly increased since 2010. Even though the U.S. remains a net importer of oil, it cut purchases from other countries. Statistics show that the U.S. prefer to give up on oil from the Middle East, while supplies from Mexico remain stable since 2016 and supplies from Canada are on the rise for several decades in a row.

Source: Energy Information Administration

Such dynamics can be perceived by the Arab countries as a formal U.S. strategy aimed at reducing the dependence on Middle East markets, in order to have a free hand in their Middle East policies. In response, Saudi Arabia will cross over to alternative centers of power, China and Russia. Especially since it is China that has become the largest buyer of Saudi oil.

As for the future, we can foresee a spiral of tensions between the U.S. and OPEC+ states. After all, rising oil prices will continue to whip up inflation. To fight inflation, the U.S. and the EU are raising the key interest rate, putting pressure on oil prices. In response, producers may cut production still further in an attempt to support prices, forming a sort of a vicious circle. To put pressure on Saudi Arabia and other producers, the U.S. could pass the NOPEC (No Oil Producing and Exporting Cartels Act), which would allow the U.S. to impose sanctions on OPEC+ nations under the pretext of antitrust violations. This will cause a backlash down to the imposition of an embargo and a repeat of the 1973 energy crisis. For now, such a scenario is unlikely to happen, though recent developments suggest that no scenario can be totally ruled out.