Diversifying Kazakhstan’s Economy: From Oil Dependency to Competitive Industrial, Innovative Development

(votes: 4, rating: 5) |

(4 votes) |

PhD, Patent Hatchery LLC, USA

Analyst, Patent Hatchery LLC, USA

Kazakhstan is currently experiencing the negative impacts of volatile oil prices. Kazakhstan's growth slowed from 4.1 per cent in 2014 to 1.2 per cent in 2018, adversely affecting the economy. The economy continued to suffer from a protracted slowdown in global oil prices and weak domestic demand, resulting in a real GDP growth rate estimated at 1 per cent in 2016. The policy problem is that the lower the level of oil prices, the greater the budget deficit, which has a significant impact on the living standards of citizens.

The three major causes are low oil prices, sanctions to Russia and the Eurasian Economic Union, and the switch of oil countries from oil-oriented economy to more competitive sectors. The analysis shows many problems in Kazakhstan’s economy, from low capacity development in critical sectors of the economy, inefficient fiscal and monetary policy and limited R&D to an unfavourable investment and business environment and corruption (Annex 1).

The government of Kazakhstan has been trying to overcome the negative impacts of external factors and internal structural weaknesses by establishing new goals and diversify its economy from hydrocarbon dependency to more innovative sectors. In 2012, the government announced the new Kazakhstan 2050 strategy, which proposes sweeping socio-economic and political reforms to hoist Kazakhstan into the top 30 economies by 2050. The new course focuses on efficient government projects with an increasing role for the innovative private sector, which could be drivers for the future economic growth of the country.

In 2003, the Government of Kazakhstan launched two state programs for the country’s industrial and innovative development (2003-2015 and 2015-2019) as Kazakhstan's new vision and strategy. During the implementation of state programs, many innovation projects failed, and some strategic indicators have not been achieved. Now resource extractors must allocate 1 per cent of the total annual revenue to research and development. According to the Ministry of Industry and New Technologies, the amount of R&D funding by subsoil users will increase up to 250 million USD. However, it is not enough to significantly change the situation. Moreover, Kazakhstan needs an economic transformation from hydrocarbon dependency to more dynamic, export-oriented and productive industrial and innovative sectors to achieve more sustainable and inclusive growth.

A strong intellectual property rights regime, amongst other factors, will contribute to the future prosperity and economic growth of developing countries by strengthening the sustainability of the micro and macroeconomic framework and significantly improving their competitiveness in the global market. The government needs to reconsider the policy framework by creating a new competition policy program to develop institutions that support competition, to encourage the free flow of resources and innovation.

Kazakhstan is currently experiencing the negative impacts of volatile oil prices. Kazakhstan's growth slowed from 4.1 per cent in 2014 to 1.2 per cent in 2018, adversely affecting the economy. The economy continued to suffer from a protracted slowdown in global oil prices and weak domestic demand, resulting in a real GDP growth rate estimated at 1 per cent in 2016. The policy problem is that the lower the level of oil prices, the greater the budget deficit, which has a significant impact on the living standards of citizens.

The three major causes are low oil prices, sanctions to Russia and the Eurasian Economic Union, and the switch of oil countries from oil-oriented economy to more competitive sectors. The analysis shows many problems in Kazakhstan’s economy, from low capacity development in critical sectors of the economy, inefficient fiscal and monetary policy and limited R&D to an unfavourable investment and business environment and corruption (Annex 1).

The government of Kazakhstan has been trying to overcome the negative impacts of external factors and internal structural weaknesses by establishing new goals and diversify its economy from hydrocarbon dependency to more innovative sectors. In 2012, the government announced the new Kazakhstan 2050 strategy, which proposes sweeping socio-economic and political reforms to hoist Kazakhstan into the top 30 economies by 2050. The new course focuses on efficient government projects with an increasing role for the innovative private sector, which could be drivers for the future economic growth of the country.

In 2003, the Government of Kazakhstan launched two state programs for the country’s industrial and innovative development (2003-2015 and 2015-2019) as Kazakhstan's new vision and strategy. During the implementation of state programs, many innovation projects failed, and some strategic indicators have not been achieved. Now resource extractors must allocate 1 per cent of the total annual revenue to research and development. According to the Ministry of Industry and New Technologies, the amount of R&D funding by subsoil users will increase up to 250 million USD. However, it is not enough to significantly change the situation. Moreover, Kazakhstan needs an economic transformation from hydrocarbon dependency to more dynamic, export-oriented and productive industrial and innovative sectors to achieve more sustainable and inclusive growth.

The authors aim to investigate the leading causes of government failures and perspectives by providing policy recommendations for the government of Kazakhstan and explaining the importance of substantial intellectual property rights. This can be done by demonstrating how paying attention to intellectual property rights can facilitate the transition of a developing economy towards sustainable development.

Global Context

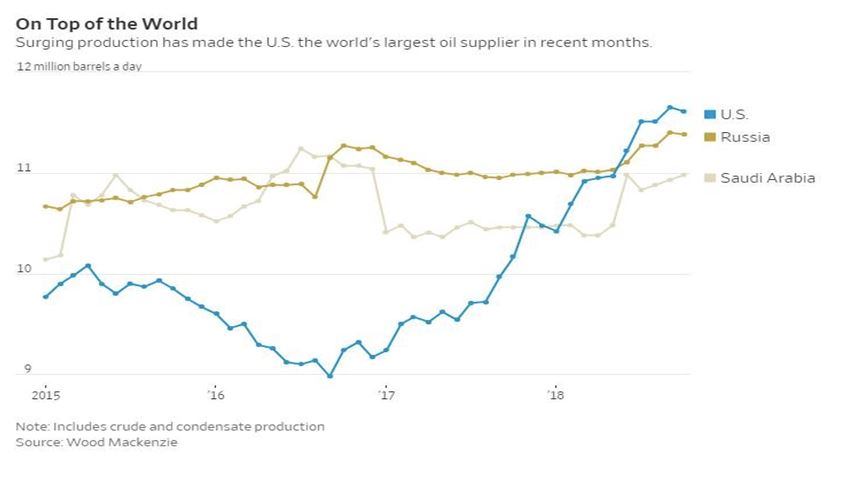

The drop-in oil prices has become a trend in the last five years. There are many factors why oil prices have been declining. First, according to the International Energy Agency (2018), this summer, the US surpassed Saudi Arabia and Russia as the largest crude-oil producer—a title it has not held since 1973. According to the energy consulting firm Wood Mackenzie, monthly output in the US reached a record 11.65 million barrels a day in September and nearly the same amount in October. On the other hand, Saudi Arabia's supply was almost 11 million barrels a day, and Russian production stood at 11.4 million a day (Annex 2). Today, the US is exporting more than it imports, which helps to protect the country from global price fluctuations in its decision whether or not to reduce oil production (Annex 3).

Second, the technological breakthrough has enabled oil extraction by a new innovative method in place of traditional techniques. Production of shale oil has allowed the U.S. to become a global leader of oil and natural gas production. The US output of shale production has doubled since the start of 2012. As a result, it has made the US a key supplier and aggravated concerns about a global excess of crude oil (Annex 4).

Third, Arab countries are trying to diversify their oil-depended economy. Saudi Arabia launched a strategy to diversify its economy via other sectors such as innovation, cluster sectors and tourism. Saudi Aramco has become the most valuable listed company in history, beating Apple, Amazon, and Microsoft with a market value of up to $ 1.9 trillion on the first day of trading. Thus, the government of Saudi Arabia reduced the risks of oil dependency.

Policy Problem Statement

The steep oil price decline beginning in 2014 cut Kazakhstan's oil and gas export revenues (two-thirds of export proceeds) by more than half, and oil revenues (half of the fiscal revenues), by about half. The current account surplus swung to a deficit, as did the fiscal surplus. The negative supply shock, compounded by a slowdown in Russia and China, the country's principal trading partners, caused a depreciation of the Kazakhstani Tenge of 84 per cent, and a loss of foreign reserves of US$30 billion. The state-owned enterprise (SOE) sector, a major employer (30 per cent of the labour force), but dependent on budgetary transfers, faced difficulty servicing external debt. Bank non-performing loans (NPLs) spiked, heightening corporate solvency risks and hampering bank lending. Overall, economic growth (oil and gas output had been a quarter of GDP) slowed from 6.0 per cent in 2013 to 1.2 per cent in 2015, and the national poverty rate climbed from 16.1 per cent in 2014 to 19.5 per cent in 2015. (World Bank, 2016). (Figure 1)

Figure 1

Source: IMF (2017).

Government operation to support private banks led to a higher fiscal deficit in 2017. The government transferred KZT 2 trillion (US$6 billion, 4 per cent of GDP) to buy assets of the largest Kazakh private bank, Kazkommertzbank, to assist its acquisition by the second-largest private Halyk bank (Figure 2).

Figure 2.

Source: IMF, 2018.

As a result, the overall deficit enlarged to 6.5 per cent of GDP from 5.4 per cent in 2016; the non-oil deficit increased to 12.6 per cent of GDP from 9.5 per cent in 2016. While oil revenues picked up, other expenditures remained constant as a share of GDP. Excluding bank support, the non-oil deficit declined from 9.5 per cent of GDP in 2016 to 8.6 per cent in 2017.

State support to banks was funded by transfers from the National Fund of Kazakhstan and issuance of government securities (50/50 per cent) (IMF, 2018).

The government of Kazakhstan reacted to the macroeconomic developments in 2014 and early 2015 with a three-pronged strategy. Also, the government of Kazakhstan made a substantial effort to increase research and development (R&D) activity by initiating core legal reforms, strategies and programs focused on developing science and technology. These initiatives aimed to improve scientific output and have achieved some successes. However, despite these achievements, the goal of more significant innovation and value creation has not been fully realized.

Problems and Challenges: R&D Expenditure

In Kazakhstan, all R&D performing sectors have steadily increased the volume of their R&D activities since 2000. R&D expenditure grew from about KZT 11 billion in 2003 to KZT 69.3 billion in 2015. This rise of investment in R&D has, however, not translated into a concomitant increase in R&D intensity (the ratio of GERD to gross domestic product [GDP]) as the country experienced rapid economic growth during the same period. Against this background, the R&D intensity decreased from a peak of 0.28 per cent in 2005 and has stagnated with some fluctuations between 0.15 per cent to 0.17 per cent since 2010 (OECD, 2017).

According to the Global Innovation Index 2018, Kazakhstan holds 96th place (out of 128) in terms of R&D intensity. Despite systematic efforts, Kazakhstan does not differentiate itself from other Central Asian neighbouring countries which also receive low investment in R&D. All countries in the region have around 0.12-0.17 per cent range. Kazakhstan's GERD is far below the OECD average of 2.5 per cent (2013) and most benchmark countries such as China, Russia, Malaysia or Belarus. According to the World Bank (2013), Kazakhstan substantially lags behind other countries when R&D expenditure per head is considered. In 2013, GERD per capita (in PPP terms) amounted to USD 35 in Kazakhstan, well below the USD 174 per capita invested in the Russian Federation (World Bank, 2016) and the USD 895 per capita average investment in OECD countries (OECD, 2016).

Scientific Publications

Over the past few years, the number of Kazakh scientific publications has considerably increased. According to Scopus (2018), it has doubled, and according to the Web of Science (2018), it has increased threefold since 2010. While on an upward trajectory, the number is still low (1 168 publications in 2014) by the standards of developed countries. Kazakhstan's scientific performance also appears very low when the number of populations normalizes the number: it was 198 publications per million inhabitants over the period 2011-14, compared with 6 707 in Germany, 11 833 in Australia and 3 126 in Malaysia (OECD, 2016). In terms of numbers of publications, Kazakhstan holds 85th position among 239 countries.

Patents

The number of patent applications in Kazakhstan has fluctuated between 1 500 and 2 000 during most of the last two decades, with a peak of 2 764 in 2013. The majority of applicants are residents (68 per cent of applications in 2013). However, the World Intellectual Property Organization (WIPO) data clearly illustrate an increase of patents applied for by non-residents, which is a sign of the internationalization of the innovation system in Kazakhstan beyond the mere acquisition of foreign technologies by Kazakhstan. Another encouraging signal is the near tripling of the number of patent application applied for abroad by Kazakhstan citizens since 2010.

In terms of numbers of resident patent applications, Kazakhstan ranks in 26th in the WIPO global ranking in 2013 (WIPO, 2015) compared to 25th position in 2004. The total number of resident applicants for patents in Kazakhstan in 2014 was 1 820, which represents about 67 per cent of all patent applications made during the year. There is a strong trend of an increased number of patent applications by residents, more and more applying for patents abroad. For instance, there was just only one patent application in 2002 abroad while in 2014 there were 633 such applications.

Statistics show the growth of the number of applications for utility model filed in Kazakhstan. According to the WIPO (2018), the IP office of China received 1.69 million applications in 2017 (see figure 3), followed by Germany (13,301), the Russian Federation (10,643), Ukraine (9,108), the Republic of Korea (6,811) and Japan (6,105). Among the top 20 offices, the Philippines (+22.8 per cent), Kazakhstan (+16.3 per cent) and Finland (+13.1 per cent) witnessed double-digit growth in 2017 – albeit from a low base. In contrast, the number of applications filed in Mexico (−12.9 per cent), Austria (−12.4 per cent), Poland (−12.4 per cent) and the Republic of Korea (−12.3 per cent) fell sharply in 2017.

Figure 3.

Source: WIPO Statistics Database, September 2018.

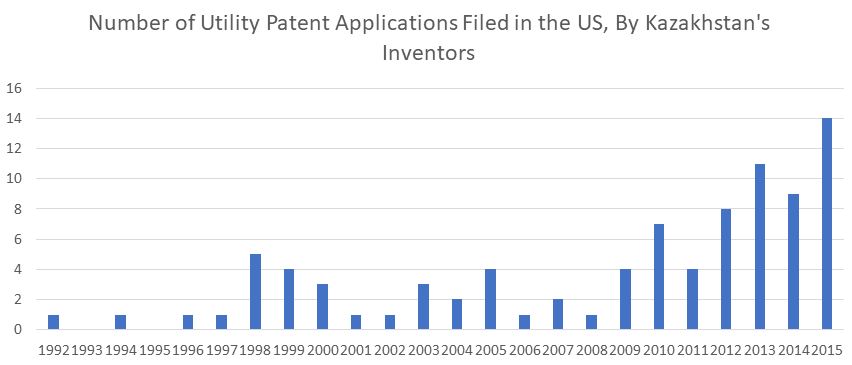

Statistics also show that the number of Kazakhstan utility patent applications filed in the US is steadily increased (Figure 4). In the early years of independence from 1992 to 2002, the number of applications was one per year, except 1998 to 2000. Then, starting in 2003, this number has been steadily increasing, except for 2006 and 2008. Surprisingly, during the global financial crisis from 2009 to 2010 and falling oil prices from 1998 to 2000 and from 2012 to 2015, the number of applications has demonstrated a significant upward trend.

Figure 4

Source: USPTO database.

According to the data of EPO (2019), Kazakhstan is one of the leaders among former Soviet republics in European patent applications filed by a non-EPO state. However, the number of applications is still low compared to leading countries such as Israel, Canada, USA, China, South Korea, and Japan (Figure 5).

Figure 5

Source: USPTO database.

Education

The number of students enrolled in higher education substantially decreased from 2006 to 2016. This decrease is a real problem for the country. Except for Astana, all regions show steadily decline in student numbers. One of the official reasons explaining this tendency is the decline in the birth rate in Kazakhstan in the 1990s.

At the same time, the government has made a significant effort to reform the higher education system. Following the successful model of the world's most prestigious universities, the government of Kazakhstan established Nazarbayev University (NU) in 2011, which was endowed with unique human and financial resources and granted a high degree of autonomy. NU is intended not only to become a world-class research and education institution but also to function as a model for other universities aiming at research excellence and high innovation performance. Therefore, it is expected that ten national universities are going to form the second level of autonomy in the future.

Wong et al. (2007) found that universities shifting from their traditional model to the new "entrepreneurial" model is expected to be even more urgent in the context of the Asian newly industrialized countries and highlighted three reasons for this trend. NU has the same typical symptoms of an institution with the traditional primary role of educational provider. Firstly, NU is a relatively young institution, compared to their academic partners in developed countries. Secondly, while some part of the faculty members are still state employees and university managers, and officials are government appointees, NU tends to have much less autonomy than western analogues. Thirdly, it requires a significant increase in the indigenous capabilities of local enterprises to create and commercialize new knowledge imported from advanced countries.

Development of the Triple Helix Model

According to the Etzkowitz H. and Leydesdorff L. (2000), the main actors of the triple Helix model are science, business, and government. At different stages of innovation development, their roles change. The market plays an essential role in encouraging innovation activities, but it is not always able to provide dynamic innovation development. The government plays a precise function — it develops a long-term strategy of innovation and socio-economic development on the one hand, and, on the other hand, it realizes activities for the support of science and business incentives (Dnishev F. et al. (2015).

Unfortunately, higher education in Kazakhstan is a vestige of the old supply-driven Soviet education system where the majority of universities and scientific institutes function using the teaching model and are subsidized by the government. Scientific institutes and universities do not cooperate with various relevant industries on a regular basis. Scientific research results are not in demand in the economy in general and are hardly commercialized. A business, in general, is concentrated in the commodity sector, which demonstrates a lack of interests in collaboration. There is also a low motivation for entrepreneurs. Moreover, there is a gap between science and business. Previous links between academic institutions and industry were paralyzed following the collapse of the Soviet Union, and new ones have not yet been constructed.

Kazakhstan’s Ranking in the Doing Business and Global Competitiveness Index

Kazakhstan significantly improved its position in the Doing Business ranking. Despite the fact that the country is tackling structural weaknesses in financial market development and its ease of doing business ranking has substantially improved in recent years, the scope of national fundamental problems remains substantial. Kazakhstan fell by one position in the World Bank’s 2018 Doing Business Ranking, to number 36 (out of 190 economies globally). The government reforms focused on three areas captured by the 2016/17 ranking. The registering property indicators demonstrated positive changes improving transparency and dispute resolution mechanisms. Kazakhstan government achieved success within the protecting minority investors indicator, showing registered improvements in the areas of increasing shareholder rights, clarifying ownership, requiring greater transparency, and allowing greater access to information during court proceedings. Kazakhstan also improved its position in the ranking for enforcing contracts following the introduction of respected time standards in civil court proceedings.

Despite moving up in the Doing Business ranking, Kazakhstan’s place on the World Economic Forum’s Global Competitiveness Index (GCI) for 2017–18 has fallen. Kazakhstan fell by four positions and is now at 57 of 137 economies (Annex 5). While the ranking for macroeconomic environment declined the most, owing to higher inflation and lower domestic savings, a general drop was detected in almost all areas; 8 out of 12 pillars registered a lower score than a year earlier. Innovation (84) was constrained by a reduction in private-sector spending on research and development (R&D) and public-sector purchases of high-tech products. On the other hand, there were some positive developments underlined by the index. For instance, Kazakhstan grew significantly in the ranking for health and primary education, higher education and training, technological readiness, and market size.

Dutch Disease

Since the 2000s, the Kazakhstan economy indicates typical signs of the Dutch disease (Akhmetov 2017, IMF 2013, OECD 2016). The Dutch disease can be measured by considering the following symptoms: (i) faster growth in prices of non-tradable goods compared to tradable; (ii) the lagging non-oil tradable sectors of the economy decreasing their share of GDP, exports and employment; and (iii) rapid income growth overcoming productivity growth.

According to an analysis conducted by the OECD (OECD-2016) and the IMF (IMF 2013, 2017), this is what is happening in Kazakhstan. In other words, Kazakhstan's economy, which bases its economic model on oil export revenues, may be at serious risk. For these reasons, the government of Kazakhstan is currently under pressure to help non-competitive sectors, such as agriculture, by subsidizing farmers and imposing import limitations.

Strong Intellectual Property Rights Facilitating the Move Towards Sustainable Development

Today a strong intellectual property rights regime is a crucial factor in becoming a part of the advanced global economy for developing countries. Kazakhstan became a member of the World Trade Organization after 20 years of negotiations on November 30, 2015. One of the obstacles in the talks was the reform of the intellectual property framework. Although the rules of the TRIPS agreement require a strong intellectual property rights (IPR) regime, the strong IPR are extremely important for the country’s development for the following reasons.

The first reason is that strong IPR promotes economic growth and competitiveness. Nowadays, technology plays an essential role in the sustainable economic growth of the country. Intellectual Property Protection is a critical element of the Global Competitiveness Report which measures countries competitiveness as the set of institutions, policies and factors that determine the level of productivity of a country. At the same time, strong IPR encourages investments in the economy. For example, the case of Mexico shows that foreign investment in the pharmaceutical sector has increased since the government established a new legal framework for IPS (Bancomext, 2000). In other words, a strong IPR serves as a guarantee for investors to attract potential investments. Without a healthy root structure, plants do not thrive, and, absent a strong IPR structure, a nation cannot succeed, given the direct correlation between the strength of a nation's IPR regime and economic growth.

The second reason is that strong IPR provides access to technology and stimulates innovation and entrepreneurship. Indeed, accepting the WTO and TRIPS commitments to protect intellectual property, the country opens new markets. As a result, it creates more opportunities for business to access technology. For instance, the famous Korean auto giants, Hyundai, Kia and Daewoo, began with technologies licensed from Ford, Peugeot, General Motors and Mercedes. They then went on to significantly contribute to Korea’s economic development (Nathan Associates Inc, 2003). Moreover, according to the National Bureau of Economic Research (2005), there is a strong correlation between the effects of reform on the royalty payments and R&D expenditures of U.S. multinational affiliates, as well as the level and growth rate of patent filings by non-residents and technology transfer to reforming countries. The survey shows that strong IPR will yield profits by inducing multinational corporations to engage in more technology transfer. This research empirically proved that hypothesis by analyzing the effects of reform undertaken by 16 countries over the 1982-1999 period and finds that all these factors increase the following changes. Thus, IP rights encourage entrepreneurs to keep pushing for new advances in the innovation economy, minimizing risks and potential failure.

In conclusion, all these factors will contribute to the future prosperity and economic growth of the developing countries by strengthening the sustainability of the micro and macroeconomic framework, significantly improving their competitiveness on the global market. The government needs to reconsider their policy framework by creating a new competition policy program to develop institutions that support competition, encouraging the free flow of resources and innovation.

Annex 1

Problem Tree

Annex 2

Annex 3

Annex 4

Annex 5

Diagram 1. Kazakhstan’s ranking in the GCI declined for the second year in a row

Source: World Economic Forum, 2017–18 Global Competitiveness Index.

Bibliography:

Asian Development Bank. 2018. “Kazakhstan: Accelerating Economic Diversification Washington, DC. Retrieved from https://www.adb.org/publications/kazakhstan-economic-diversification.

Akhmetov (2017). Testing the Presence of the Dutch Disease in Kazakhstan, retrieved from https://mpra.ub.uni-muenchen.de/77936/1/MPRA_paper_77936.pdf.

Bancomext (2000) The pharmaceutical industry in Mexico, retrieved from http://www.academia.edu/1026711/The_impact_of_stronger_intellectual_property_rights_on_science_and_technology_in_developing_countries.

Dnishev. F., F. Alzhanova and G. Alibekova (2015), “Innovative development of Kazakhstan on the basis of triple helix and cluster approach”, Economy of the Region, No. 2(2015), pp. 160-171, Retrieved from http://cyberleninka.ru/article/n/innovative-development-of-kazakhstan-on-the-basis-of-triple-helix-and-cluster-approach.

Doing Business Ranking, 2018. Washington, DC. Retrieved from http://www.doingbusiness.org/content/dam/doingBusiness/media/Annual-Reports/English/DB2018-Full-Report.pdf.

Etzkowitz H., Leydesdorff L. (2000). The dynamics of innovation: from National Systems and “Mode 2” to a Triple Helix of university-industry-government relations, retrieved from https://www.sciencedirect.com/science/article/abs/pii/S0048733399000554.

Forero-Pineda, C. (2006). The impact of stronger intellectual property rights on science and technology in developing countries. Research Policy, 35(6), 808-824. Retrieved from http://www.academia.edu/1026711/The_impact_of_stronger_intellectual_property_rights_on_science_and_technology_in_developing_countries.

Global Competitiveness Report, 2018. Washington, DC. Retrieved from http://reports.weforum.org/global-competitiveness-report-2018/?doing_wp_cron=1543449956.7898581027984619140625.

Global Competitiveness Index (2018) Retrieved from https://www.weforum.org/reports/the-global-competitveness-report-2018.

Global Innovation Index (2018). Retrieved from https://www.globalinnovationindex.org/gii-2018-report.

International Monetary Fund (IMF). 2012a. “Macroeconomic Policy Frameworks for Resource-Rich Developing Countries.” Washington. Retrieved from http://www.imf.org/external/np/pp/eng/2012/082412.pdf.

International Monetary Fund. 2017 “Republic of Kazakhstan: 2017 Article IV Consultation-Press Release; and Staff Report” Washington, DC. Retrieved from https://www.imf.org/en/Publications/CR/Issues/2017/05/09/Republic-of-Kazakhstan-2017-Article-IV-Consultation-Press-Release-and-Staff-Report-44884.

International Monetary Fund. 2018 “Republic of Kazakhstan: 2018 Article IV Consultation-Press Release; and Staff Report” Washington, DC. Retrieved from https://www.imf.org/en/Publications/CR/Issues/2018/09/14/Republic-of-Kazakhstan-2018-Article-IV-Consultation-Press-Release-and-Staff-Report-46243.

International Monetary Fund. 2017. “A Crude Shock: Explaining the Impact of the 2014-16 Oil Price Decline Across Exporters. Washington, DC. Retrieved from https://www.imf.org/en/Publications/WP/Issues/2017/07/18/A-Crude-Shock-Explaining-the-Impact-of-the-2014-16-Oil-Price-Decline-Across-Exporters-44966.

International Monetary Fund. 2017. “Economic Diversification in Oil-Exporting Arab Countries”. Washington, DC. Retrieved from https://www.imf.org/external/np/pp/eng/2016/042916.pdf.

International Monetary Fund. 2003. “GCC Countries: From Oil Dependence to Diversification”. Washington, DC. Retrieved from https://www.imf.org/external/pubs/ft/med/2003/eng/fasano/index.htm.

National Bureau of Economic Research (2005). Do Stronger Intellectual Property Rights Increase International Technology Transfer? Empirical Evidence from U.S. Firm-Level Data/ Retrieved from https://www.nber.org/papers/w11516.

Nathan Associates Inc. (2003) Intellectual Property and Developing Countries. Retrieved from https://www.hsdl.org/?view&did=446296.

OECD. (2007). Competitive Regional Clusters: National Policy Approaches, 2007. Retrieved from http://www.oecd.org/cfe/regional-policy/competitiveregionalclustersnationalpolicyapproaches.htm.

Poh-Kam Wong, Yuen-Ping Ho and Annette Singh (2007), Towards an “Entrepreneurial University” Model to Support Knowledge-Based Economic Development: The Case of the National University of Singapore. World Development vol.35, № 6, pp.941 -951, 2007, retrieved from https://www.sciencedirect.com/science/article/abs/pii/S0305750X07000381.

World Bank. 2013. “Oil Rules: Kazakhstan’s Policy Options in a Downturn.” Washington, DC. Retrieved from https://openknowledge.worldbank.org/handle/10986/16721 \.

World Bank. 2017 “Kazakhstan - The economy is rising: it is still all about oil - country economic update” Washington, DC. Retrieved from http://documents.worldbank.org/curated/en/563451512743145143/Kazakhstan-The-economy-is-rising-it-is-still-all-about-oil-country-economic-update-Fall-2017.

(votes: 4, rating: 5) |

(4 votes) |

The biggest threat to Central Asia’s security is the overflow of terrorist activity from Afghanistan

The Paradoxes of Social and Economic Development in Central AsiaCentral Asia is riddled with many paradoxes that pose serious challenges to the region’s socio-economic development