Regular attacks by the Islamic State movement on civilians and other business interests have so far failed to scare off Russian oil companies from Iraq. Despite numerous risks, these businesses appear prepared to continue pumping Iraqi hydrocarbon reserves, only proving that their degree of safety is sufficiently solid, even amidst this time of Iraqi troubles.

Keeping Abreast

After large-scale fighting broke out in Iraq last summer, energy majors, among them ExxonMobil and BP, began withdrawing some of their personnel.

Working in Iraq's southernmost part at the West Qurna second stage, Russia's LUKOIL Overseas also has evacuation plans, but is moving forward since the bloodshed has until now only swept over the country's north.

The security alert is of course prominent in the red area and the corporation is prepared for the worst-case scenario, up to a complete exit, but LUKOIL managers hope that the situation will at least remain frozen and no need will arise to suspend the massive project.

Notably, over the past several months, West Qurna-2 has been operating smoothly, with the project roadmap advancing as scheduled and all production plans and contractual obligations of the Russian company fulfilled to the letter.

Late last summer, the port of Basrah saw off the Sea Triumph, a tanker chartered by LUKOIL's marketing and sales arm Litasco to take out the first consignment of oil received as payment for the Russians' efforts at West Qurna-2. Carrying one million barrels of oil, the ship set sail for Sicily, where LUKOIL's Priolo refinery is located.

According to financial records, despite the extreme instability in Iraq and volatility on the global oil market, in the second quarter of 2014, the company earned USD 1.179 billion from West Qurna-2, including the compensation of expenditures of USD 1.163 billion and remuneration of USD 16 million. According to LUKOIL Vice-President Leonid Fedun, the firm plans to recompense its Iraqi expenses of almost USD 4 billion in 2015, while the overall situation would not slow down West Qurna-2 progress. The production rate will soon reach 400,000 bpd or even exceed this level, whereas the current rate stands at 330,000 bpd.

Baghdad is Strengthening Ties

Although Russian-Iraqi oil cooperation is unquestionably restrained by export pipeline difficulties and red tape, Russian oilmen are genuinely happy about their engagement with the Iraqi administration and Oil Ministry.

As a matter of fact, Iraqi officials, who are often surrounded by Western advisors, have refrained from hurting LUKOIL Overseas despite the U.S.-led sanctions against the Russian hydrocarbons sector; they do support many of the company’s initiatives, especially those with a social focus.

The training of local personnel and creation of jobs are only part of the story, as the company has also provided 31 secondary schools with educational and other equipment, and is establishing modular classrooms, buying high-tech medical equipment and building soccer fields.

After West Qurna-2 proves successful, LUKOIL Overseas appears ready to expand its presence in Iraq. The heart of the matter lies in the risks and feasibility of future projects. If upon weighing all pros and cons, the company finds that the effort is worth the costs, it will certainly bolster its positions in the Iraqi oil sector.

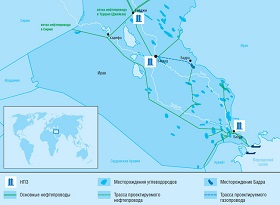

In spring 2014, LUKOIL and the Iraqi state-owned Oil Exploration Company signed a memorandum of understanding on a geology survey of the 17,000-square-km West Euphrates block, after which the sides will make a decision about signing a contract. The LUKOIL press service states that Russian oil company Zarubezhneft will stand as its partner.

Both Russian firms have thus far been selected for bidding within the Nassiriyah integrated project which is aimed at developing a gigantic oil deposit and constructing a refinery on Iraqi territory.

Paying in Black Gold

Also operating in the south of Iraq, Gazprom Neft is about to open a tender for drilling in the Badra field.

The Russians have already commissioned the 60,000-bpd first stage of the oil gathering station that now should be filled to lay the grounds for expanding infrastructure, including the transportation facilities to carry oil to the Basrah area. The six production wells will be drilled by China's Zhongman Petroleum and Natural Gas Group Co., Ltd (ZPEC).

Last September, the Gazprom Neft-operated Badra field began exporting oil [1], with 15,000 bpd entering the Iraqi pipeline system for delivery to the terminal near Basrah.

According to the servicing contract with the Iraqi government, 90 days after the commercial flow begins, the consortium of investing companies will begin receiving part of the Badra oil. Gazprom Neft expects to receive the first batch for compensation exports as soon as this year.

Every three months, the Iraqi State Oil Marketing Organization will provide the Russian firm with part of Badra oil, so that the consortium can reimburse its expenses, after which the investors will be remunerated in the amount of USD 5.5 for each barrel of oil produced. Each company will sell its share independently.

Chasing Two Rabbits

Gazprom Neft is somewhat unique among foreign operators by working both with Baghdad and Erbil in Kurdistan.

Last year, the company sank an exploration well in the Kurdish block of Shakal and is about to handle another one, with testing expected to be completed by early 2015.

Gazprom Neft is also prospecting the Halabja block, where it has launched a seismic survey and intends to drill the first exploratory well in 2015-2016. At the Garmian block, the company continues its exploration in order to prepare the field for full-scale production.

Since Baghdad and Erbil are far from friendly, the Russian investor may as well gain from their attempts to lure foreign investors by offering better partnership terms.

The deals are not likely to produce quick results because doing business in Iraq and the entire Middle East is quite an experience. Among other things, local officials and entrepreneurs are always wary of foreigners eager to make a fast buck. Iraqis prefer to partner with those that are prepared for long-term cooperation, offer state-of-the-art technologies and create jobs, as Russian companies usually do. As a result, thanks to LUKOIL's insightful engagement and employment policies, the once hostile Arab tribes are doing their best to defend the territory of West Qurna-2 and fulfill their production plans.

* * *

With immediate Russian projects so far unthreatened, LUKOIL Overseas and Gazprom Neft will begin making a profit.

Through close cooperation with local firms, Russian companies are earning respect both in Iraq and globally. The world can clearly see that those who can operate in Iraq have a healthy safety margin and are fit to operate in a tricky environment, because the Iraqi environment has different standards from those in Europe, which have become customary for many Russian players. As far as the LUKOIL Overseas and Gazprom Neft are concerned, they are always open to cooperation with Iraqi businesses and Asian contractors, from building field camps to using technologies for oil production and sales.

As a matter of fact, Russian oil interests in Iraq have received support at the highest level. In 2013, President Putin discussed hydrocarbons cooperation both with Iraqi Prime Minister Nouri al-Maliki at the 2nd Gas Exporting Countries Forum in Moscow and with Kurdish President Massoud Barzani who was in the Russian capital on an official visit.

Although Kremlin policies on the Iraqi track are somewhat twofaced, Russian players are already earning their daily bread in the Iraqi oil sector. Engaging simultaneously with Baghdad and Erbil, Moscow is of course running the risk of losing both long-time antagonists. But on the other hand, the approach may as well generate more projects and strengthen Russian positions in Iraq.

Until now, the Kremlin has been lobbying Russian firms operating in Iraq with exceptional results. For example, Gazprom Neft is surveying in Iraqi Kurdistan and has managed to enlist the effective cooperation from its government. At the same time, it is developing the Badra project jointly with Baghdad. Credit should certainly go to Russian top officials who displayed outstanding diplomatic skills in engaging both Iraqi and Kurdish leaders during their visits to Moscow and promoting the interests of Russian oil companies.

Overall instability notwithstanding, the current Iraqi environment is not too hostile for the operation of Russian firms, since LUKOIL Oversea and Gazprom Neft are working in areas free of major military clashes and terrorist attacks against oil infrastructure.

However, the medium- and long-term prospects for increasing output at the operating fields and expanding assets in Iraq are still blurry, as the military-political and socio-economic situation there is prone to radical changes which could create more risks for foreign contractors.

In the worst-case scenario, the Islamic State can make good on its promises to capture the rest of Iraq and thwart the plans of Russian companies. With the menace reasonably feasible, LUKOIL Overseas has already floated the possibility of leaving Iraq.

One more risk appears to lie in the absence of an Iraqi federal law on hydrocarbons that would regulate contractors' rights and secure foreign investments in the national oil sector.

Notably, the risks for international companies in Iraq vary and Russians face more difficulties than firms from the United States and Europe, whose legal advisors took part in writing the bidding laws and Baghdad's service contracts with foreign entities.

In contrasts to Baghdad, Erbil offers foreign contractors much better guarantees, which makes the legal risks considerably lower. Besides, in Kurdistan, international companies enjoy a much friendlier taxation climate.

Of course, local hazards in Kurdistan are also substantial, since the local separatism may easily degrade into a regional war involving not just Baghdad and Erbil but also Turkey, Syria and Iran.

Forecasting events is quite a messy affair by definition, while predicting developments in Iraq is especially unsafe. However, in the near future Russian businesses are unlikely to suffer major losses from the jihadists whose intentions seem to be more formidable than ousting the foreign businesses.

1. The Badra field produced first oil in December 2013, whereas the startup, commissioning and testing of the production and transportation infrastructure began last May. Currently, the field has two production wells, with three more drilled with help of the Chinese company ZPEC. One more well is about to go on-stream, and last June yet another one was sunk for expectedly speedy commissioning. The service contract provides for production at 170,000 bpd (about 8.5 million tons a year) over seven years.

Notably, Badra is LUKOIL's first major production project carried out abroad from the level of zero. Commercial production and integrated testing of the oil preparation and transportation system were launched in May 2014. The startup and adjustment works at the central gathering station, export pipeline and tank pool are complete, while the water and power supply arrangements, as well as other facilities have already been tested.