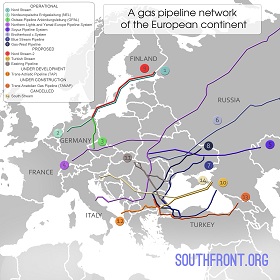

Gazprom seems to be serious in its intention to smooth out differences with the European Commission. After breakdown of the «South Stream» pipeline project, «North Stream-1» multi-year obstructionism, and numerous attempts by Brussels to deprive the Russian gas giant of a competitive advantage in prevent its dominance, events in recent months might boost new projects of the Russian export monopolist in Europe.

Gazprom seems to be serious in its intention to smooth out differences with the European Commission. After breakdown of the «South Stream» pipeline project, «North Stream-1» multi-year obstructionism, and numerous attempts by Brussels to deprive the Russian gas giant of a competitive advantage in prevent its dominance, events in recent months might boost new projects of the Russian export monopolist in Europe.

Gazprom’s first non-arbitral victory is European Commission (EC) reviewing its decision on its use of the Opal pipeline, one of the key ground-level connector pipelines in Germany. Before that, the company was allowed to supply only 18 bcm of gas a year via the pipeline that reaches Czech-German border, which is about 50% of the total throughput of 36.5 bcm. According to the new EC decision, along with the set rate Gazprom gains the right to bid for another 50% of pipeline capacity; the additional gas volume might grow to 12.8 bcm (about 80% of gas carrying capacity). If other suppliers do not take up a provision giving them access, rivals will be given access to up to 20 percent. How does the new scheme work?

Gazprom will have to give 10% of the volume claimed, about 2.6 bcm, to third parties. Should demand for this gas cover at least 90% of the gas volume claimed, next year Gazprom will have to give the equivalent of 15% of the gas volume claimed. This gradation is not endless: when the 20% point is reached, the mechanism is not applicable. Besides, Gazprom will have the right to bid for the 10% that was initially given to third-party companies at the basic rate that, according to the EC, has to comply with prices in comparable European gas pipelines. It is noteworthy, that granting access to third parties depends not on the carrying capacity of the pipeline, but on Gazprom’s gas volume supply. In this way, a situation where all the gas in Opal pipeline is Russian is quite predictable (if the Russian export monopoly stays in force, the gas will also be produced by Gazprom), though part of this volume is already being sold by local operators. It doesn’t mean though that Gazprom will increase its share to the desired 80-90%. At present, Gasprom’s share in Opal is 25.6 bcm, with other volume being claimed by the German energy company Uniper (6.4 bcm) and Gascade, operator of pipelines (4.5 bcm). The gas these companies supply is Russian and runs via «North Stream -1», the property rights shifting to them in Greifswald, where the North Stream reaches the territory of the Federal Republic of Germany.

Ukrainian Discontent

It should be noted that the agreement between the European Commission and Gazprom expires in 2033, while Gazprom’s contract with Ukraine expires in 2019, which is essential. This deal is profitable for everyone except Ukraine, which is about to lose the additional fiscal revenue from gas transit. As expected, the Ukrainian energy community responded resolutely - Ukrainian Naftogaz CEO complained that this decision supports Russia’s plan to destroy Ukraine’s gas transmission system as a competitor in the delivery of gas to the EU consumers. In the event that Gazprom’s share in Opal pipeline capacity reaches 80%, Ukraine transit revenues will fall by USD 290-320 mln, should it reach 90%, no other provisions being made, the decrease will be USD 395–425mln.

Ukraine’s negative response to the situation was expected. The President of Ukraine P. Poroshenko stated that expanding access of Gazprom to the Opal pipeline did not comply with the spirit of the Association Agreement between Ukraine and the EU. He made reference to Article 274 of the Agreement, which provides for mutual accounting of the parties of the potential and opportunities of energy infrastructure. The Ukrainian political elite has approved a project that had been promoted by the International Monetary Fund and discussed for three consecutive years to extract Mahistralni Hazoprovody Ukrayiny (Main Gas Pipelines of Ukraine) gas pipeline system operating company from Naftogaz Ukraine company structure as a key means to reforming the energy sector right after the agreement between Gazprom and the EC was announced.

Gazprom made certain concessions to the EC, which is still concerned about the monopoly status of the Russian company in some European markets. One of these markets is Czech Republic, an Opal pipeline terminal, where the parties have been searching for a mutually acceptable solution for some years. It was in October 2015, that Gazprom applied to use 100% of Opal pipeline capacities. In May 2016, Germany, whose business community is the key lobbyist for Gazprom’s access to Opal, asked the European Commission to free the Opal pipeline from the restrictions of the Third Energy Package and allow Gazprom to use it at full capacity. In 2009, some months after the Third Energy Package, restricting gas transit and supply rules in the EU was approved, while the EC made an exception for Opal pipeline.

First Step towards Total Reconciliation?

It has been announced many times in the recent years that the EC and Gazprom are close to agreeing on settlement terms. According to media reports, the EC and Gazprom are again about to reach an agreement. If successful, the final entry into legal force will require an approval from all the countries involved, which doesn’t ensure its acceptance by Poland or Baltic states who seem resentful towards the «North Stream-2» pipeline construction or towards the gradual decline of Russian supplies via Baltic sea ports.

The EU investigation led by the European Commissioner for Competition Margrethe Vestager, was based on the belief that Gazprom broke European Union Competition Law when supplying gas to eight countries of the integration unit - Bulgaria, Hungary, Latvia, Lithuania, Poland, Slovakia, Czech Republic, and Estonia. In addition to overpricing, another alleged offense is tying gas contracts to the oil quotas and the prohibition of Russian gas re-export. It will be quite difficult for the EC to prove that Third Energy Package provisions are retrospectively applicable, though Brussels will do its best to limit the room for Gazprom’s maneuver.

Taking into consideration the opinion of Russian Ministry of Energy that Ukraine lacks 1.5–2 bcm of gas (only 14.7 bcm was pumped instead of 17 bcm) for a regular winter heating season, the contract with Opal will lead to a softening of Russia’s line in the course of tripartite negotiations Russia-EU-Ukraine on price formation for the gas supplied to Ukraine. Brussels has expressed interest in the tripartite negotiations for several months - Maroš Šefčovič, European Commissioner for Energy was going to reopen the negotiations by autumn, though amid the administrative delays, the visit of the commissioner in October 2016 was called off.

Ukraine-Gazprom Arbitration Procedures

Unlike Gazprom-EC relations, Naftogaz of Ukraine arbitration procedures against Russia’s Gazprom will be presumably completed without compromise from both sides. It has been two years that the action is being processed in the Arbitration Institute of the Stockholm Chamber of Commerce at the request of Ukraine to indemnify for expenses it had on account of gas being overpriced and transit revenue being too low in 2009-2014, as stated by the prosecution, as well as to cancel the contract clause on the «blue fuel» re-export ban. Naftogaz of Ukraine made particulars of a claim worth of USD 27 bln, including USD 14 bln for overpricing and USD 8.2 bln for gas transit revenue.

Gazprom retaliated against Ukraine with a claim of USD 31.75 bln, including the amount owed for gas supply (about USD 29 bln in 2012-2015), fines for take-or-pay contracts, and the amount owed for the gas supplied to the self-proclaimed Donetsk and Luhansk People's Republics. The decision is expected to be made by March 2017, though Gazprom being penalized to pay this prodigious sum of money is an unlikely scenario. Moreover, in June 2016 the same Arbitration Institute held that similar claims from Lithuania towards Gazprom (that the Russian company had to supply gas at a «reasonable» price) were unjustified and the Russian company hadn’t violated competitive conditions. At the same time, a decision in favor of Gazprom is not to be expected, as that would basically mean the total bankruptcy of Naftogaz. A stalemate is the most probable outcome - neither Kiev will be able to retrospectively prove the ill-practices of the Russian side, nor Gazprom will secure the full clearance of debt.