An almost sixth-month-long negotiation process came to a weird end on July 12, 2015. Why should we call this process “weird”? First because of the text that is to be signed by the European parliaments. This piece of paper is not the end of the story between Greece and its creditors. On the contrary, it is a new start for both Greece and Germany as well as Europe more generally. The second reason is due to the process of negotiations itself. However, since the E.U. is a “family”, the use of threats and blackmail was too obvious. Nonetheless, these main questions should not bother us. What are the clear facts to be taken away from the text? Can we predict the future of this text? Has a “winner” or “loser” emerged?

An almost sixth-month-long negotiation process came to a weird end on July 12, 2015. Why should we call this process “weird”? First because of the text that is to be signed by the European parliaments. This piece of paper is not the end of the story between Greece and its creditors. On the contrary, it is a new start for both Greece and Germany as well as Europe more generally. The second reason is due to the process of negotiations itself. However, since the E.U. is a “family”, the use of threats and blackmail was too obvious. Nonetheless, these main questions should not bother us. What are the clear facts to be taken away from the text? Can we predict the future of this text? Has a “winner” or “loser” emerged?

Pandora’s Box is now open

We can easily see that the past six years for Greece were a time of economic depression. The seventh and next year will similarly be marked by depression. The sequel to the Greek issue was a total mistake from the beginning. The technical groups that were created to fix the grey days of 2009-2010 with help from the IMF revealed that the huge loans made under Memorandums I and II were created to protect Germany’s and France’s bonds. Without any doubt, the Eurozone project is very weak. Moreover, the leaders of the Eurozone states did not prevent the difficulties that Eurozone itself could have tackled, which had members with serious structural problems such as Greece.

Therefore, the first fact comes through loud and clearly and reflects the total failure of the Eurozone project and the EU’s unification process in general. These problems demonstrate the clear division that has taken place within the Eurogroup. Greece had the support of France, Cyprus and Italy. The Baltic countries, Slovenia, Netherlands and Slovakia supported Berlin’s position. This is the second clear fact. The EU’s unification process has been frozen by the Greek issue. Taking both these facts together, we easily see that Eurosceptisism is not anymore a proclivity. It is the present and future European reality. Economic and financial issues cannot be separated from social and political factors. Who should be blamed for this situation? Corrupt Greece? Of course not.

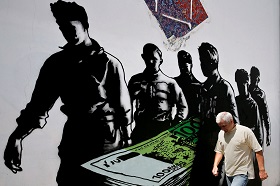

German cards are out in the open

Counter to the position of Brussels and Berlin, the Greek issue (like every debt problem in the Eurozone) is not only a technical or financial problem; it is completely political, as proven by the Greek Referendum. It is obvious that the main goal of Berlin was not to agree with Greece. Berlin’s point instead was to cancel the result of Greek elections held on January 25th, 2015.

At a first glance at the text of the third program, it is important to underline the measure that calls for a new Fund which will be obliged to sell Greek assets. To include such a program for Greece to follow means only one aim: to punish Greece because it tried to change the conditions and measures. The extra benefit of this “economic punishment” is the second aspect of Berlin’s strategy. A domino effect of fear being projected towards other countries like Portugal, Italy, Spain, or even France could establish Germany’s hegemony over the E.U. But this strategy is quite bad for Germany.

Economists and investors from all over the world are already disappointed with the Eurozone project. Germany has proven that it does not have the ability to solve an internal problem within the E.U. The Eurozone itself is being questioned. The French President has already admitted that the Εurozone needs to be restored. Of course, French supported Greece because it is well-known that it will have follow austerity programs if Germany continues to prevail. At the end of the day, Germany failed to prove that it is a responsible leader of the Eurozone. As for the economics of the decision, who is going to invest in a monetary union that has a doubtful future? Germany achieved a win over Greece, but one that will turn into a loss for Berlin itself.

The Greek future

The European creditors have already shown a measure of irresponsibility concerning the complicated Greek issue. Moreover, Greece is facing significant domestic economic problems. However, the Greek government, despite German pressure to remove it, is going to be transformed so to establish the appropriate adjustments that Greece needs, whether it remains in or out of Eurozone.

To create a real structure for economic growth, the German government must relieve a large amount of Greek debt. Calling this procedure a “haircut” or whatever else is a matter that should be left to the creditors. The core of the Greek issue is completely political. The current plans made by the Greek government are temporary and the Greek Prime Minister does not have the support of Syriza party. The previous parties that had come to power do not enjoy high levels of popularity and it is extremely doubtful that Greece will be able to amend the measures of the 3rd program. Even if the other Greek political parties did not have problems, these measures are completely toxic and some of them pose a direct threat to destroying all of economic activity in Greece.

If we follow the current trends in this situation, both Greek and European, we will conclude that this program and its measures will not take place in reality. It would be wise to focus on the changing attitudes of national and international actors (USA, Russia, Great Britain, France, Italy, IMF, ECB, and the U.N). We should wait for extra pressure to be put on Germany, so the so-called 3rd program of Greece will be made more flexible.