Development Prospects of the Civil Aviation Industry in BRICS Countries

Irkut MS-21 medium-range passenger aircraft

In

Login if you are already registered

(no votes) |

(0 votes) |

PhD in Economics, Senior Research Fellow at the Institute of Applied Economic Studies, Presidential Russian Academy of National Economy and Public Administration

Currently, about 80 companies from 20 countries offer products for the international civil aviation market. On the whole, companies from the U.S., Canada and Europe currently dominate production and sales. With the exception of Brazil, BRICS countries supply, for the most part, parts and appliances for the world's major manufacturers Airbus and Boeing.

Currently, about 80 companies from 20 countries offer products for the international civil aviation market. On the whole, companies from the U.S., Canada and Europe currently dominate production and sales. With the exception of Brazil, BRICS countries supply, for the most part, parts and appliances for the world's major manufacturers Airbus and Boeing.

With the ongoing current recession hitting the market for raw materials and capital outflows occurring from emerging economies, a strengthening of the aviation industry can help promote the development of other high-tech sectors and procure new resources for economic growth. Developing the aviation industry is not only a key challenge for the national innovation systems of the BRICS countries, but also represents a basic requirement on the way to increasing the competitive advantage of BRICS aviation industries on the international market and reducing dependence on imports.

Moreover, the emergence of new actors will promote competition in the global aviation industry, change the existing system of production chains, and contribute to cost reductions in the industry.

Aviation Industries in the BRICS Countries Today

Although the industrial structure of the BRICS countries is heterogeneous, the general trend of their industrial policy is internationalization, including the expansion of exports, attraction of foreign direct investment (FDI), and the technological modernization of production facilities. These areas of work provide a platform for local producers to gain a competitive edge in international markets, including in the aviation industry.

According to European Commission estimates, the collateral effects produced by developing high-tech production systems in the aircraft industry are four times higher for the national economy in terms of the volume and tax base than those produced by the industry itself. Moreover, output beyond the aviation industry exceeds that of the actual sector by 2.8 times and that of sectors supplying products for the aviation industry by 1.2 times [1]. Therefore, the aviation industry is not only a prerequisite for the growth of the BRICS countries’ national economies, but also an indicator of their technological development.

The aviation industry is not only a prerequisite for the growth of the BRICS countries’ national economies, but also an indicator of their technological development.

Currently, BRICS countries occupy different positions and perform different functions in the international aviation production system. Brazil is the undisputed leader among the BRICS countries in this sphere. India and China make up a separate category of countries that provide the technical conditions for the development of the world aviation industry. These countries offer services to aircraft manufacturers by producing parts and appliances and servicing aircraft. This has become possible due to two factors. First, the scope of international cooperation in research and development of production has expanded. Aircraft manufacturers have begun to create joint ventures and grant licenses to produce patented equipment. Secondly, the expansion of trade cooperation among these countries has changed the geography of production location.

Having also oriented its industrial development towards import substitution, South Africa belongs to the number of countries that are actively integrating into the world market of aircraft industry production. South Africa is developing and manufacturing civilian aircraft on its own and in collaboration with the leading producers of the world [9].

Due to constant toughening of international requirements for aircraft technical and operational characteristics, the present-day aviation industry in Russia is radically different from the one from the USSR. Since the Russian Federation regards aviation industry as an indicator of its technological development, the Russian Government its adopting ongoing measures to support its domestic aviation industry.

Barriers to the Aviation Industry Development in the BRICS Countries

General structural imbalances in the economies of the BRICS countries are a key obstacle for developing national aviation industries. These include low demand for high-tech products, segment imbalances, inefficient use of natural resources, and significant socio-economic differences [8]. These problems create significant challenges not only for developing aviation industries, but also for BRICS countries’ integration into the world economy.

However, data for the period from 1980 to 2010 indicate the aviation industry's transition from a labor-intensive to a capital-intensive production model (Table 1). Moreover, except for Russia and South Africa, the aviation industry sector has shown relative growth in added value, compared with other, more labor-intensive sectors of industry. There has been a real technological breakthrough in some BRICS countries. This is particularly true for the Brazilian company Embraer, which has begun to work into the market of regional and short-haul jets since the late 1980s, increasing its market share in the segment of commercial aviation [2].

Table 1. Added value and share of employment in the aviation industry of the BRICS countries, 1980-2010, %

| Brazil | Russia | India | China | South Africa | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | 2010 | 1980 | 2010 | 1980 | 2010 | 1980 | 2010 | 1980 | 2010 | |

| Added value in the sector | 7,5 | 11,3 | 10,2 | 7,0 | 4,8 | 6,4 | 2,6 | 8,2 | 11,5 | 9,5 |

| Share of employment in the sector | 3,5 | 4,7 | 11,2 | 11,1 | 1,4 | 2,5 | 3,3 | 4,2 | 7,1 | 10,9 |

Source: UNIDOINDSTAT, 2012.

Although technology transfer through FDI can be important and successful in theory, in practice this process may be complicated by the lack of mechanisms to adapt new technologies at the national level. Outsourcing production (particularly, in China and India) can slow down the process of industrialization in the aviation industry; the transfer of know-how is not automatic [3]. In addition, the degree of benefits derived from integrating into global production chains in the aviation industry depends on the development of national innovation systems and their ability to spread positive effects to other sectors of the economy.

The degree of benefits derived from integrating into global production chains in the aviation industry depends on the development of national innovation systems and their ability to spread positive effects to other sectors of the economy.

The problem of adapting new technologies is also caused by a low level of efficiency in national research commercialization and weak links connecting different components of national innovation systems. This is partly due to a low degree of business involvement in the high-tech development of the aviation industry.

The key efforts of countries to overcome the above-mentioned barriers are focused on exchanging horizontal and vertical contiguous effects, generated by the aviation industry. Horizontal contiguous effects, produced by aviation industry integration with other related industries working in high-tech production, may become an integral part of the sector’s development. Vertical contiguous effects, implying the transfer of finished production schemes, increase the efficiency of separate segments of aircraft production. Therefore, the exchange of vertical and horizontal contiguous effects among the BRICS countries will intensify their integration into the international aviation production.

The success of future cooperation between the BRICS countries in the aircraft industry will depend on technology and infrastructure, the development of which requires additional support by institutional investors, rather than on “outdated” industrial policy instruments, such as tariffs, quotas, and exchange rate mechanisms. Thus, state support may become the decisive factor for the developing civil aviation industry in the BRICS countries.

State Support: Pros and Cons

It is impossible to analyze the development of aviation industry without studying the issue of government support. It should be noted that government support was the key factor that allowed companies from the U.S., Canada and Europe to gain a competitive edge and occupy dominant positions in the international aviation market. After the WTO dispute between the U.S. and the EU countries, as well as between Canada and Brazil, direct subsidies that had previously prevailed as the main instrument of state support in the 1970s-1990s, gave way to an extended list of indirect support measures, such as tax credits, development of domestic demand, and infrastructure support [7].

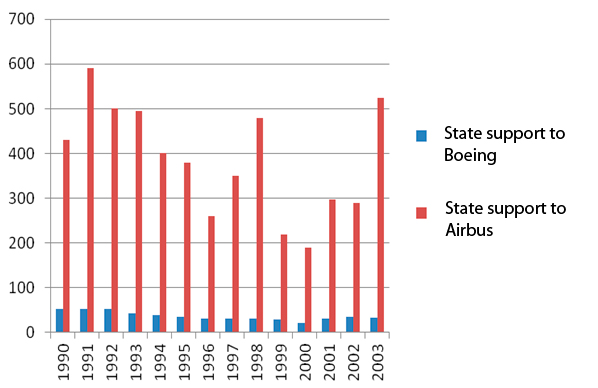

In developed countries, the largest government support was granted to Airbus projects. If the U.S. and EU countries mainly assist in reimbursing research and development in aircraft building, Canada supports exports of aircraft industry products, for example, by compensating interest payments [11]. (Fig. 1)

Figure 1. State support to Boeing and Airbus in 1990-2003

Source: Gellman Research Association, AIA Facts and Figures

As for emerging powers, the development of aviation industry has also seen the importance of state support. Brazil offers the most successful example of government contributions to overcoming structural changes in aviation production and promoting national aviation products on the international market.

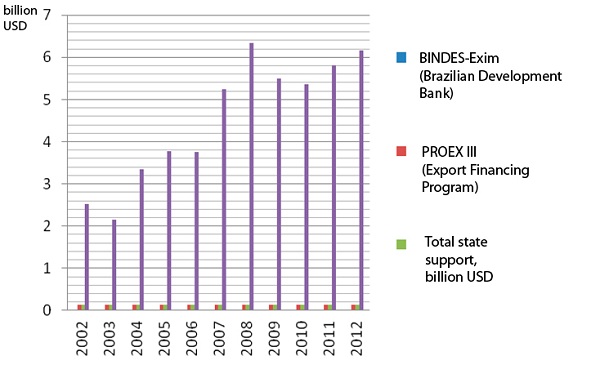

Figure 2. Share of state support in Embraer’s revenue

Sources: Embraer data, United Aircraft Corporation, author’s calculations

State support is a major factor for the development of aviation industry in other emerging powers, namely China, India, and South Africa. The main directions of state support in these countries are tax credits, infrastructure development, and the integration of domestic manufacturers into global and regional production chains. These forms of support help aircraft manufacturers from these countries to contribute to the global aviation industry by offering services to aircraft manufacturers in parts and appliances production and aircraft maintenance.

Table 2. Mechanisms and volumes of state support for the aviation industry in emerging economies

| State support mechanism | Amount of funding |

|---|---|

| Brazil | |

| BNDES-Exim mechanisms (2002-2012) | $ 422 million |

| PROEX III mechanisms (2003-2012) | $ 1.4 billion |

| China | |

| Budget funds in AVIC authorized capital and other assets (2008) | $ 7.5 billion |

| Lax credits (2009) | $ 29.5 billion |

| Export credits (2009) | $ 50 million |

| South Africa | |

| R&D support (2008) | $ 61 million |

Source: compiled by the author

The level of aviation industry development in Russia lags behind the world leaders in this area. Therefore, the current measures taken by the Russian government are aimed at:

- implementing programs to support promising non-profit research projects in order to lay the scientific and technological groundwork (technologies, competences, etc.) for new commercial products;

- providing state subsidies;

- implementing a number of Federal Target Programs (FTP) [6, 12].

Figure 3. Dynamics of state support for 2013-2025

Source: United Aircraft Corporation

Apart from many pros of state subsidies for aircraft manufacturers at the national level, there are cons too. The most significant of the latter is the risk of breaching fair international trade. Up until 2004, the issues of direct and indirect state support for the largest aircraft manufacturers were regulated by the EU-US Agreement on Trade in Large Civil Aircraft [4]. Following the U.S. withdrawal from the framework agreement, the disputes between the parties have acquired a persistent nature [10]. Obviously, strengthening the international market positions of new aviation industry actors from emerging economies will require a new approach and regulations of state support in the context of international trade.

Coordinating opportunities in aircraft industry development will allow BRICS countries to take the lead in the international aviation industry system.

As for Russia, its entry into the WTO has entailed several consequences for is national aviation industry. The most important of them are the abolition of leasing and certification procedures, the reduction of customs duties and taxes in respect of foreign aircraft industry products and the possibility of foreign manufacturers to receive state subsidies [5].

Conclusions and Recommendations

The growth of aviation industry is an integral part of the national strategy of high-tech development not only in Russia but in other BRICS countries too. Moreover, output growth in the aviation industry contributes to increased positive effects for the national economy through the development of related industries. International practice has shown that aviation industry development stimulates the growth of production in supply industries at a higher rate than in the aviation industry itself. Strengthening cooperation among countries can increase the competitiveness of national aviation industry systems, if the following key conditions are met.

First, it is necessary to establish an institutional system of multilateral cooperation that would allow BRICS countries to solve common problems facing their national industrial structures, such as the aviation industry sector, through the sharing of expertise, resources and data. A strategic operational framework, shaping the contours of BRICS cooperation in the aviation industry could become a political tool for its materialization. An action plan with clearly defined objectives, implementation mechanisms, and separate programs may serve as a practical instrument for realizing this type of cooperation.

Second, it is necessary to take full advantage of synergies resulting from cooperation among the countries in the aviation industry. Coordinating opportunities in aircraft industry development will allow BRICS countries to take the lead in the international aviation industry system.

Third, adopting the best practices of the most successful partners in aviation industry development is of crucial importance. Thus, the experience of the industry in Brazil can be applied to other BRICS countries. In the short term, one of the forms of such cooperation could be the joint production of aircraft. Brazilian companies could place an order for components with partners from other emerging economies.

Fourth, cooperation in the aviation industry should imply a close partnership between business and government (for example, public-private partnerships, or PPPs) to minimize the risks and costs of joint investment projects. Since the economies of the BRICS countries are highly risk-laden, PPPs re also needed for research and development, as well as commercialization and technology transfers in the field of aviation industry.

Achieving the goal set by the Russian government to make the country one of five largest economies in the world is inextricably linked to supporting high-tech industries. This affords grounds for expecting not only more mechanisms of state support to the high-tech sector of the aviation industry, but for the introduction of cooperation instruments providing for production growth at the international level as well.

References

1. Analysis of the Joint Technology Initiative (JTI) in the area of aeronautics and air transportation, European Commission.

2. Revenue, Profits and Delivery Orders, the official web site of Embraer. URL: http://www.embraer.com.br/en-US/ConhecaEmbraer/EmbraerNumeros/Pages/Home.aspx

3. 1. Fagerberg J., Shrolec, M., Verspagen, B. (2010). Innovation and Economic Development (In Handbooks in Economics, vol 2, chapter 20, pp. 834—871.

4. EU-US Agreement on Trade in Large Civil Aircraft (LCA), 1992.

5. Protocol of the Accession of the Russian Federation to WTO. Geneva, 16 December, 2011. URL: http://www.economy.gov.ru/wps/wcm/connect/6a8797004983acf68844aa5f9eae86bc/russia_protocol.pdf?MOD=AJPERES&CACHEID=6a8797004983acf68844aa5f9eae86bc

6. The Russian Federation Government Decree dated December 24, 2012 No. 2509. State Program of the Russian Federation “Development of aircraft building industry for 2013–2025” URL: http://www.minpromtorg.gov.ru/reposit/minprom/ministry/fcp/avia2013-2025/text0000000000.pdf

7. Competitiveness of EU Aerospace Industry Aeronautics Industry. Within the Framework Contract of Sectoral Competitiveness Studies – ENTR/06/054. Munich, 18 December 2009. URL: http://ec.europa.eu/enterprise/sectors/aerospace/files/aerospace_studies/summary_aerospace_study_en.pdf

8. Structural Change, Poverty Reduction and Industrial Policy in the BRICS, UNIDO, 2012 p. 23-30.

9. National Industrial Policy Framework. Department of Trade and Industry of South Africa. URL: http://www.info.gov.za/view/DownloadFileAction?id=108831

10. How Russia Joining World Trade Organization Affects Aviation. URL: http://www.corporatejetinvestor.com/articles/russia-joins-wto-aviation-741/

11. International Air Transport: the Impact of Globalization on Activity Levels. Globalization, Transport and Environment, the OECD, 2010.

12. The Federal Target Program “Development of Civil Aviation Technology of Russia in 2002-2010 and up to the year 2015”; the Federal Target Program “Development of the Military-Industrial Complex of the Russian Federation for 2011-2020”.

(no votes) |

(0 votes) |