A little over six months ago, Beijing overtook San Francisco as the global leader in the number of unicorn companies. The Shanghai-based Hurun Research Institute reported 82 unicorns in the Chinese capital compared to 55 in Silicon Valley. This success was made possible by the accumulation of a critical mass of knowledge and resources, the maturity of the startup ecosystem, and government support.

Emulating American startup models helped the budding Chinese online sector to acquire, consolidate and develop new skills and technologies. By adapting and optimizing their projects for the Chinese market, the “American copycats,” helped by aggressive domestic competition, were able to grow into world-class companies.

By 2010, the experience accumulated by Chinese companies enabled the country to become the global leader in the number of patent applications by 2010. China has held first place for ten years, with most of the patent applications filed by individual enterprises. Analysts say that most Chinese unicorns are supported by technology giants such as Alibaba, Tencent, Baidu, JD, Xiaomi, Qihoo 360, Lenovo and Fosun.

The giants nurture a new generation of startups by providing a well-developed infrastructure and ample investments. At the same time, the young unicorns accelerate the growth of the titans by bringing in external potential and know-how, as well as increasing their capitalization through access to external resources.

According to the Decision of the State Council on Accelerating the Cultivation and Development of Strategic Emerging Industries, the added value generated by the seven strategic emerging sectors will account for 15 per cent of the country’s GDP by 2020.

Over the next decade, Chinese startups nurtured in the mature startup ecosystem will scale up and perfect their technologies, relying on government policies and the support of giant companies. Despite the record decline in GDP in the first quarter of 2020 and the socio-economic consequences of COVID-19, the scientific and technological potential that China has amassed will contribute to the unprecedented growth of unicorn startups, especially in the strategic emerging industries.

In October 2019, China overtook the United States in the number of unicorn companies, defined as startups that have achieved a capitalization of more than $1 billion over a short period of time. In total, the Shanghai-based Human Research Institute (Hurun) identified 206 Chinese unicorns compared to 203 companies of American origin. According to their estimates, China and the United States account for more than 80 per cent of all unicorns in the world.

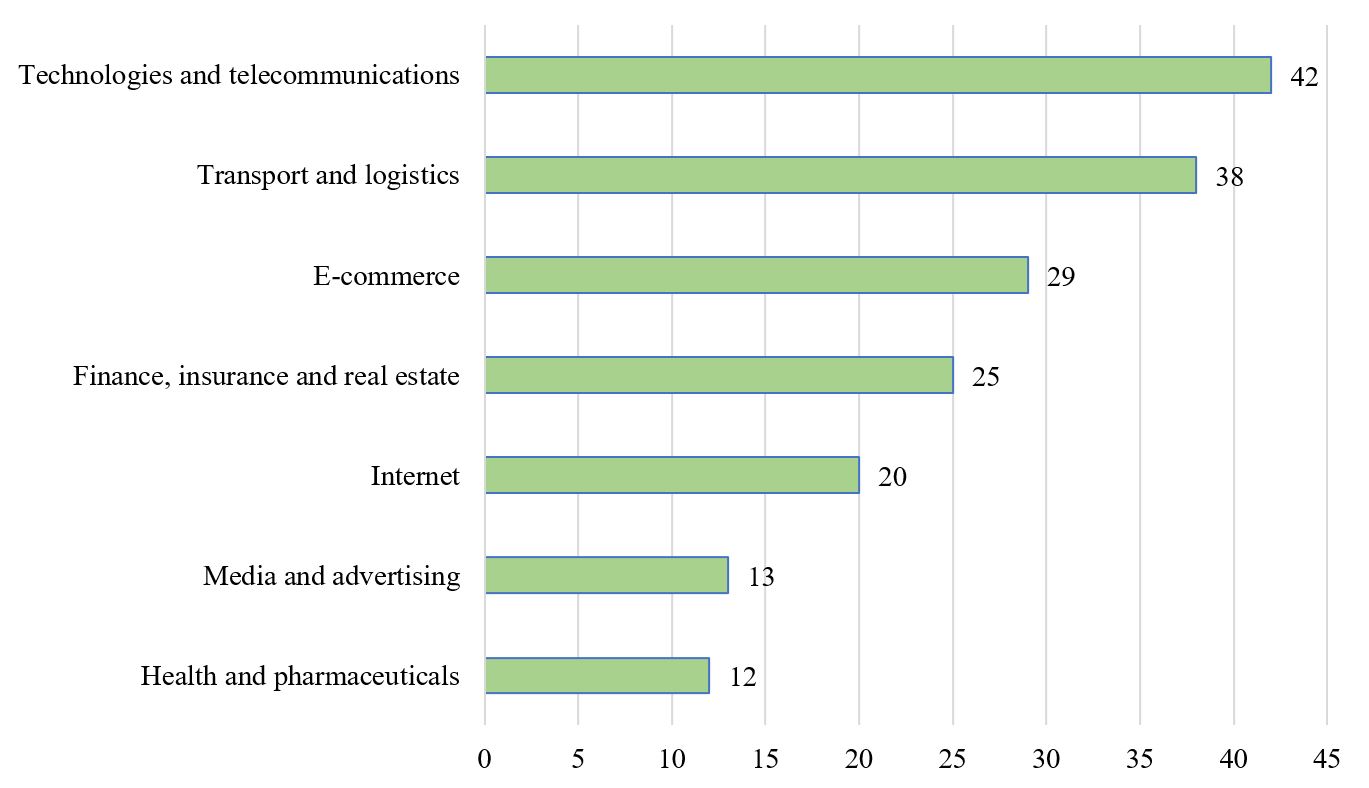

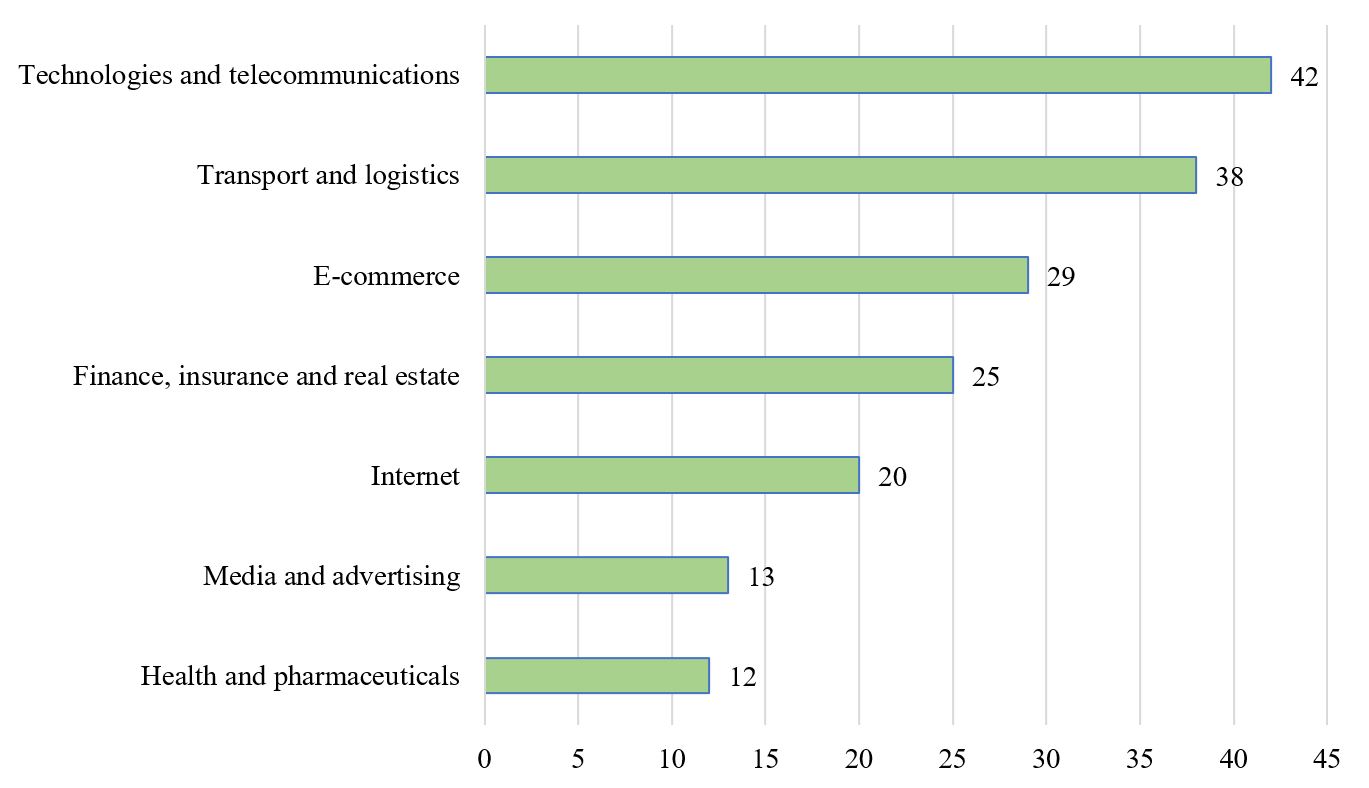

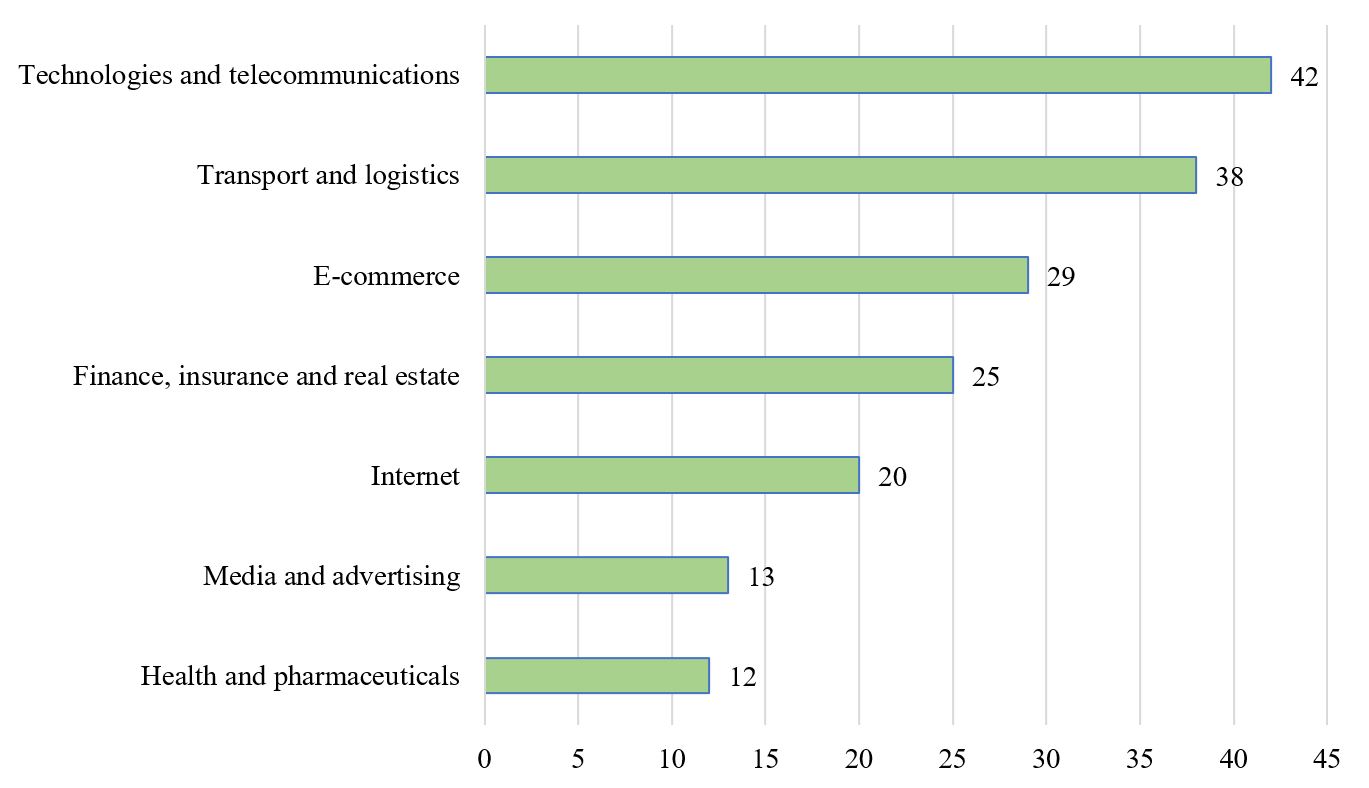

Distribution of Chinese Unicorn Startups Among the Top Seven Industries. Source: Statista, January 2020.

However, Hurun’s estimates differ from the latest data from the CB Insights research team, according to which the number of unicorn companies in the United States is twice as high as in China, with 226 and 121 startups, respectively.

The critical difference between the data lies in the calculation methodologies. In order for a company to be included in the Hurun list, it needs to satisfy four main criteria: 1) the company must have been founded in 2000 or later; 2) it must be valued at $1 billion or more; 3) it must be financed by external investors; and 4) it must not be a public company.

Fortune magazine’s list of unicorn startups is based on a cumulative assessment of data from PitchBook, CB Insights, news reports and its own research. For example, CB Insights, headquartered in New York, does not include the Chinese startup Ant Financial, which has an estimated market value of $125 billion.

For comparison, a 2017 estimate from the Deloitte and China Venture global startup statistics put the number of Chinese unicorns at 98, a little fewer than 106 in the United States. In June 2016, the ratio of Chinese to American unicorn startups to American ones was 34 to 47, according to the McKinsey Global Institute.

The Imitation Game

Three decades ago, the startup environment in China was not a particularly thrilling research topic.

Social media platforms such as Facebook, Twitter and YouTube, as well as online services such as eBay, Groupon, Uber, BuzzFeed and PayPal, and even search engines such as Yahoo! and Google, were all bluntly copied. The imitators of Brin, Page, Yang and Kalanick borrowed the basic concepts, targeted advertising system, colour schemes and designs, and chose similar names (e.g., Sohoo, now Sohu). Facebook's Chinese counterpart Xiaonei (now Renren) went so far as to run the slogan "A Mark Zuckerberg Production" in the footer of its pages.[1]

Emulating American startup models helped the budding Chinese online sector to acquire, consolidate and develop new skills and technologies. By adapting and optimizing their projects for the Chinese market, the “copycats,” spurred by aggressive domestic competition, were able to grow into world-class companies.

By 2010, the experience accumulated by Chinese companies enabled the country to become the global leader in the number of patent applications by 2010. China has held the first place for ten years, with most of the patent applications filed by individual enterprises. Analysts say that most Chinese unicorns have been supported by technology giants such as Alibaba, Tencent, Baidu, JD, Xiaomi, Qihoo 360, Lenovo and Fosun.

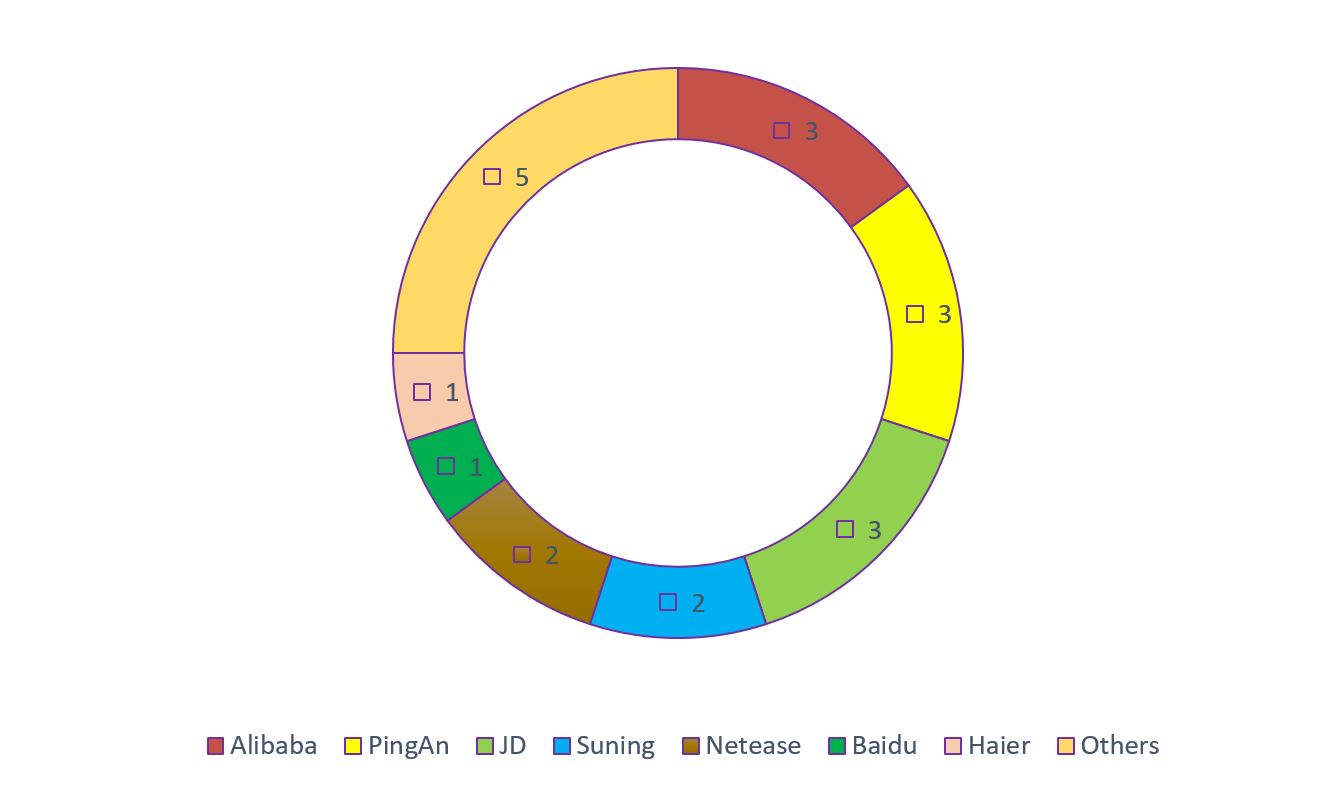

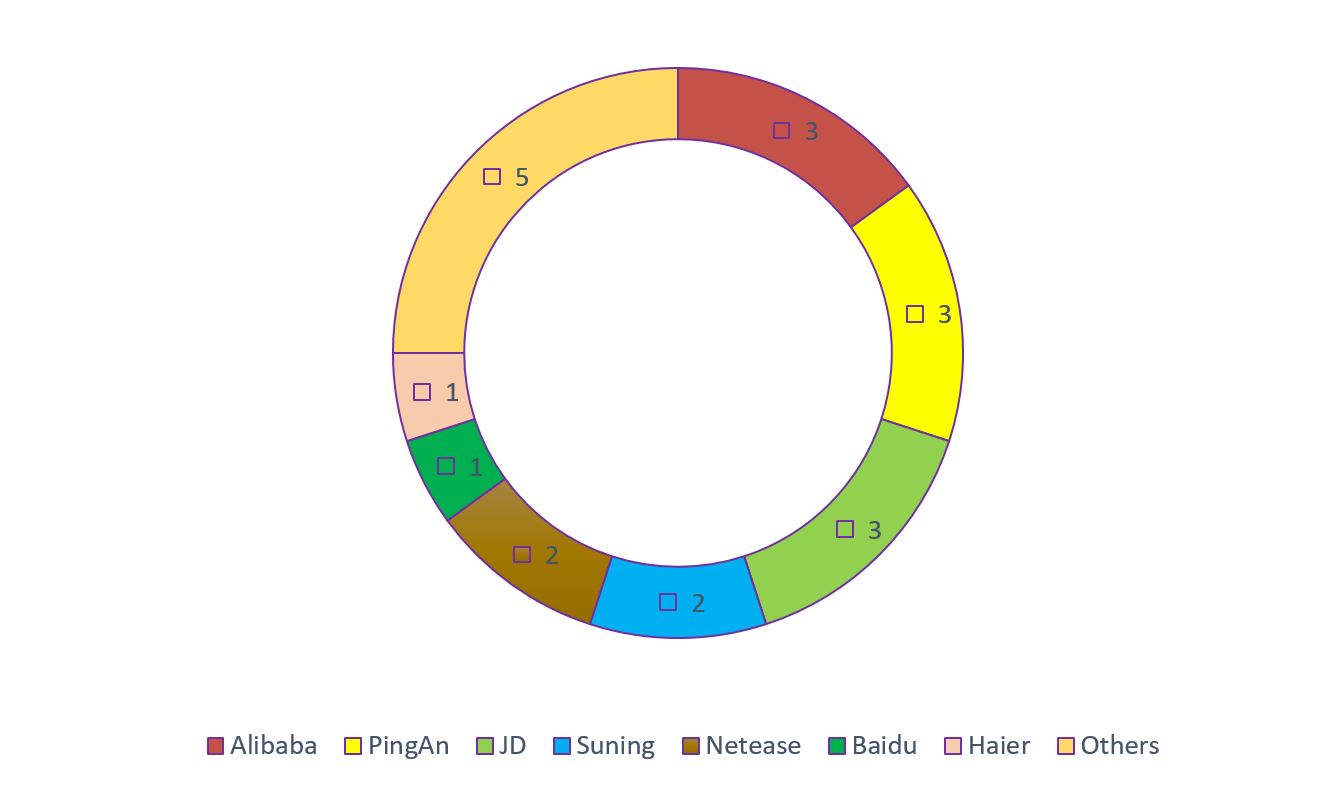

The giants nurture a new generation of startups by providing a well-developed infrastructure and ample investments, while the young unicorns accelerate the growth of the titans by bringing in external potential and know-how, as well as increasing their capitalization through access to external resources. For example, the highest-valued Chinese fintech startup Ant Financial was spun out of Alibaba in 2011; the financial marketplace Lufax (estimated at $38 billion) separated from PingAn the same year; and JD Digits (formerly JD Finance, $19 billion) and JD Logistics ($12 billion) were transferred from the internet giant JD in 2013 and 2004, respectively.

Chinese Companies that Grew Unicorns. Source: Hurun 2019.

In their 2019 financial statements, China’s listed companies reported an increase in R&D spending, which amounted to $59 billion. Among the 1193 companies included in the analysis, 189 saw R&D investments rise by over 50 per cent, while 75 companies reported growth of more than 100 per cent. Overall, R&D spending increased by 21.88 per cent.

R&D Costs of Chinese Giants, million USD. Source: Statista, Bloomberg, Macrotrends, Statstic, Gizmochina, Fosunpharma annual reports: 2017, 2018, 2019.

China’s market is large, young and is avidly embracing new technologies, which provides for the rapid commercialization of digital business models. Digital tools (online applications) for internal consumers support the growth of capitalization, increase the companies’ competitiveness and encourage rapid innovation.

Innovation is the Watchword

After the financial crisis of 2008, the Chinese government adopted a package of anti-crisis measures to revive the economy and began a turn towards increasing competitive advantages, adjusting the structure of the industry and developing new sectors. Along with the stress on agriculture and projects to provide livelihoods and raise incomes in urban and rural districts, China’s key priorities included developing advanced technologies and promoting technical innovations. Over the next two years, the Chinese government allocated 4 trillion yuan (about $570 billion) to priority areas of economic development.

In September 2009, responding to the new economic environment and international competition, Premier of the State Council of the People’s Republic of China Wen Jiabao (2003–2013) identified a number of “strategic emerging industries,” that formed the basis of a long-term development programme and served as a kind of roadmap for China’s economic revitalization.

On October 10, 2010, the State Council of the People’s Republic of China officially announced its Decision on Accelerating the Cultivation and Development of Strategic Emerging Industries.

|

Industry

|

Industry subdivision

|

|

Next-generation IT

|

Network infrastructure; next-generation mobile communications; next-generation internet; next-generation core equipment and smart terminals; three-network convergence; internet of things; cloud computing; new displays; high-end software; services based on value-added internet and other IT services; intelligent infrastructure; digital virtualization.

|

|

Energy saving and environmental protection

|

Equipment and products for efficient energy saving; R&D of resource processing technologies; modern equipment and products for environmental protection; an energy-saving and environmental protection service system; a system for processing and recycling waste and old products based on advanced technologies; the clean use of coal and sea water.

|

|

Biotechnology

|

Biotechnological drugs; new vaccines and diagnostic tools; chemical substances; modern Chinese medicine and other innovative types of medicine; biopharmaceuticals; medical devices, materials and other biomedical engineering products; bio-breeding, green bio-products for agriculture; bio-agriculture; products of marine biotechnology; bioproduction.

|

|

Manufacturing of hi-tech equipment

|

Main aircraft and other aviation equipment; space infrastructure; satellites and their application; dedicated passenger lines, urban rail transit and railway equipment; marine engineering equipment; smart manufacturing equipment based on digital, flexible technologies and system integration.

|

|

Alternative energy sources

|

Next-generation nuclear energy and advanced reactors; use of solar energy; photovoltaic and photothermal energy generation; wind power equipment; smart power systems; biomass energy.

|

|

New materials

|

Rare-earth functional materials, high-performance membrane materials, special glass, functional ceramics, luminescent semiconductor materials and other new functional materials; high-quality special steel, new types of alloys, engineering plastics and other modern structural materials; carbon fibres, aramid fibres, ultra-high molecular weight polyethylene fibres and other high-performance fibres and complex materials, nanoscale, superconducting and smart materials, etc.

|

|

New energy vehicles

|

Power batteries; electric vehicles; drive motors; electronic control; plug-in hybrid vehicles; automotive fuel cell technology.

|

Seven Strategic Industries. Source: Decision of the State Council on Accelerating the Cultivation and Development of Strategic Emerging Industries, 2010; Mastering Innovation in China, 2015.[2]

In September 2014, Premier of the State Council of the People’s Republic of China Li Keqiang spoke at the annual “Summer Davos” meeting of the World Economic Forum. In his keynote speech, Li Keqiang highlighted the crucial role of innovation for the growth and modernization of the Chinese economy and formulated the concept of “mass entrepreneurship and innovation.”

This declaration by the Premier of the State Council meant that the government was ready to support technical innovation not only with targeted subsidies, but also by forming an integrated startup ecosystem.

The policies that followed provided tax incentives and preferential tariffs, expanded the R&D capabilities of Chinese companies, and simplified the procedure for obtaining state permits. Two and a half years after the concept of “mass entrepreneurship and innovation” was announced, the State Council and local governments jointly implemented over 400 support measures. The number of new startup incubators increased fourfold to 6600.[3]

Human Capital

The technical and commercial implementation of startup projects, the active phase of introducing new ideas with transformative potential and building new business models requires a large amount of human resources.

Having gradually accumulated a critical mass of knowledge and resources, China was able to become the global leader in scientific and technical human potential in 2012, boasting 255.4 million skilled personnel. In the early years of tech innovation, elite and highly qualified professionals were highly sought after, but now, at the stage of active implementation and data processing, the quality of expertise has finally matched the quantity.

According to the Harvard Business Review, the growth in workforce accounts for 10–20 per cent of China’s GDP growth, with 11–15 per cent of GDP growth provided specifically by highly skilled workers and valuable specialists.

In addition, a recent survey by the China Institute for Employment Research at Renmin University, conducted in collaboration with the online recruiter Zhaopin, showed that 25 per cent of university graduates would like to work in IT, the internet, communications and electronics.

The main goal of 2020 graduates is still to work at an enterprise (75.8 per cent of respondents), followed by freelance work (7.7 per cent) and further study in China or abroad (7.5 per cent).

The New Technology Pandemic

According to the Decision of the State Council on Accelerating the Cultivation and Development of Strategic Emerging Industries, the added value generated by the seven strategic emerging sectors will account for 15 per cent of the country’s GDP by 2020.

However, the COVID-19 pandemic has taken its toll on China’s economic growth, bringing GDP down by a record 6.8 per cent in the first quarter of this year.

At the same time, the first three months of 2020 saw the “information transfer, software and information technologies” sector expand by 13.2 per cent compared to the first quarter of last year. Recent economic data demonstrates that the added value of strategic emerging industries in Hebei Province increased by 16.3 per cent year over year in the first quarter of 2020, with Shaanxi Province showing a growth of 2.3 per cent.

CCID Think Tank, a Chinese consulting firm (which emerged from the abolished Ministry of Electronics, predicts that the value added by strategic emerging industries to GDP is expected to reach15 per cent by the end of 2020.

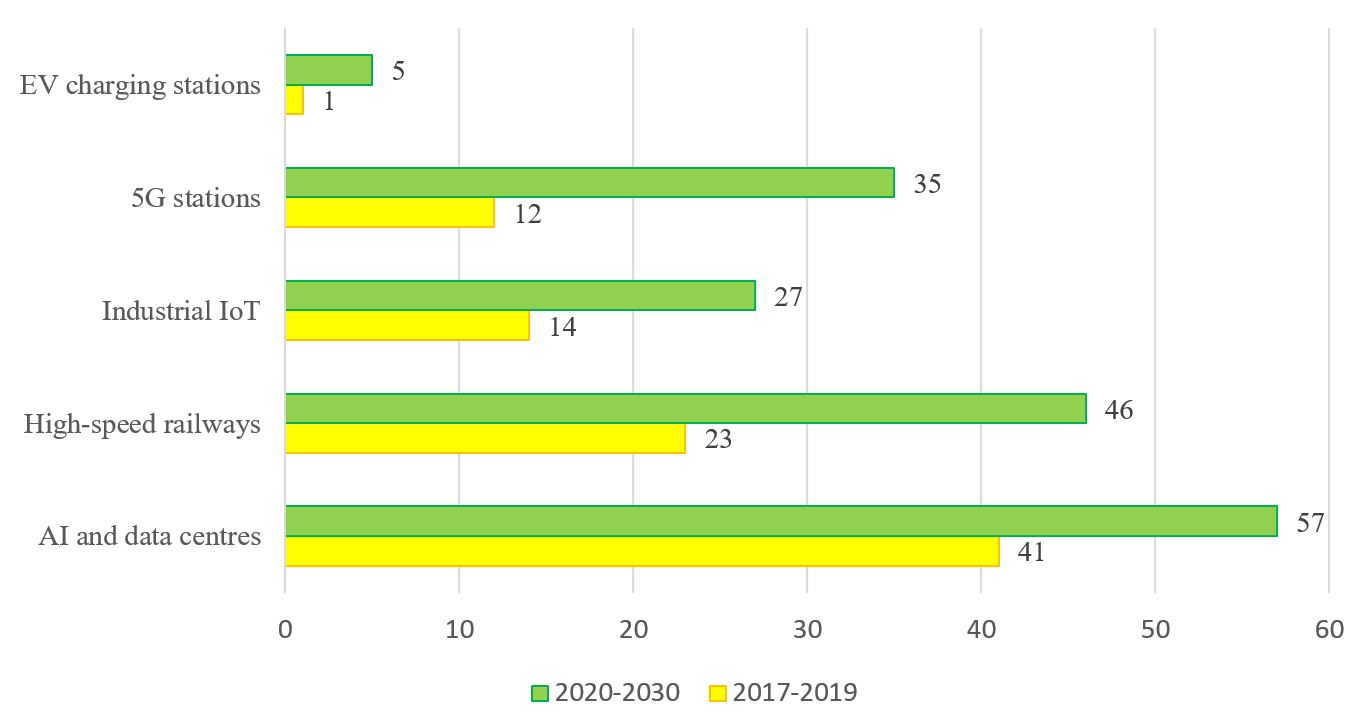

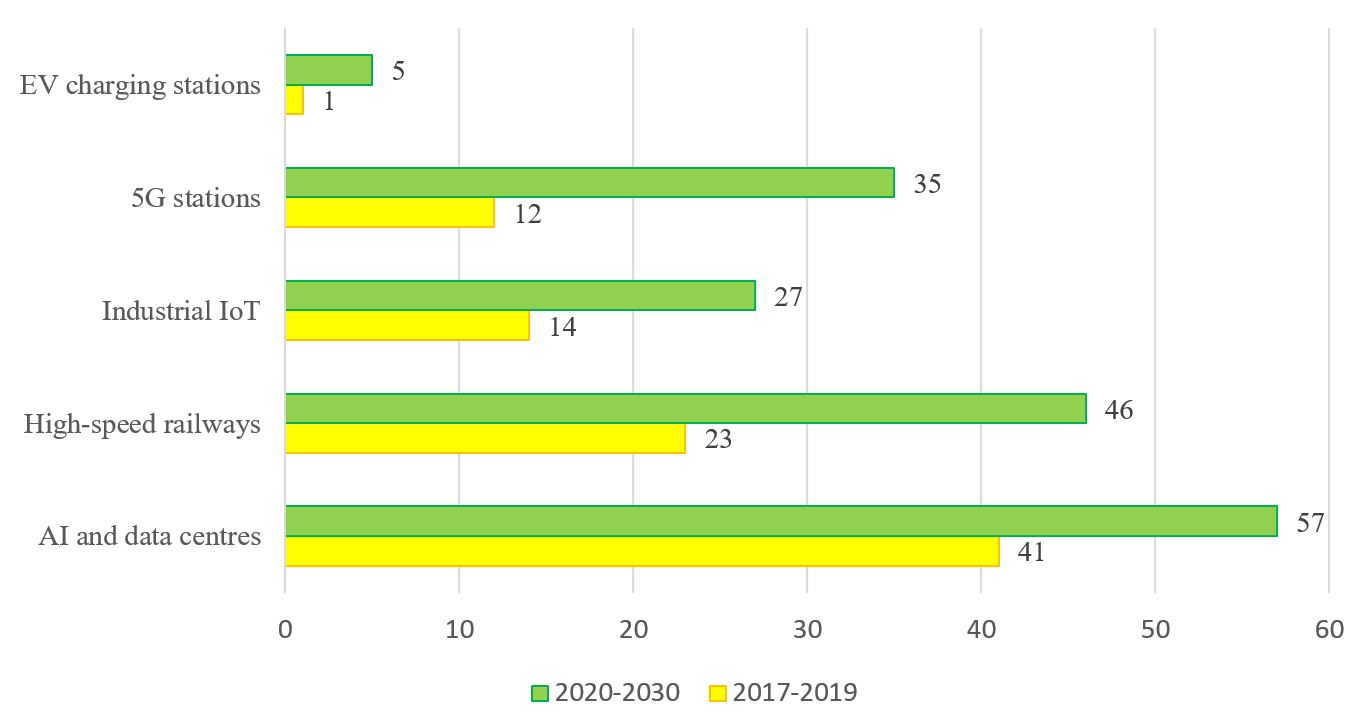

Despite the decline in the country’s overall GDP, Morgan Stanley predicts that China’s spending on new infrastructure will increase to $2 trillion in 2020–2030.

China’s Investment in Smart Technologies, billion USD. Source: Morgan Stanley.

According to experts, the country will spend $57 billion on artificial intelligence and data centres, $35 billion on 5G stations and $46 billion on high-speed railways, which is double the investment of 2017–2019. Additionally, China will spend $27 billion on the industrial internet of things and $5 billion on electric vehicle charging stations.

The Development Vector

In April 2020, the Xpeng Motors national company started taking pre-orders for its P7 smart sports sedan, which will compete with the Tesla Model 3 on the Chinese electric car market. The Xpeng P7A sedan will be the first smart car to use the Alibaba in-car mini-app platform. At the same time, Chinese automakers Geely and Changan have launched mass production of cars with antibacterial filters and super filters capable of removing 97.7 per cent of bacteria and viruses from the passenger compartment.

Less than a month after the announcement by Xpeng Motors, Chinese internet giant Baidu announced the completion of Apollo Park, “the world’s largest site to test both autonomous driving and vehicle-to-infrastructure communication” in Beijing with an area of 13,500 square metres. Similar smart technologies using 5G communication links are also being tested by Huawei. Both Chinese companies aim to make it possible for cars to connect with each other remotely, as well as with various traffic elements, such as traffic lights, cameras and speed limit signs.

During the COVID-19 outbreak, China started actively rolling out contactless autonomous deliveries by robots and unmanned aerial vehicles (drones) both from government agencies and businesses. Drones and robots were used for spraying disinfectants, measuring temperature and probing temperature conditions, making announcements in public spaces, controlling urban traffic, delivering food and essentials to remote and inaccessible areas, providing hospital services (for example, Hezhou sent five drones with medical care to the isolated province of Wuhan), as well as fulfilling regular orders from online stores (ranging from the JD online hypermarket to the delivery of new car keys from Geely).

Over the next decade, Chinese startups nurtured in the mature startup ecosystem will scale up and perfect their technologies, relying on government policies and the support of giant companies. Despite the record decline in GDP in the first quarter of 2020 and the socio-economic consequences of COVID-19, the scientific and technological potential that China has amassed will contribute to unprecedented growth of unicorn startups, especially in the strategic emerging industries.

1. Kai-Fu Lee. AI Superpowers. Moscow: Mann, Ivanov & Ferber. 2019, p. 35

2. Joachim Jan Thraen. Mastering Innovation in China. Insights from History on China’s Journey Towards Innovation. Zurich; Springer Garbler, 2015, pp. 60–61.

3 Kai-Fu Lee. AI Superpowers: China, Silicon Valley, and the New World Order. – Boston: Houghton Mifflin Harcourt. Mann, Ivanov & Ferber. 2019, p. 73.