As the next UN Climate Change Conference (COP26) approaches, calls from the international community to step up the efforts to combat climate change are getting ever louder. While the issue of renewable energy sources has been high on the agenda for most developed economies for quite a while now, the only agent of radical change seems to be some serious crisis—something that would push the energy community out of their comfort zone. This time has seemingly come, with prices for natural gas, coal and electricity hitting record highs in Europe over the past few weeks, and analysts from Europe expecting the factors that drive these prices to persist in the coming weeks.

As we look ahead, it is worth noting that electricity prices would likely decline in the end, at least when the situation with wind energy is sorted out, as wind forecasts for the North Sea in October are largely positive. French nuclear power plants returning to operation and the reinstallation of coal-fired power plants will also help alleviate the shortage in energy supply. Nonetheless, natural gas, the main “transition fuel” on the path to a low-carbon economy, will remain at the core of debates. Europe will still compete with Asia for the LNG shipments remaining on the market, although it is unlikely to be willing and able to pay more than its competitors in Asia. There are few factors that could improve the situation in Europe, which will fuel greater interest in Nord Stream 2. The ardor of traders may temporarily be cooled if the requirements of the German regulator, the Federal Network Agency (BnetzA), for granting a license to use the pipeline are met. However, Berlin is unlikely to rush to this decision, unwilling to demonstrate a preferential attitude to business. This is why we will have to wait and hope that the winter of 2021/2022 will come to be mild.

As the next UN Climate Change Conference (COP26) approaches, calls from the international community to step up the efforts to combat climate change are getting ever louder. While the issue of renewable energy sources has been high on the agenda for most developed economies for quite a while now, the only agent of radical change seems to be some serious crisis—something that would push the energy community out of their comfort zone. This time has seemingly come, with prices for natural gas, coal and electricity hitting record highs in Europe over the past few weeks, and analysts from Europe expecting the factors that drive these prices to persist in the coming weeks.

Many in European political circles would like to believe it is the Russian Gazprom that is ultimately responsible for what has been going on, claiming that its alleged reluctance to supply gas to the European market has sparked the events that caused prices for natural gas to increase fourfold and prices for electricity to double in 2021. However, the Russian company was not in breach of any contracts, nor was it guilty of lowering the transit volumes of gas passing through Ukraine. Besides, hybrid pricing under long-term contracts makes Russian gas significantly cheaper for the consumer as compared to the cost of that coming from the main hubs of the European Union. While it would be hard to argue with the fact that Gazprom is filling its underground gas storage facilities in a fashion slower than does the market on average or that the company hardly books additional gas transit capacity through Ukraine, these factors can only have a marginal effect on the overall cost of energy commodities.

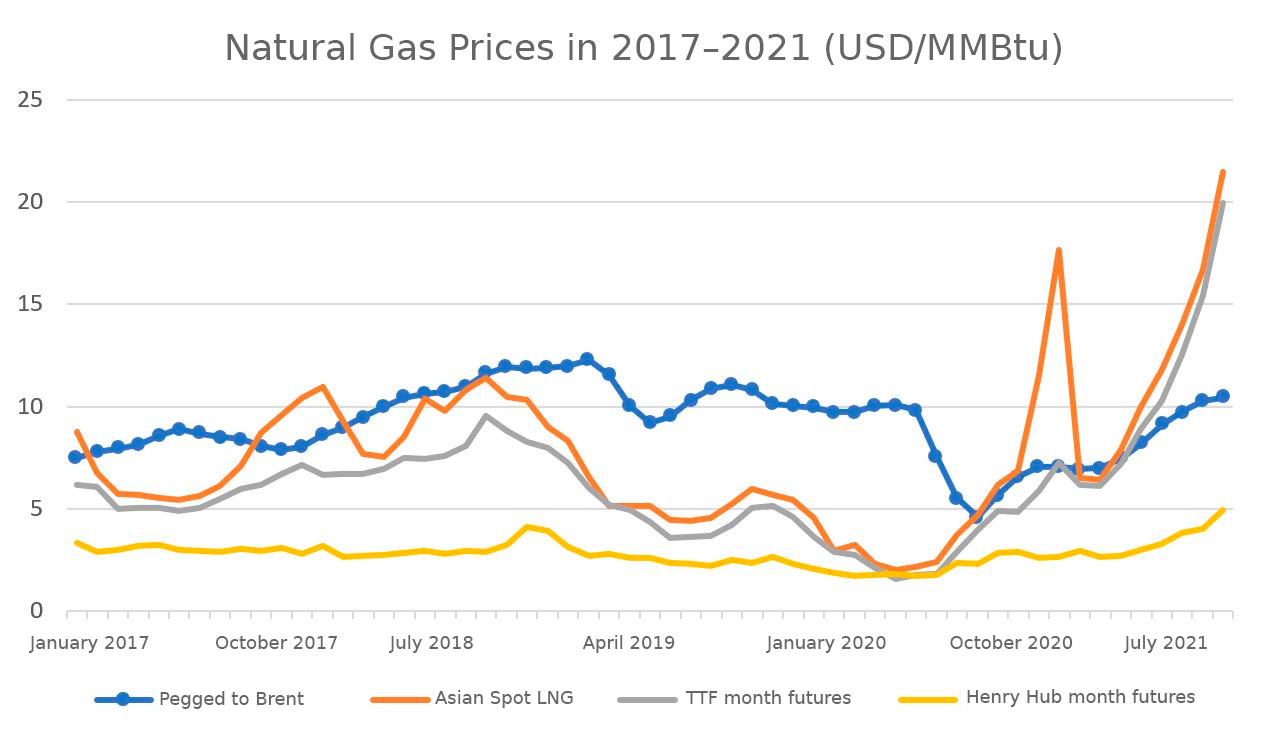

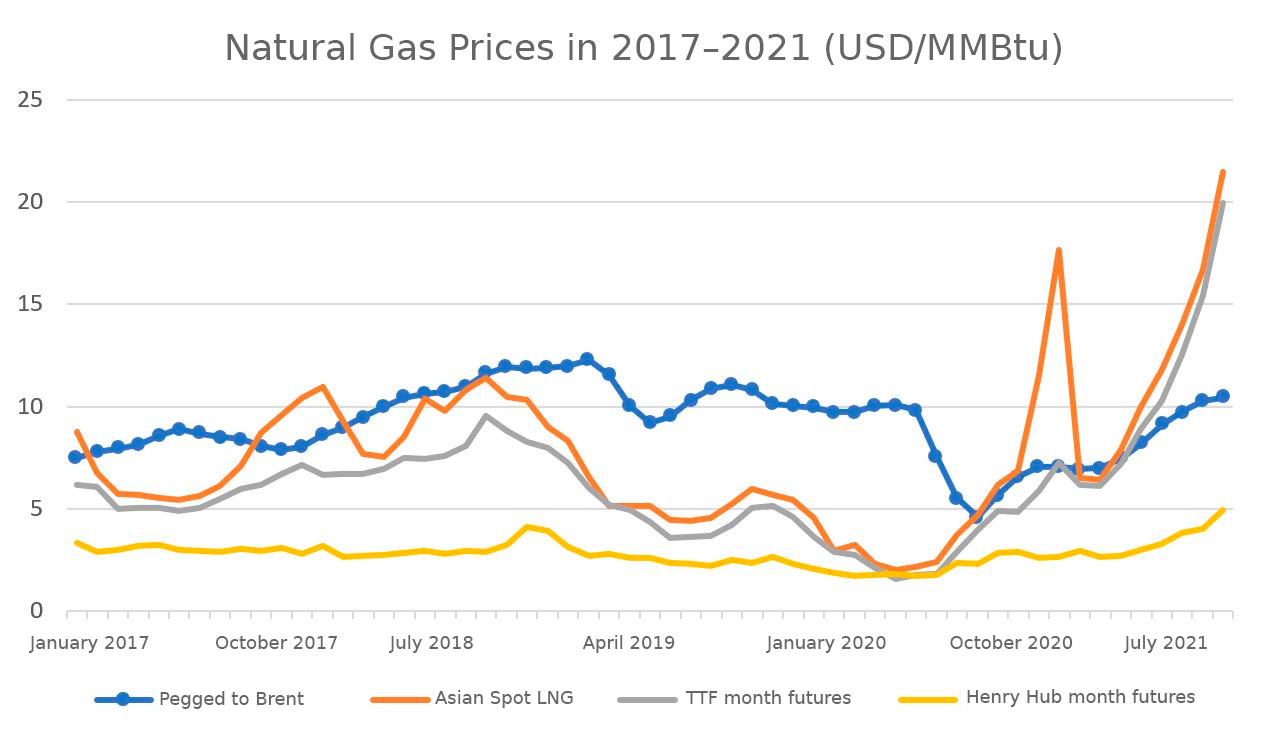

Graph 1. Natural Gas Prices in 2017–2021 (USD/MMBtu)

Source: Thomson Reuters

Gas Prices: In Circumvention of the Rules?

The high cost of gas in Europe became apparent early in 2021 as European countries were exhausting their gas reserves after the relatively cold winter of 2020/2021. At the same time, industries in Europe, as well as the economic activity in a broader sense, were recovering from the recession triggered by the COVID-19 pandemic, which translated into an increasing demand for gas. Every month, it became ever more obvious that the injection of natural gas into underground gas storage facilities (UGS) was occurring slower than expected. From August to September 2021, all hopes for the situation to return to normal came to evaporate, as the filling level of UGS facilities was an average of 20 points lower than over the past five years.

Against this background, the public in Europe began to pay careful attention to Gazprom’s moves on the European market, since most of its gas storage facilities in the EU (approximately totaling 12 billion cubic meters, of which some 6.5 billion are located in Germany) were being filled up significantly slower than the European average. The already slow gas injection was aggravated by a fire that occurred at the Urengoy Condensate Treatment Plant, forcing the Russian gas monopoly to temporarily cut production. Nonetheless, Gazprom spokespeople assured the public that the work to fill storage facilities in Russia—approximately 73 billion cubic meters in total—continued in accordance with the plan with no setbacks expected, although they never provided any specific data on the injection rate.

These events led some MEPs to file an official request for the European Commission to investigate possible manipulations on the gas market by Gazprom. First of all, the misunderstanding owes to Gazprom’s reluctance to increase production. Export forecasts for 2021 have not changed throughout the year, hovering around at 175–183 billion cubic meters per year, whereas Gazprom’s 2021 budget assumed an average price of $170 per 1,000 cubic square meters, which is exactly $100 per 1,000 cubic square meters higher than is envisioned in the current forecast of the average annual export price, which has now been revised three times. However, it would be a mistake to squarely place the blame for the spike in gas prices over January–September 2021 on Gazprom’s shoulders, since its influence on the LNG market, a principal driving force to impact the situation with gas shortage in Europe, was rather negligible.

It is worth noting that the global LNG supply did not decrease as compared to the previous year: while 274 million tons were supplied in January–September 2020, the same period in 2021 witnessed a rise up to some 290 million tons. While the global economy is recovering to see the demand for LNG grow, gas disruptions in Australia, Malaysia, Peru and Oman, alongside the continued downtime of the Snøhvit LNG export terminal in northern Norway, coupled with the drop in production and reduced export volumes in Nigeria and Trinidad and Tobago, have led people to believe that there is a shortage of LNG on the market, realizing that consumers in Europe and Asia may be in direct competition. All this resulted in higher LNG prices, despite the fact that prices are usually lower in summer as compared to the average level in winter.

As the Wind Blows…

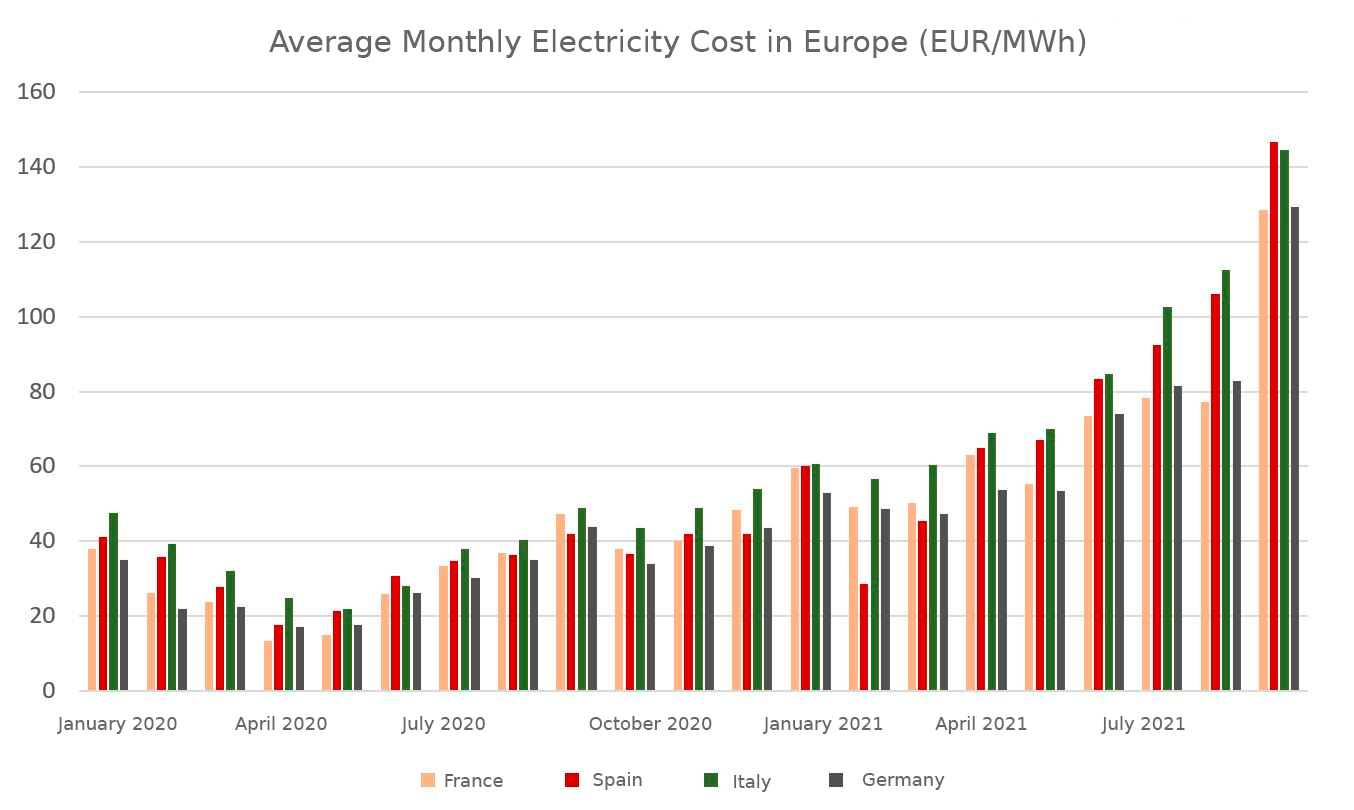

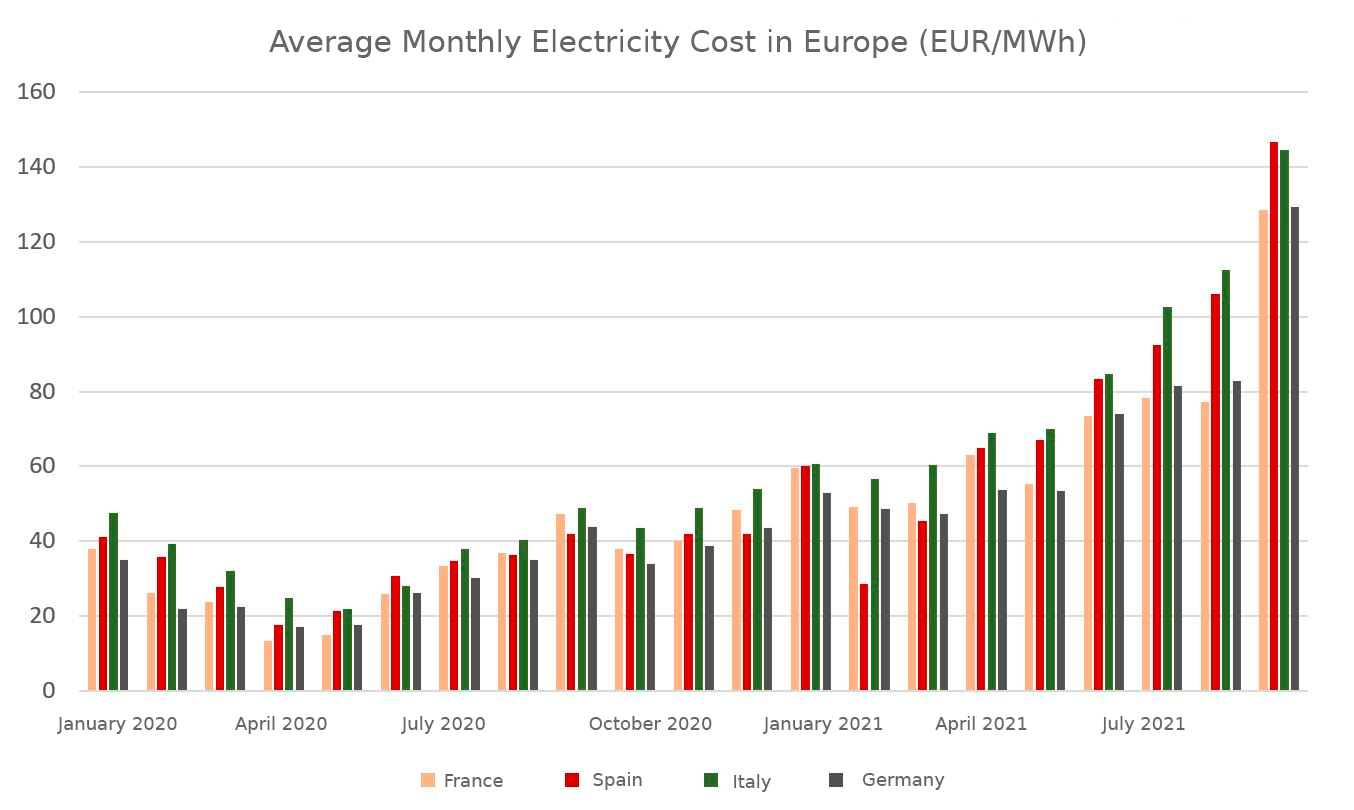

While the price of natural gas continues to rise, the nations of Northwest Europe have been facing another challenge—namely, the unpredictability of the wind. Countries like the UK, where up to a third of electricity can be generated by wind farms (depending on weather conditions), were unprepared for a long period of calm. During the first half of September, the North Sea witnessed a rather rare phenomenon when offshore wind turbines failed to generate even half of the power they typically produce: over a two-week period, power generation was below 6 MWh, in quite a contrast to the usual 10–12 MWh.

The situation with both wind and power generation had returned to normal by mid-September; however, the issue of wind reliability in the long term remains. In the meantime, the EU is looking to increase the share of wind energy in its energy matrix up to 20 per cent by 2050. Its overall wind power capacity took a massive hit in the wake of Brexit, as the UK’s 11,000 turbines provided more than 24 GW of power—the country has long been a European frontrunner in terms of wind farm penetration into the domestic market. Many countries have followed in the Britain’s footsteps, with France having set out to build its first offshore wind platform, Spain having published a new wind energy strategy and Greece intending to do the same soon. However, no one has a convincing answer to the question, “What will happen if the wind no longer blows?”

Where possible, nuclear power is the easiest—as well as cheapest—solution. As the largest nuclear power in the EU, France would have endured the market panic over electricity prices with fewer losses if four of its nuclear reactors (with a total capacity of 4.2 GW) had not been undergoing scheduled repairs. Where Europe fell short, South Korea and Japan can succeed. Excessively high LNG prices forced South Korea to restore some of its nuclear reactor production capacity. Japan has made progress in this regard during the Olympic Games, when the Kansai nuclear power plant helped cover additional electricity needs. Japan’s reluctance to buy expensive LNG shipments on the spot market is one of the reasons why the country already has nine nuclear reactors operating.

Coal: Old but Gold

The reinstallation of unused nuclear facilities was shadowed by the revival of old coal-fired power plants. The UK, seeking to shut down all coal-fired power plants by 2024, was forced to restart some of its generating capacity. Less than a year has passed since wind turbines became the main electricity source in Germany—yet, by the autumn of 2021, the EU’s biggest economy had to see another renaissance of the coal as electricity generation at coal plants has more than doubled since 2020, reaching an average of 8.5 GWh in the course of September. Not only will coal serve as Germany’s main energy source in 2021, but it will also retain its competitive edge over gas, which costs 10 euro per MWh more.

The first step towards a gradual increase in coal prices appeared to be China’s embargo on the Australian coal while Australia and Indonesia have been leading suppliers of coal to China since November 2020. The ongoing embargo has significantly increased the cost of coal for Chinese importers as they need to build relationships from scratch and with more remote countries. At the same time, Australia’s export flows have redrawn the map of Asia in terms of market share. Mining in China, however, continues to suffer due to government involvement aimed at combating unfair competition. For example, a mandatory two-month inspection period was established in the country’s largest coal-mining province. Domestic coal prices then doubled: in mid-September, futures contracts on the Zhengzhou Commodity Exchange were slightly below CNY1000 ($160) per ton.

Still, coal received a boost following unprecedentedly high prices for natural gas. Once global trade in the commodity fell sharply in 2020, many had written coal off, but it is enjoying renewed interest in countries that have traditionally been able to switch from one hydrocarbon feedstock to another (Germany is precisely such a state in Europe). Therefore, coal imports to Europe in August 2021 returned to pre-pandemic levels (meaning the levels of Autumn 2019, some 12 million tons per month) and continued to grow later in September. This growing demand drove up the prices, seeing them double over mere four months to reach a never-before-seen $185/t.

Although it might seem to be a temporary surge doomed to crash, the annual average Rotterdam Coal Futures for 2022 (also called API2) fluctuates in the range of $130–140/t. We can thus expect prices to remain high—and not just for a one month. Besides, coal remains competitive as compared to gas, although its use entails higher carbon costs (carbon emissions are taxed under EU legislation). With carbon trading at an unprecedented level of EUR61–62/t as well as coal, the latter is still more profitable than natural gas, even with these added costs. The relatively simple combination of weak power generation from renewable energy sources and the insufficient supply of natural gas may well have brought the two most unpopular segments of the European energy sector—nuclear and coal—to the fore.

Graph 2. Average Monthly Electricity Cost in Europe (EUR/MWh).

Source: Thomson Reuters

As we look ahead, it is worth noting that electricity prices would likely decline in the end, at least when the situation with wind energy is sorted out, as wind forecasts for the North Sea in October are largely positive. French nuclear power plants returning to operation and the reinstallation of coal-fired power plants will also help alleviate the shortage in energy supply. Nonetheless, natural gas, the main “transition fuel” on the path to a low-carbon economy, will remain at the core of debates. Europe will still compete with Asia for the LNG shipments remaining on the market, although it is unlikely to be willing and able to pay more than its competitors in Asia. There are few factors that could improve the situation in Europe, which will fuel greater interest in Nord Stream 2. The ardor of traders may temporarily be cooled if the requirements of the German regulator, the Federal Network Agency (BnetzA), for granting a license to use the pipeline are met. However, Berlin is unlikely to rush to this decision, unwilling to demonstrate a preferential attitude to business. This is why we will have to wait and hope that the winter of 2021/2022 will come to be mild.