China's energy strategy

In

Login if you are already registered

(votes: 1, rating: 5) |

(1 vote) |

PhD, Chief of the Executive Committee CIS Electric Power Council

The twenty-first century, characterized by a multipolarity of political and economic life on the planet, saw ensuring national energy security in the development of states and regions as of prime importance. In these circumstances, the Russian-Chinese partnership identified priorities and the most problematic points of contact in the energy sector between these economies. At the same time, Russia faces the task of solving the issues of energy cooperation with China, whilst maximizing economic benefit for itself.

The twenty-first century, characterized by a multipolarity of political and economic life on the planet, saw ensuring national energy security in the development of states and regions as of prime importance.

In these circumstances, the Russian-Chinese partnership identified priorities and the most problematic points of contact in the energy sector between these economies.

The parties, as shown by the experience of cooperation at governmental level and at the level of the leading Russian and Chinese energy companies, have common geopolitical and economic interests, and their consistent implementation is beneficial to both countries. At the same time, Russia faces the task of solving the issues of energy cooperation with China, whilst maximizing economic benefit for itself.

The interests of the energy cooperation between Russia and China

The forthcoming summit of the Asia-Pacific Economic Cooperation (APEC) in September 2012 in Vladivostok will be one of the most important events in the partnership of the Asia-Pacific region (APR). The significance of the summit is shown by the fact that the APEC member countries have about 40% of the world's population and account for approximately 54% of GDP and 44% of world trade. This forum is a forum of 21 regional economies, aimed at increasing economic growth and strengthening of the Asia-Pacific community.

Russia is interested in participating in integration projects in the Asia-Pacific region, a particular role in which is played by Siberia and the Far East, primarily in the fields of energy and transport. The energy issue at the summit in Vladivostok could be key, taking into account Russia's interests and capabilities. The task of the Russian leadership is to make an "energy proposal" which will be profitable for Russia and at the same time it should a proposal from which it will be difficult for Russia’s partners to refuse. China is the major economic player in Asia-Pacific region, in a strategic energy partnership with Russia.

Trade and economic relations between Russia and China in the energy sector are regulated by the worldwide legal norms in line with equal confidence of interaction aimed at the strategic partnership between both countries. The current partnership has been in place for more than twenty years. A new impetus was given to it by the signing of the 2001 Treaty of Good-Neighborliness and Friendly Cooperation Between the People's Republic of China and the Russian Federation by the Russian President Vladimir Putin and the President of China Jiang Zemin on July 16th. The contract was a platform for economic cooperation, including first of all – in the field of energy.

This formed the mechanisms of the Russian-Chinese energy cooperation, based on the political agreement of the parties (the 16th Summit held in October 2011 in Beijing): which produced energetic dialogue, which connected not only representatives of government institutions and businesses , but led to the signing of dozens of agreements between governments and between leading Russian and Chinese energy companies.

The energy potential of the parties

Based on geopolitical and economic interests, the most important point of contact between the economies of Russia and China is locked in the energy strategies of the two countries.

The Chinese economy is the second largest (after the USA) in terms of aggregate GDP, and is the fastest growing major economy in the world. China (along with the USA) is the biggest world consumer of energy resources (in 2010 – it consumed more than 2.3 billion tons of oil equivalent per year), which is of particular interest to the Russian economy.

Russia ranks first in terms of world production of oil and gas: in 2010 oil and gas production totaled about 1.1 billion tons of oil equivalent, including 505 million tons of oil and 650 billion cubic meters of gas, more than 370 million tons and 185 billion cubic meters of which have been exported, respectively.

As you know, China is a direct neighbor of Russia. Western Siberia produces about 70% of Russian oil and more than 90% of gas. In the future, new industrial centers of production and hydrocarbon processing will be Eastern Siberia and the Far East where there have already been discovered 140 large oil and gas fields and it is scheduled to discover another 220. By 2020, based on these natural deposits it is possible to produce 70-75 million tons of oil and 140 billion cubic meters of gas annually. This is the basis of Russia's leadership in supplying hydrocarbon to APEC members in a time of acute demand for energy in the region.

However, until recently Russia only supplied small volumes of energy resources to China. In 2010, 12.5 million tons of oil were supplied, which amounts to 5.2% of the total imports of 239 million tons, and 3.1% of natural gas - (0.5 billion cubic m.) per total pipeline and liquefied and natural gas imports, coal (about 13 million tons), which is about 4% of Russian production and less than 1% of consumption in China.

Supplies of Russian electricity to China are carried out at regional level on the border agreement of local authorities using two transmission lines of 110 kV and 220 kV in the amount of 1.0-1.2 billion kWh / year. In 2011, they built and tested a 500 kV DC link for the expansion of electricity supply without ensuring synchronous operation of power systems between the two states. Input from the line will increase the volume of Russian electricity exports to China up to 4.5-5.0 billion kWh per year.

Prospects for energy partnership between the parties

But the main issue, the price of gas, still remains unresolved: so far a convergence of views, that has been achieved, does not suit any of the parties. This is the main stumbling block in finalizing the strategic transactions which removes the possible scope and timing of its implementation.

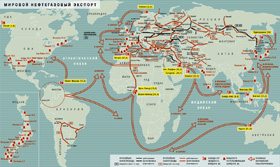

Under these conditions, based on geopolitical and economic interests, the most important point of contact between the economies of Russia and China is locked in the energy strategies of the two countries. Russia is interested in the reorientation of the flow of oil and gas to the European market for high capacity and dynamic Asia-Pacific markets (especially the Chinese market). For China, in turn, it is necessary for the state security, energy security and stable development of the national economy to expand imports of oil and natural gas from Russia.

In 2010-2011, in the field of energy cooperation between Russia and China significant progress was made in the strategic partnership, part of which was the commissioning of the pipeline between Russia - China ("Skovorodino - Dacin"), replacing the system from Eastern Siberia to the Pacific Ocean. Russia received the opportunity to increase trade in energy resources - a large stable and reliable energy market, contributing to progress in advancing the strategy to diversify energy exports. The pipeline from Russia can supply China with 15 million tons of crude oil every year, increasing the total amount of supply up to 35-40 million tons.

To further strengthen the Russian presence in the Chinese market they will need to increase the capacity of the pipeline between "Skovorodino - Dacin" up to 30 million tons, to expand the supply of oil from the sea ports and to increase its transit through Kazakhstan to the existing oil pipeline from Siberia. Total exports of oil and oil products to China could reach up to 70-80 million tons by 2020.

In carrying out such large-oriented international energy projects in China, in the Far East, West and East Siberia, Russia is able to develop with the assistance of reputable foreign investment not only the fuel and energy industries, but also social and transport infrastructure in these regions.

In the area of gas policy years of negotiations between the Russian and Chinese sides are aimed at addressing two major issues - coordination of the delivery areas (western and eastern China) and the price of delivered gas. China is interested in the implementation of the eastern route - from the fields in Yakutia and Sakhalin Island. The position of the Russian side, that of transporting from Western Siberia to the Chinese border via the pipeline known as "Altai", does not agree with the priority of Chinese interests. The Chinese side prefers another option, built in 2009,the pipelines from the Kazakhstan coast of the Caspian Sea and Turkmenistan to Xinjiang Uygur Autonomous Region, and further to the east of the country, as well as a planned for commissioning in 2015, a third gas pipeline from Central Asia to China. China has a contract with Turkmenistan for gas supply (2011 - 17 billion cubic m., 2012 - 30 billion cubic m, the plan is that by 2015 this figure should reach 65 billion cubic m.)

China is planning to receive 10 billion cubic meters of gas from Uzbekistan, and it is possible that it will get 10-20 billion cubic meters of gas from Kazakhstan.

Deliveries of gas from Central Asia to China at affordable prices may, according to the Chinese side, supply all its needs for the region. As for the eastern region, the gas has to come to the northeast of China, where more than 100 million people and a large number of business enterprises suffer a shortage of gas supplies.

After lengthy and difficult negotiations, the Russian Company Gazprom and the China National Petroleum Corporation (CNPC) in late 2009 signed a gas deal for the future, which would make China the biggest consumer of Russian natural gas. In 2010, the parties agreed on the basic conditions of supply, starting with the 2015 plan to deliver 30 billion cubic meters via the already constructed pipeline "Altai" (design capacity - about 70 billion cubic meters) and along the eastern route around 38 billion cubic meters. But the main issue, the price of gas, still remains unresolved: so far a convergence of views, that has been achieved, does not suit any of the parties. This is the main stumbling block in finalizing the strategic transactions which removes the possible scope and timing of its implementation. The long-term inconsistency of the gas price to Gazprom can be considered as the missed time for scale penetration into the Chinese market, especially during the construction of the third stage of the pipeline from Central Asia to China and planned increase in 2015 of deliveries of Central Asian gas to 68 billion cubic meters, which would solve the problem of shortage of gas supplies in the region.

The coal trade remains an important focus of Sino-Russian energy cooperation. As was concluded in the 2010 agreement to supply coal to China the current five-year period provided for its annual imports from Russia an amount of at least 15 million tons per annum, and in the next twenty years up to 20 million tons per annum. For its part China will provide to Russia loans in the amount of 6 billion Yuan for the joint development of coal resources in the Far East, for the acquisition of mining equipment and related infrastructure.

Due to the fact that the Russian Far East is directly adjacent to the north-east of China, Russian large-scale development of coal resources in this area could allow China tosignificantly reduce the cost of transportation. For example, in 2009 the price of imported coal from Russia amounted to 87 USD per ton, while the price of coal from Australia was111 USD per ton. In this situation, strengthening of the Russian strategy focused on the east, and cooperation with China will not only stimulate the Russian coal industry, but also give impetus to economic development in the Far East.

Problem areas of Russian-Chinese energy cooperation

In the broader market supply of energy resources, China has the ability to vary its business partners in the supply of not only gas, but other hydrocarbons.

Russia's energy policy includes the active development of the eastern vector, and a significant increase in the share of Asia-Pacific countries in the export of energy resources. In this respect, China is a key partner; its economy is developing and will continue developing at a rapid pace. For the sustainable development of the Chinese economy it is necessary to increase imports of natural gas and oil. In this regard, Russia is a natural partner for China.

China, for its part, being the largest energy consumer in the world, is building a balanced energy policy. Its essence is not to become dependent on one or another political or geopolitical force (either from America or from Europe or from Russia).

Assessing China's interests, it should be noted that the energy partnership between China and other countries is combined with foreign policy to ensure national energy security. In particular, it concerns the diversification of energy supplies to reduce dependence on North Africa and the Persian Gulf, as events increase the political risks for energy supply to China from these countries. In addition, China accepts the fact that active cooperation with Russia in the energy sector will contribute to a regional system of energy security. Energy supply from the neighboring regions of Russia may be more cost effective and reliable in comparison with the supply from other regions of the world.

By virtue of geography, Russia and China are destined to cooperate, but in a multipolar world, this fact does not ensure its trouble-free nature, especially in the energy sector. By becoming virtually a guarantee of stability of the global financial system, China has made national benefit the priority in making relations with all countries, and only national benefit matters. Having contracts with dozens of countries on the supply of hydrocarbons, and participated in their development, China has a very careful approach to the pricing of obtaining energy resources from Russia. Thus, the problem with promising Russian gas supplies is not solved in the first place because of the reason that Russian gas is not competitive in comparison with the Turkmen gas (160-180 dollars per thousand cubic meters). Gazprom prices are based on the prices of exports to Europe, where it intends to sell it at a price of 280 dollars per thousand cubic meters. Despite some convergence of positions on the gas price in the negotiation process between the Russian and Chinese parties this has not led to a solution, which is fraught with future problems the effects of which were mentioned above.

In the broader market supply of energy resources, China has the ability to vary its business partners in the supply of not only gas, but other hydrocarbons. The result is a situation where Russia is committed to supply China with over twenty years of oil worth $ 100 billion at an average price of about $ 45 per barrel, which is almost two times lower than the market price.

Electricity supplies also have pricing problems, which led, in particular, in 2007 to their cease due to raising prices for electricity exports to China from 0.6 rubles to 1.25 rubles per 1 kW / h. Deliveries were resumed in 2009, but problems remain, since neither the Chinese nor the Russian side like the price. Currently, electricity is supplied to China at a price of 1.32 rubles per 1 kW / h, while the population of the Far East pays 2.0-2.5 rubles, but in general the electricity price in the Amur region is about 5 rubles per 1 kW / h.

The Chinese side has said that local authorities bordering the Russian Far East region were interested in building their own power stations (obtaining additional taxes and dealing with unemployment problem), so the only advantage is to purchase electricity at low prices.

As you can see in the hard economic struggle of interests in the Far East Beijing beats Moscow. The reason for this lies, according to Russian analysts, primarily in the fact that after the collapse of the Soviet Union, Russia has not yet decided what it wants in an easterly direction, and why it needs its own Far East. V. Larin, Professor of the Far Eastern Branch of RAS called this policy spontaneous: Moscow is in the East not due to the wish to become a full member of the Asia-Pacific region, but because of a "a new round of confrontation with the West" and "desire to establish equal relations with it" at the expense of friendship with China.

Given China's strategy Russia should build its trade policies on a similar basis, which is seeking to obtain maximum economic benefit from the partnership in the Asia Pacific region. And for this it is necessary to build a clear agenda for the short and long term period, the implementation of which should provide the participation of Russian energy companies. In this case, it will be possible to get away from unprofitable sales of energy resources in a certain period of time, and redirect their flow from one (China), to a wider market.

Moscow is in the East not due to the wish to become a full member of the Asia-Pacific region, but because of a "a new round of confrontation with the West" and "desire to establish equal relations with it" at the expense of friendship with China.

In addition, it is necessary to accelerate the construction and commissioning of Seaside refinery complexes for the production of liquefied natural gas and a capacity for the allocation of gas valuable components, as well as other chemical facilities in order to make products with high added value.

This will allow Russia, to a large extent, to withdraw from the role of supplier of energy resources, save energy resources for future generations and ensure more profitable sales based on the increase in demand, as well as contribute to the development of regional economy and employment growth in the Far East and the Transbaikalia region.

An important aspect of the organization of Russian energy exports to the Asia-Pacific region (in the first place - in China) is the formation of a clear national export policy, which excludes energy fuel competition in order to maximize export earnings of the Russian companies.

Conclusion

Russia and China, due to their geographical position and long-term traditional friendship between its peoples, have the opportunity to strengthen and develop economic partnerships, including those of priority - in the energy sector.

As a world leader in terms of the reserves of energy resources, concentrated mainly in Siberia and the Far East, Russia has come to use them as a zealous owner. By exporting resources for the rapidly developing markets of Asia-Pacific region, Russia has the ability to vary the type of resources supplied to its customers and the time of sale and prices, primarily in the interests of national benefit. As follows from the above information, the price of hydrocarbons and electricity delivered and planned for delivery to China does not meet the national interests of Russia. It is obvious that the progressive consumption of energy in China in the foreseeable future will be importing cheaper resources from other countries, and then inevitably Russia’s “hour" will come. Based on this approach, it is necessary to build the export of Russian hydrocarbons and electricity in China in the near and distant future, not only in the interests of particular Russian companies.

Another important area of hydrocarbons use, which has been emphasized by Russian analysts but overlooked by business executives and entrepreneurs, is the deep processing of products at source in order to increase value-added products and then export at reasonable prices. The direction of this work is to minimize the role of raw materials for the Russian economy in the world (according to the Federal State Statistics Service of Russia, the share of energy products in Russian exports is 64%).

Thus, the main Russia’s task is to develop and begin implementation of a national fuel and energy policy, which would proceed from their responsibility to future generations for the conservation and rational use of energy resources.

(votes: 1, rating: 5) |

(1 vote) |