Argentina: Fighting on the Outskirts

The fledgling military-technical cooperation between Russia and Argentina was the subject of a recent article. The only recent contracts between the two parties are the delivery of two helicopters. The Armed Forces of the Argentine Republic are in dire need of rearmament, and China has arrived to fill that niche, being more active on the market than Russia.

In 2011, for example, Argentina’s Fábrica Argentina de Aviones “Brigadier San Martín” S.A., the oldest aircraft manufacturer in Latin America, signed an agreement with China National Aero-Technology Import & Export Corporation (CATIC) on the joint production of the Z-11 helicopter, a “clone” of the French AS350 Eurocopter.

In June 2013, Jane’s Information Group reported that Argentina was in talks with the Chengdu Aircraft Industry Group on the supply of FC-1 lightweight fighters. Цhat happened to that deal nobody knows.

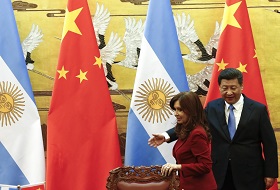

A working group on fighter jets was set up following President Cristina Kirchner’s visit to China in February 2015. According to Jane’s Information Group, Argentina was offered J-10 fighters. Experts believe that the Latin American country might need as many as 300 such aircraft.

In June 2015 it was reported that Argentina had purchased 110 armoured vehicles manufactured by the Chinese company Norinco. Negotiations took place as part of an extensive programme of military and technical cooperation between the two countries that included several projects, one of which was the production of 8×8 wheeled armoured vehicles. In addition to the delivery of 110 units to Argentina, the agreement provides for the joint production of BTR VN-1 armoured vehicles, which will be assembled at combined Tandanor and SINAR facilities in Buenos Aires. Not only will this allow Argentina to supply its armed forces with the required volumes of equipment, it will also give the country the opportunity to re-export the vehicles to other countries in the region.

China has also offered to purchase corvette warships and provide assistance in the construction of icebreakers.

Peru: China’s Counterattack

Peru is both a new and long-established partner for Russia on the Latin American arms market. The country was a major buyer of Soviet weaponry back in the 1970s and 1980s. Now that weaponry is both worn out and outdated, active relations can be resumed in this sphere.

According to Dmitry Shugaev, Deputy Chief Executive Officer of International Affairs at Rosoboronexport, between 2002 and 2015, the company signed contracts to the tune of more than $700 million with its Peruvian partners. At the 2015 International Exhibition of Technology for Defense and Prevention of Natural Disasters (SITDEF), which took place in Lima in the middle of May, Shugaev stated that Peru was a strategic partner of Russia in Latin America. In 2015, Peru’s defence budget (which included national security) increased by 20 per cent compared to 2014.

The main threats to peace in Peru are narcoterrorism and territorial disputes, as well as the active rearmament of its neighbours, above all Chile. All of this implies a spike in military spending.

President of the Republic of Peru Ollanta Humala decided back in 2012 to modernize the country’s outdated air fleet. The decision was dictated primarily by the increased activity of drug traffickers and armed gangs in the valleys surrounding the Apurímac, Ene and Mantaro rivers. Russia was quick to take advantage of the new opportunities that had presented themselves, and in late 2013 the purchase of 24 Mi-171Sh helicopters was announced. The $406 million contract was the largest bilateral agreement between the two countries since Soviet times. The programme to modernize the Peruvian Air Force by upgrading the MiG-29 fighters delivered during Soviet times was set to be another bonanza deal for the Russian defence industry. However, it seems that only eight fighters have been upgraded to the MiG-29SMT version, with negotiations on the upgrading of a further eight machines apparently stalling. In autumn 2014, Jane’s Information Group reported that the Russian side had offered to sell MiG-35 fighters to Peru instead of upgrading the MiG-29 models.

Military-technical relations between the two countries continue to grow, as do the now-traditional vectors in Russia’s foreign military-technical cooperation of technological collaboration and knowledge transfer. In September 2014, the two countries signed an agreement on the construction of a helicopter service centre in the town of La Joya. The repair centre, which will open in 2016, is the result of an offset agreement signed as part of a 2013 contract containing a stipulation allowing the Peruvian side to provide repair services for Mi-17 family helicopters to other countries in the region.

It was announced at the SITDEF 2015 defence exhibition in spring 2015 that Rosoboronexport was ready to provide the Peruvian side with certain defence technologies and even a license for manufacturing of individual types of weapons. In particular, we are talking about the localization of the production of Kalashnikov AK-103 assault rifles. The deal, which could amount to $69 million, involves the construction of an assembly plant and the eventual manufacture of 7.62mm calibre cartridges with technical documentation and the training of personnel. The first 10,000 units of the assault rifle will be assembled entirely out of components brought in from Russia. After this, 30–50 per cent of the components will be produced in Peru. In addition, Russia has offered to supply up to 110 BTR-80 armoured vehicles to Peru, which will also be assembled locally.

Another promising market niche on the Peruvian defence market for Russian weaponry is air defence. And Russia has something to offer in this respect as well. Specifically, at SITDEF 2015 Russia demonstrated its “Sosna” and “Palma” land- and sea-based anti-aircraft missile systems.

Russia is also attempting to return to the Peruvian market for land combat equipment, although it faces competition from China in this sphere. Over the past five years, China has delivered a small amount of its Man-Portable Air Defense systems (MANPADS) to the country, and has decided to offer the Peruvian side Chinese-made armoured vehicles.

In the late 2000s, Peru returned once again to the subject of replacing its outdated T-55 battle tank fleet. A committee on the purchase of these vehicles was set up to consider offers. At the time, Peru was eager to restore military parity with Chile, which already had German Leopard tanks in its arsenal. The Peruvian Government was looking at the Chinese MBT-2000, the Ukrainian Oplot, the German Leopard and the Russian T-90S. Ollanta Humala’s predecessor opted for the MBT-2000, as it was the cheapest option. A deal between Peru and China never came to be struck, however, because of a ban imposed by Ukraine on re-exporting its technology (Chinese tanks used Ukrainian-made transmission systems and engines).

As of the present time, Humala has revived the project to modernize the country’s tank fleet. The Ministry of Economy and Finance of Peru has allocated $820 million for the purpose, which should be enough to purchase around 100 new tanks.

Ecuador and Bolivia: The Chinese Offensive with Mixed Results

Considering the political leanings of the Bolivia and Ecuadorian leaders, as well as the tight budgets of these countries and the need to modernize their national armies, Russia and China should definitely be considered the most promising partners in terms of military-technical cooperation.

However, despite the fact that Russia and Ecuador have signed an agreement on military-technical cooperation, there has been little to shout about on this front. In 2006, the two sides held talks on the purchase of 18 Mi-17Sh helicopters. According to SIPRI data, a deal was struck in 2009 (and the contract executed in 2011), but this was for the supply of just two helicopters.

In 2013, President of the Republic of Ecuador Rafael Correa, and then Minister of Defence María Fernanda Espinosa, announced the country’s intention to develop military-technical ties with Russia, noting the interest in both purchasing finished products and gaining access to technologies. A serious stumbling block to the development of relations of this kind (and not only with Russia) is the fact that the Constitution of the Republic of Ecuador has a ban on the purchase of weapons on credit. It is probably for this reason that the Russian–Ecuadorian Intergovernmental Commission on Military-Technical Cooperation, which met in in Quito in April 2014 and in Moscow in May 2015, did not bring any tangible results in the form of signed contracts.

China’s attempts to break into the Ecuadorian military market have been even less successful. After the Columbian Air Force’s incursion into Ecuadorian territory in 2008, which destroyed a FARC camp and killed one of its leaders, Raúl Reyes, Ecuador signed an agreement with China on the purchase of four mobile three-dimensional radar stations (two long-range YLC-2V stations and two short-range YLC-18 stations). The $60-million deal was substantial for the small South American nation. However, in April 2013, it was reported that the Chinese radars were incompatible with Peruvian aeronautics and the deal was subsequently annulled. Ecuador demanded that China pay a compensation for terminating the contract and announced a new tender for the purchase of radar systems, which was eventually won by the Spanish Indra Sistemas.

China has developed much closer relations with Bolivia on the arms market. This is hardly surprising, seeing as though the two countries have been working together in this sphere since the early 1990s, when Bolivia purchases anti-aircraft guns, howitzers, MANPADS and AT assault weapons [1].

Cooperation between the two countries has stepped up over the past five years. Bolivia makes extensive use of Chinese aviation equipment. The Bolivian Air Force has six Hongdu K-8 jet trainer aircraft, which were delivered by the Chinese side to Evo Morales’ government in 2011. That same year, the countries signed a major agreement on the purchase of two MA60 passenger jets and six Z-9 H425 helicopters. The $103-million agreement was financed by a $300-million line of credit extended by the Chinese side to Bolivia in 2012.

Military-technical cooperation between Russia and Bolivia is extremely limited. Right now, the issue being negotiated concerns the purchase of Russian helicopters by the Bolivian side. In spring 2014, Minister of Defence Ruben Saavedra reported that his agency was seeking to purchase multipurpose Mi-17 helicopters, which would be needed for the fight against drug trafficking. The Bolivian delegation visited Moscow in mid-March, although no information regarding the purchase of Russian helicopters was forthcoming.

***

Given the current state of the local economies, the Latin American region cannot replace the traditional arms markets of Russia and China. However, these markets are important for both countries in terms of diversifying supplies, and their military presence in the Western hemisphere remains relevant for obvious geopolitical reasons.

China poses a greater threat to Russia in the medium term than Western countries on the region’s smaller markets, where the end price of the products and the best offers in terms of financing deals and offsetting programmes for their implementation continue to be the decisive factors. What is more, the economic dependence of Latin American countries on China, which will only continue to grow in the coming years, will have a noticeable impact. By providing loans to poorer countries, China opens up new niches for itself on the Latin American arms markets.

Russia is trying to make greater use of offsetting transactions and looks for opportunities to finance projects that are of interest to the countries in the region. However, these efforts have not always proved successful. In addition to this, non-economic factors, such as the strained relations with the West and the reputational risks that have carried over from earlier projects, play an important role. One such example is the construction of a plant for the manufacture of Kalashnikovs in Venezuela. The new factory in Caracas was expected to create 800 new jobs and allow the country to export the assault rifles to third party countries and manufacture its own products at the facility. But the project stalled, which would have been far from encouraging for neighbouring countries, including Peru, where Rostec wanted to open a factory for the very same purpose. Russia is also dogged by the fact that it repeatedly missed deadlines when carrying out upgrades on MiG-29 fighters for Peru. The contract has now been honoured in full, but the bad taste surely remains in the mouths of the Peruvian side.

Time is running out for Russia to correct the situation and keep a hold on the Latin American arms market. Ten years ago, for example, broader military-technical cooperation with Bolivia was a real possibility, if only Russia had been more flexible in terms of its pricing and credit policy. Now, however, the relatively small Bolivian market is oversaturated with Chinese weapons, and there is little chance that the country’s government will start buying from Russia in an attempt to diversify its suppliers.

Here, Russia’s sole advantages in terms of the products and technologies it traditionally offers and its readiness to take part in joint projects, like it does with the “big” countries in the region, are not enough. Economically challenged countries tend to be difficult partners. But cooperation with them can bring economic and political dividends in the long run. And China understands this all too well. In order to do this, however, it is necessary to sink money into these countries now – and this is something that Russia, it would seem, is either unable or unwilling to do.

1. Barabanov, M.C., Makienko, K.V., Pukhov, R.N., Rybas, A.L. Russia’s Military-Technical Cooperation with Foreign States: A Market Analysis; ed. By A.L. Rybas. Moscow: Nauka, 2008.