Indian Prime Minister Narendra Modi is visiting Russia again—and this meeting is likely to be quite different from all previous ones, because over the past two years, India–Russia relations have undergone a transformation that would have been hard to imagine even five years ago. After the start of the special military operation in Ukraine, economic ties with the West began to fray, and the Russian economy urgently refocused on new markets, including India. Trade was growing at a spectacular rate, jumping from $12 billion to $65 billion in two years. Although large holdings have emerged as the driving force behind the rise in trade, small and medium-sized businesses are becoming increasingly more important in boosting trade. Gradually, albeit slower than desirable, India is entering a role that Russia needs it to play: a supplier of technology and ready-made hi-tech products, either Western or its own, built within the framework of Western architecture. In tactical terms, this will provide Russian manufacturers with a much-needed substitute for Western hi-tech imports; in strategic terms, it will allow the Russian economy to avoid technological dependence on China.

Trade between India and Russia continues to grow, but more importantly, Indian exports to Russia are growing in absolute numbers. Now the next stage is looming ahead: the building of production chains with the participation of Russian and Indian companies. This is necessary both for Russian enterprises, which will thereby be able to remove at least part of their production from under the sanctions, and for Indian companies, given that hopes for a stable decoupling between the U.S. and China seem to have been dashed, while the amount of Western investment in the Indian economy, which rose sharply a few years ago on the back of aggressive rhetoric by U.S. leaders, is dwindling.

On the one hand, India is benefiting from the conflict in Ukraine: never before has so much oil been injected into the Indian economy at such a low price. Moreover, Russian entrepreneurs, seeking to evade Western sanctions, are beginning to explore the Indian market, lugging knowledge, money and technology with them. The downsides, however, outweigh the upsides: entering the Russian market now is risky, transactions are difficult, and the need for constant political maneuvering is not going anywhere.

However, after Moscow made it clear that it does not aim to occupy and annex Ukraine, whereas Kiev, despite its rants about getting back to the 1991 borders, will clearly not be able to do so, a window of opportunity is opening for India. It has a real chance to play the role of an arbiter and a moral superpower by acting as one of the mediators and reconcilers. In this sense, Deputy Foreign Minister Pawan Kapoor’s trip to Geneva and Narendra Modi’s visit to Moscow may well turn out to be links in the same chain. The very fact of the Indian prime minister’s visit to the Russian capital is quite telling: before that, both sides tacitly preferred not to poke the Western bear, focusing on practical results rather than fine gestures. But now Modi’s trip will be perceived much warmer in the Western capitals. The Ukraine conflict has been dragging on, Kiev is clearly not going to win on the battlefield, and not only Russia but also the West are suffering from sanctions. There is more talk about a ceasefire and freezing the situation along the demarcation line—and Modi has a chance to score political points for himself by acting as a messenger of peace. Especially when the burgeoning ties between Russia and China are of equal concern to India as to the West, although for different reasons.

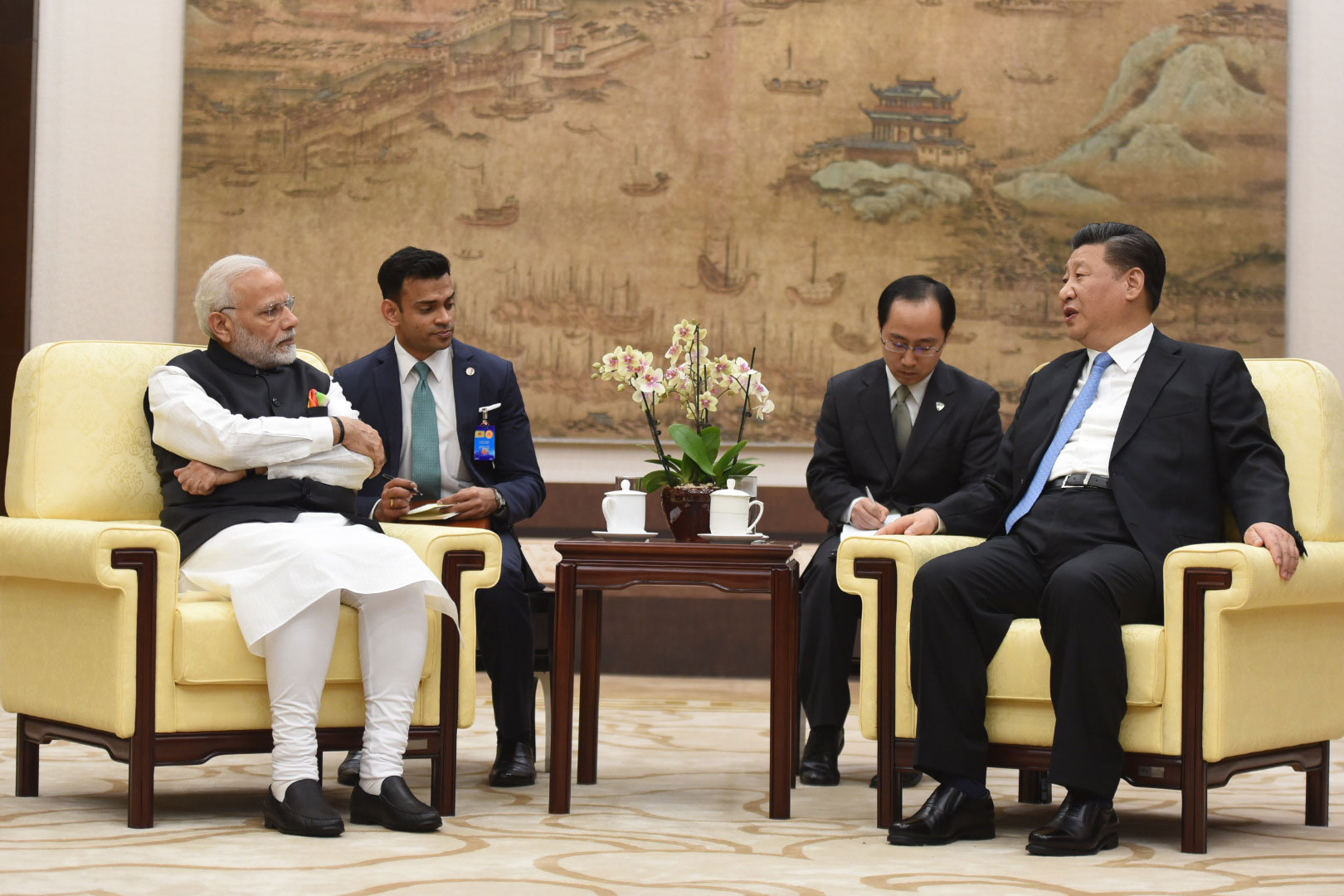

The last time Indian Prime Minister Narendra Modi visited Russia to meet President Vladimir Putin was almost five years ago, in September 2019. The following year, the pandemic broke out, and the Russian leader did not pay a return visit until December 2021. A few months later, the Ukraine crisis began, and since then the annual bilateral summits have been unofficially put on pause. Now, finally, Modi is coming to Russia again—and this meeting is likely to be quite different from all previous ones, because over the past two years, India–Russia relations have undergone a transformation that would have been hard to imagine even five years ago.

Still a Polycentric World

In the previous decade and a half, Russian and Indian political and expert circles have shaped consistent narratives describing the present and future of bilateral relations. While Russian experts nostalgically recalled the good times of Soviet–Indian friendship and deplored the stagnation of trade, Indian experts looked at the situation more pragmatically. Russia in their worldview was an important balancer, helping to escape an excessive bias of Indian policy toward the most promising non-regional partner—the United States. In addition, a further weakening of Moscow, which could push it toward an alliance with Beijing, was seen as a major risk. In the latter case, resource-rich Russia might turn into a multiplier of Chinese power, which was in direct conflict with India’s foreign policy interests. As a result, developing political dialogue with Russia and forming a new polycentric world in which Moscow, as one of the world centers, would be a reliable partner for New Delhi, fully met India’s strategic goals.

The start of the special military operation came as a shock to Indian policymakers. By then, the Indian leadership had by and large outlined and begun implementing a plan for a major restructuring of the national economy that would ensure sustained growth of over 5% per year and India’s gradual emergence as the world’s third largest economy by GDP, which in turn would help reduce social tensions. This required a relatively stable foreign policy situation and continued U.S.–China decoupling, which would stimulate the outflow of Western capital from China and the development of alternative production chains that would bypass the PRC and threatened border zones. India was expected to take advantage of these dynamics and be able to attract Western capital that would bring along modern technology, facilitating a surge in Indian economy. In this scenario, the U.S., Japan, Taiwan, Singapore, Israel and European nations would be assigned the role of capital and technology suppliers, the wealthy Gulf states—the role of investors, whereas China would be looked upon as a convenient adversary and Russia as a balancer.

This whole scheme came apart after the start of the operation in Ukraine. Overnight, Russia ceased to be a balancer, relations between India’s Western partners and Russia deteriorated, Moscow began to drift economically toward Beijing, while India’s relations with China remained as tense as before. In this situation, India was faced with a choice: to dismantle the entire support system of its strategic autonomy, which has been decades in the making, to give in to Western pressure and join the anti-Russia camp, or to stick to the previous course, hoping that the Ukraine crisis would end in the foreseeable future and the situation would more or less improve. The Indian leadership chose the second option, showing remarkable political flexibility: the author of these lines has often attended events featuring Indian Foreign Minister Subrahmanyam Jaishankar, where he skillfully parried all the attacks of Western politicians, experts and journalists, demonstrating that the West itself is slow to sever profitable trade ties with Russia while urging the countries of the Global South to do so. This tactic was successful: by the time Western business finally pulled out of the Russian market, the political pressure on India significantly subsided.

This choice was easier for India than for European nations: for Indian politicians, the Ukraine crisis is a relatively insignificant conflict somewhere on the western tip of Eurasia, much less important than the Afghan conflict, for example. Furthermore, Kiev had been actively developing cooperation with Islamabad over the previous years, supplying Pakistan with weapons. Of course, many people in India sympathize with Ukraine in this conflict, especially among the middle-class, who receive information about world events from the Western media, but the Ukraine crisis does not have a serious impact on India’s domestic political agenda. There were only two notable incidents: the evacuation of Indian students from Ukraine at the very beginning of the conflict and the recent scandal involving the enrollment of Indians as contract soldiers in the Russian army and the subsequent posting of plaintive videos where they plead for evacuation from the trenches. In the end, the ruling party and Modi personally turned the first episode to their advantage by organizing an exemplary operation of repatriating the students; the second instance is still being covered in the Indian media but has slipped out of the spotlight since the elections. Now that the elections are over, it’s time to discuss the backlog of challenges in bilateral relations.

Economy: Onward and Upward

Prior to the special military operation, Russia – India trade was effectively stagnating: passing the $12 billion mark took strenuous effort, this growth being due in no small part to dollar inflation. Traditionally, Russian–Indian economic cooperation was based on three pillars—military-technological cooperation, nuclear energy and space; exports of Indian foodstuffs and light industry products to Russia were slowly increasing, and Indian medicines were steadily carving out a niche in the Russian market. Yet given the course taken by both Russian and Indian leadership to localize manufacturing, business increasingly favored investing and developing production capacity locally. The economies of both countries benefited, but trade stagnated.

After the start of the operation, economic ties with the West began to fray, and the Russian economy urgently refocused on new markets, including India. Trade was growing at a spectacular rate, jumping from $12 billion to $65 billion in two years, with crude oil accounting for the lion’s share of this growth. Initially, Western countries tried to cut off this flow, but Russian big business demonstrated a phenomenal ability to dodge sanctions: they used shell or fly-by-night companies in third countries and shadow fleets, along with other tricks. Indian big business provided much help in establishing bypass routes. In the end, this strategy bore fruit: Western political and economic elites, having realized that their economies may crumble without Russian energy, generally accepted the new reality.

Although large holdings have emerged as the driving force behind the rise in trade, small and medium-sized businesses are becoming increasingly more important in boosting trade. These smaller firms have had a particularly hard time: they have entered an unfamiliar market with a distinctive corporate culture, established rules and specific legislation. But gradually, albeit slower than desirable, India is entering a role that Russia needs it to play: a supplier of technology and ready-made hi-tech products, either Western or its own, built within the framework of Western architecture. In tactical terms, this will provide Russian manufacturers with a much-needed substitute for Western hi-tech imports; in strategic terms, it will allow the Russian economy to avoid technological dependence on China.

Thus, trade between India and Russia continues to grow, but more importantly, Indian exports to Russia are growing in absolute numbers. Now the next stage is looming ahead: the building of production chains with the participation of Russian and Indian companies. This is necessary both for Russian enterprises, which will thereby be able to remove at least part of their production from under the sanctions, and for Indian companies, given that hopes for a stable decoupling between the U.S. and China seem to have been dashed, while the amount of Western investment in the Indian economy, which rose sharply a few years ago on the back of aggressive rhetoric by U.S. leaders, is dwindling.

Blessed Are the Peacemakers

On the one hand, India is benefiting from the conflict in Ukraine: never before has so much oil been injected into the Indian economy at such a low price. Moreover, Russian entrepreneurs, seeking to evade Western sanctions, are beginning to explore the Indian market, lugging knowledge, money and technology with them. The downsides, however, outweigh the upsides: entering the Russian market now is risky, transactions are difficult, and the need for constant political maneuvering is not going anywhere.

Furthermore, Indians do not understand where the conflict is even heading. All the wars and operations that India has conducted since declaring independence were fairly short and did not involve mobilization of the population and economy. The last major war, the Third Indo-Pakistani War of 1971, ended in a quick and decisive Indian victory, showcasing the high quality of Soviet equipment and the advantages of the Soviet art of strategy. Pakistan then suffered a crushing defeat and lost its eastern territories, where the independent state of Bangladesh was founded. The most recent conflict, in Kargil in 1999, was also largely successful for India. In less than three months, Indian infantry, air force and artillery, operating under difficult conditions, routed the invading militants and Pakistani military that supported them, recapturing all the heights they had occupied.

Many people in India expected the Russian army to repeat what the Indians did in 1971, and when it became clear that there would be no blitzkrieg and Russian troops withdrew from Kiev, Kharkov Region and the right bank of the Dnieper River, the pendulum swung the other way. Indian experts expected the Ukrainian side to demonstrate a blitzkrieg during the much-touted offensive in 2023. But its result was close to nil. The shape that the conflict has taken now—with bloody battles over a forester’s hut, partial mobilizations, a shortage of munitions, total transparency of the enemy’s rear, and an obvious unwillingness to militarize the national economy and the entire life—is incomprehensible and unfamiliar to India.

However, after Moscow made it clear that it does not aim to occupy and annex Ukraine, whereas Kiev, despite its rants about getting back to the 1991 borders, will clearly not be able to do so, a window of opportunity is opening for India. It has a real chance to play the role of an arbiter and a moral superpower by acting as one of the mediators and reconcilers. In this sense, Deputy Foreign Minister Pawan Kapoor’s trip to Geneva and Narendra Modi’s visit to Moscow may well turn out to be links in the same chain. The very fact of the Indian prime minister’s visit to the Russian capital is quite telling: before that, both sides tacitly preferred not to poke the Western bear, focusing on practical results rather than fine gestures. But now Modi’s trip will be perceived much warmer in the Western capitals. The Ukraine conflict has been dragging on, Kiev is clearly not going to win on the battlefield, and not only Russia but also the West are suffering from sanctions. There is more talk about a ceasefire and freezing the situation along the demarcation line—and Modi has a chance to score political points for himself by acting as a messenger of peace. Especially when the burgeoning ties between Russia and China are of equal concern to India as to the West, although for different reasons.