INSTC: India-Russia’s Trade to Get a Major Boost

In

Login if you are already registered

(votes: 4, rating: 4) |

(4 votes) |

Joint Director, EEPC INDIA

Executive Officer, EEPC India

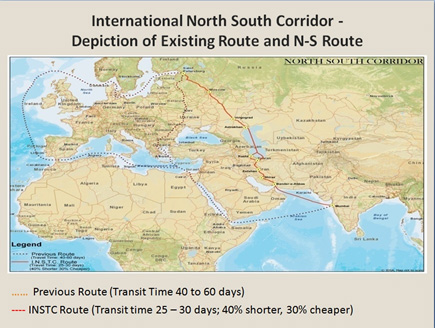

The 7,200 km International North South Transport Corridor (INSTC) is a multi-mode transport network linking Indian Ocean and Persian Gulf to the Caspian Sea via Iran, and onward to northern Europe via St. Petersburg, Russia. Throughout this network, freight between India, Russia, Iran, Europe and Central Asia will move through sea, rail, and road. This route is very different from much longer and costlier Suez Canal that India used earlier to transport goods to Russia. This new route will help connect India with Russia within 16-21 days at competitive freight rates leading to development of trade on the INSTC.

The INSTC is a joint initiative launched by India, Iran, and Russia in September, 2000 to facilitate shipments and logistics. The agreement came into effect in May, 2002 after being ratified by all three signatory states.

The initiative did not receive much favor during the early years. The development was slow and not much progress was seen between 2005 and 2012. However, it has gained momentum over the last few years and is now developing at a much faster pace, with several milestones achieved including building some corridors and two dry runs.

I. INTUC: An Introduction

The 7,200 km International North South Transport Corridor (INSTC) is a multi-mode transport network linking Indian Ocean and Persian Gulf to the Caspian Sea via Iran, and onward to northern Europe via St. Petersburg, Russia. Throughout this network, freight between India, Russia, Iran, Europe and Central Asia will move through sea, rail, and road. This route is very different from much longer and costlier Suez Canal that India used earlier to transport goods to Russia. This new route will help connect India with Russia within 16-21 days at competitive freight rates leading to development of trade on the INSTC.

The INSTC is a joint initiative launched by India, Iran, and Russia in September, 2000 to facilitate shipments and logistics. The agreement came into effect in May, 2002 after being ratified by all three signatory states.

The initiative did not receive much favor during the early years. The development was slow and not much progress was seen between 2005 and 2012. However, it has gained momentum over the last few years and is now developing at a much faster pace, with several milestones achieved including building some corridors and two dry runs.

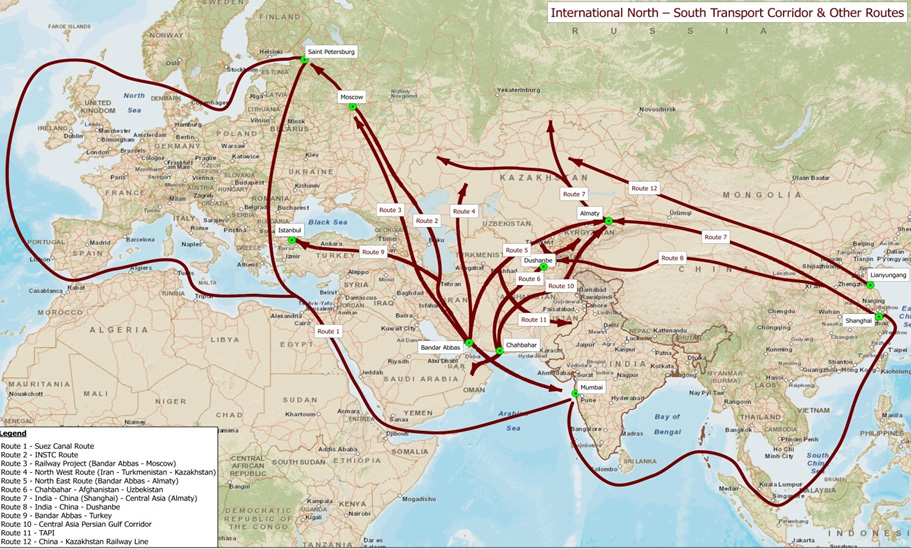

Map 1: INSTC Routes

II. Major objectives

The primary objective of the NSTC project is to reduce costs compared to the use of Suez Canal route [1]. Specific objectives of the INSTC include:

- To increase the effectiveness of transport ties in order to transport goods and passengers along the international ‘North-South’ Transport corridor.

- To promote access to international markets through rail, road, sea, river and air transportation of the parties to the Agreement.

- To provide assistance in increasing the volume of international transportation of passengers and goods.

- To provide security of travel, safety of goods as well as the environmental protection according to the international standard.

- To harmonize policies as well as legal and legislative basis in the field of transport in order to implement this agreement.

- To create equal and non-discriminatory conditions for all types of transport service providers from all the parties.

III. INSTC’s Member countries

Currently, there are 13 official members, including three founding members, who have agreed to become part of the initiative (see Box 1).

Box 1: INTUC Member Countries

IV. Transport routes and modes

Two primary routes (Route 1 and Route 2) are proposed to connect INSTC’s member countries. While the first one connects India to Azerbaijan via Iran; the second route connects India and Russia via Iran.

Route 1

- Nhava Sheva, India —> Bandar Abbas, Iran — by Sea

- Bandar Abbas, Iran —> Astara, Iran (Astara is on Iran-Azerbaijan border and also touches Caspian Sea) — by Road

- Astara (Iran) —> Baku, Azerbaijan — by Road

Route 2

- Nhava Sheva, India —> Bandar Abbas, Iran — by Sea

- Bandar Abbas, Iran —> Amirabad, Iran — by Road

- Amirabad, Iran —> Astrakhan, Russia — by Sea

Each of the two Routes (Route 1 and Route 2) connects only three countries, which was originally intended when the agreement was signed. Considering that ten other countries have joined over the period, these routes could integrate with multiple other sub-routes across member countries, connecting through roads and rail networks.

V. Advantages of the INSTC project

The INSTC is also expected to reduce the cost and time (see Table 1) and address security concerns of the existing trade route via Suez Canal. Further, it could help India and Russia boost up their bilateral trade and help to reach their target of USD 30 billion over the next 10 years from the current trade of less than USD 7 billion in 2016. At the moment these two major trade partners are witnessing a declining in bilateral trade.

With India being 4th largest energy consumer, INSTC provides huge prospects as it would reduce transit costs for India. India's investment in Chabbar port project, which is proposed to be integrated with the INSTC, and the possible comprehensive partnership with Eurasian Economic Union are additional features that will benefit India. Moreover, INSTC is widely argued as best possible option to counter China's 'One Belt' initiative.

Table 1: Comparison of Old and INSTC Routes

| Route | Distance | USD/TEU | USD/FEU | Transit |

|---|---|---|---|---|

| Nhava Sheva to Moscow via St.Petersburg | 8700 nm | 3500 | 5200 | 45 days |

| Nhava Sheva / Moscow via Kotka | 8596nm | 3900 | 5600 | 45–50 days |

| Nhava Sheva / B.Abbas | 750 nm | 200 | 300 | 5 Days |

| B/Abbas/Qazwin | 1461km |

|

|

3 |

| Qazvin — Astara | 380km |

|

|

1 |

| Astara — Yalama | 504km |

|

|

2 |

| Yalama — Moscow | 2260km |

|

|

5 |

| Nhava Sheva — Moscow via Bandar Abbas | 4605 + sea | 2100 | 3100 | 14+5 days |

| Nhava Sheva / St. Petersburg | 5566+sea | 2200 | 3037 | 15+5 days |

Source: FFFAI

VI. INSTC Progress in member countries

Azerbaijan road and rail routes: Rasht-Astara section of rail route was completed in 2016. Some technical problems to link Azerbaijan remain, and this is being resolved.

Chabahar INSTC integration: There is a long term plan to integrate Chabahar port into the INSTC, as Chabahar has high capacity of expanding from the current 2,5 million to 12,5 million tons annually.

Kazakhstan-Turkmenistan-Iran railway link operationalized: The 677 km Kazakhstan — Turkmenistan — Iran railway link, was completed and operationalized in 2014.

Armenia-Iran Railway Concession (Southern Armenia Railway or North-South Railway Corridor) : No progress has been made, as the project remains only on paper and has not got any financing because of reported lack of economic viability.

Astara port inaugurated: Iran inaugurated the port of Astara located southwest of the Caspian Sea in March 2013.

Iranrud Trans-Iranian canal: The Russian and Iranian governments are discussing the project. It is likely to be commissioned by 2020.

VII. Dry Run/Trial Run: Major findings

A Dry Run to understand major issues and challenges across INSTC routes was conducted in 2014. It pointed to an alternate route using Azerbaijan's capital, Baku, as a transit point between Iran and Russia. Trial Run was conducted in August 2016 running through both Iran and Azerbaijan. It was identified that goods could be shipped to the southern Iranian port of Bandar Abbas and from here goods could be transported to Russia through Azerbaijan using trains and trucks, avoiding the need to be shipped across the Caspian Sea as planned initially.

Baku is being developed as a transport hub. The Azerbaijani and Iranian rail networks are in the final stages of being linked together after an agreement that was recently signed by the leaders of Iran, Russia and Azerbaijan to establish a transport corridor linking the three countries. Further in March 2017, the three countries agreed to cut tariffs to encourage trans-border trade via the INSTC.

With India linking up with Myanmar and Thailand with the development of the Trilateral Highway, it is likely that a longer transport belt that would connect Southeast Asia to Europe through the INSTC will be connected. The development of INSTC in the western direction should be noted as well. The German railway company Deutsche Bahn has expressed interest in using the INSTC to deliver goods from Europe, though Azerbaijan, to Iran. In January, 2017 Estonian Foreign Minister also expressed his interest in joining the INSTC and negotiations have already begun.

Effectively, there are several existing, planned and under-construction routes, some of which link up to the original INSTC, that are forming a network across the Eurasian landscape.

Issues and constraints in operationalizing INSTC

Findings from the first Dry Run are yet to be publicized, even though it is critically important for the stakeholders to know. However, some anecdotal evidences and experts’ opinions suggest that a number of bottlenecks remain to be addressed. Some of these include:

- the lack of a strong mechanism to address the operational issues on ground;

- problems related to customs procedure and documentation;

- issues related to the funding of various infrastructure projects;

- low level of container trade on the INSTC (it can be noted that due to the low level of trade; containers often come back empty, increasing the cost of container movement on this route);

- lack of common border crossing rules among the member countries;

- problems related to the insurance and data exchange between the member states;

- gradient problem restricting speed;

- higher tariffs by rail vis-à-vis road transport for movement from Bandar Abbas to Amirabad;

- wagon shortage and load restrictions for transit traffic in Iran;

- problem of break of gauge; and,

- security fears emanating from Afghanistan.

All these could adversely impact the development of the India–Iran–Afghanistan–Central Asia route.

VIII. Current status and potential for Indian engineering exports across INSTC corridors

The INSTC a very important for India trade-wise, and its importance might significantly increase in years to come. In 2016, India exported engineering goods, to members of INSTC, (including Bulgaria which is having an observer status) worth USD 3,567 million. This is though a significant decline compared to export of over USD4, 857 million in 2014 (Table 2).

At the country level, there are only three countries, namely Oman, Syria, and Iran whose share of Indian engineering exceeds two percent. In other three countries, India’s share is quite low, below two percent.

Table 2: India's Export to the Members of International North-South Transport Corridor (INSTC)

(Value in thousand USD)

| Country | Product label | India's exports | Member country’s global imports | Share of India in country's total imports (%) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | ||

| Russian Federation | All products | 2,217,473 | 1,611,893 | 1,813,884 | 286,648,777 | 182,781,965 | 182,257,214 | 0.8 | 0.9 | 1.0 |

| Engineering Products (HS Code 72 to 94) | 753,597 | 469,296 | 571,377 | 160,092,507 | 95,968,903 | 93,749,368 | 0.5 | 0.5 | 0.6 | |

| Iran, Islamic Republic of | All products | 4,404,314 | 3,126,869 | 2,412,535 | 72,774,998 | 55,313,741 | 46,128,546 | 6.1 | 5.7 | 5.2 |

| Engineering Products (HS Code 72 to 94) | 1,186,085 | 923,867 | 494,600 | 36,520,574 | 27,088,564 | 23,107,934 | 3.2 | 3.4 | 2.1 | |

| Belarus | All products | 51,090 | 34,251 | 41,860 | 40,502,360 | 30,291,493 | 27,463,712 | 0.1 | 0.1 | 0.2 |

| Engineering Products (HS Code 72 to 94) | 15,725 | 8,044 | 5,276 | 14,244,358 | 9,846,966 | 8,944,500 | 0.1 | 0.1 | 0.1 | |

| Republic of Kazakhstan | All products | 237,906 | 168,372 | 125,026 | 41,295,456 | 30,567,159 | 25,174,779 | 0.6 | 0.6 | 0.5 |

| Engineering Products (HS Code 72 to 94) | 25,176 | 23,540 | 28,533 | 23,209,942 | 17,029,949 | 13,112,140 | 0.1 | 0.1 | 0.2 | |

| Republic of Tajikistan | All products | 60,004 | 31,348 | 19,714 | 5,018,086 | 3,584,671 | 3,242,204 | 1.2 | 0.9 | 0.6 |

| Engineering Products (HS Code 72 to 94) | 6,544 | 2,519 | 2,946 | 1,463,651 | 1,258,583 | 1,108,315 | 0.4 | 0.2 | 0.3 | |

| Sultanate of Oman | All products | 2,426,020 | 2,051,996 | 2,577,624 | 29,303,100 | 29,007,335 | 23,260,012 | 8.3 | 7.1 | 11.1 |

| Engineering Products (HS Code 72 to 94) | 861,857 | 524,053 | 602,014 | 16,309,455 | 14,814,718 | 11,634,792 | 5.3 | 3.5 | 5.2 | |

| Republic of Armenia | All products | 95,889 | 37,063 | 31,640 | 4,159,517 | 3,256,965 | 3,230,134 | 2.3 | 1.1 | 1.0 |

| Engineering Products (HS Code 72 to 94) | 12,905 | 4,054 | 6,908 | 1,168,183 | 943,049 | 903,997 | 1.1 | 0.4 | 0.8 | |

| Republic of Azerbaijan | All products | 112,074 | 59,578 | 31,627 | 9,178,588 | 9,211,126 | 7,156,696 | 1.2 | 0.6 | 0.4 |

| Engineering Products (HS Code 72 to 94) | 5,534 | 9,896 | 12,889 | 5,107,314 | 5,453,265 | 3,870,796 | 0.1 | 0.2 | 0.3 | |

| Syrian Arab Republic | All products | 217,056 | 138,255 | 124,923 | 7,247,613 | 5,314,454 | 4,304,327 | 3.0 | 2.6 | 2.9 |

| Engineering Products (HS Code 72 to 94) | 65,289 | 26,380 | 23,899 | 2,098,208 | 1,474,188 | 1,054,168 | 3.1 | 1.8 | 2.3 | |

| Republic of Ukraine | All products | 406,028 | 251,600 | 291,053 | 54,381,409 | 37,516,153 | 38,282,525 | 0.7 | 0.7 | 0.8 |

| Engineering Products (HS Code 72 to 94) | 129,038 | 49,267 | 56,620 | 15,687,110 | 10,647,106 | 14,212,594 | 0.8 | 0.5 | 0.4 | |

| Republic of Turkey | All products | 5,603,062 | 4,435,912 | 4,473,283 | 242,177,117 | 207,206,509 | 198,601,934 | 2.3 | 2.1 | 2.3 |

| Engineering Products (HS Code 72 to 94) | 1,664,423 | 1,507,864 | 1,621,002 | 103,129,329 | 98,491,636 | 100,083,669 | 1.6 | 1.5 | 1.6 | |

| Republic of Kyrgyzstan | All products | 36,036 | 29,861 | 26,620 | 5,734,704 | 4,068,084 | 3,844,473 | 0.6 | 0.7 | 0.7 |

| Engineering Products (HS Code 72 to 94) | 1,564 | 1,666 | 990 | 2,073,369 | 1,351,151 | 1,191,630 | 0.1 | 0.1 | 0.1 | |

| Republic of Bulgaria (Observer status) | All products | 231,447 | 183,317 | 226,822 | 34,740,042 | 29,265,116 | 28,875,195 | 0.7 | 0.6 | 0.8 |

| Engineering Products (HS Code 72 to 94) | 129,532 | 63,953 | 140,002 | 13,025,459 | 11,304,526 | 11,641,913 | 1.0 | 0.6 | 1.2 | |

| India's total export to INTUC members | All products | 15,860,493 | 11,991,943 | 12,071,585 | 833,161,767 | 627,384,771 | 591,821,751 | 1.9 | 1.9 | 2.0 |

| Engineering Products (HS Code 72 to 94) | 4,857,269 | 3,614,399 | 3,567,056 | 394,129,459 | 295,672,604 | 284,615,816 | 1.2 | 1.2 | 1.3 | |

Source: ITC Trade Map

India’s share in imports of engineering products from these countries is worrying low, as engineering goods worth USD 285 billion were imported by these countries in 2016. This is, however, not the limit as total engineering imports by these countries was much higher in 2014 and 2015 reaching USD 394 billion and USD 296 billion respectively. Looking at engineering import data of these countries, one can argue that there is a huge potential. Even a target of five percent could potentially provide a huge boost to Indian engineering exports, amounting to over USD 25 billion, an eightfold increase over the current export.

The INSTC certainly presents an opportunity to India to boost its engineering exports to member countries and beyond.

IX. Distribution of India’s engineering exports across INSTC member countries

At the moment most of India’s trade is concentrated in four countries within INSTC. Turkey accounts for over 45 percent of India’s total engineering exports to the INSTC member countries. It is followed by Oman (17%) and Russia (16%). Iran is another country which accounts for more than 10 percent share in India’s intra-INSTC engineering export. These together account for more than 92 percent of India’s total export of engineering products across the INSTC corridors (Figure 1).

Figure 1: Share of INSTC's member countries in India's engineering

X. Major items of export from India to INSTC member countries

Table 3: India’s major engineering exported to members of INSTC countries

| Countries |

Engineering products exported by India (2016) |

|---|---|

| Iran | Machinery, Iron Steel, Electrical Machinery, Vehicles, Articles of Iron Steel, Copper articles, Aluminum articles, Optical Medical Instruments, Machine Tools, Hand Tools. |

| Russia | Machinery, Aircraft Spacecrafts parts, Electrical Machinery, Vehicles, Iron Steel, Optical Medical Instruments, Articles of Iron Steel, Hand Tools, Machine Tools, Articles of Base Metals. |

| Armenia | Machinery, Iron Steel, Electrical Machinery, Optical Medical Instruments, Copper articles, Aluminum articles, Vehicles, Iron Steel, Hand Tools, Machine Tools. |

| Azerbaijan | Machinery, Optical Medical Instruments, Electrical Machinery, Articles of Iron Steel, Vehicles, Hand Tools, Machine Tools, Articles of Base Metals, Copper articles, Nickel articles. |

| Belarus | Articles of Iron Steel, Machinery, Optical Medical Instruments, Hand Tools, Machine Tools, Iron Steel, Electrical Machinery, Copper articles, Aluminum articles, Nickel articles. |

| Bulgaria | Aircraft Spacecrafts parts, Aluminum articles, Optical Medical Instruments, Machinery, Articles of Iron Steel, Vehicles, Hand Tools, Machine Tools, Copper articles, Railway parts. |

| Kazakhstan | Optical Medical Instruments, Machinery, Electrical Machinery, Articles of Iron Steel, Hand Tools, Machine Tools, Articles of Base Metals, Railway parts, Vehicles, Copper articles. |

| Kyrgyzstan | Electrical Machinery, Machinery, Optical Medical Instruments, Iron Steel, Copper articles, Nickel articles, Articles of Iron Steel, Vehicles, Aluminum articles, Machine Tools. |

| Oman | Articles of Iron Steel, Machinery, Electrical Machinery, Vehicles, Copper articles, Iron Steel, Optical Medical Instruments, Aluminum articles, Articles of Base Metals, Lead articles. |

| Syria | Machinery, Electrical Machinery, Articles of Iron Steel, Optical Medical Instruments, Hand Tools, Machine Tools, Aluminum articles, Vehicles, Copper articles, Iron Steel. |

| Tajikistan | Articles of Iron Steel, Machinery, Electrical Machinery, Optical Medical Instruments, Hand Tools, Machine Tools, Articles of Base Metals, Iron Steel, Copper articles, Nickel articles. |

| Turkey | Vehicles, Machinery, Iron Steel, Aircraft Spacecrafts parts, Electrical Machinery, Aluminum articles, Articles of Iron Steel, Optical Medical Instruments, Articles of Base Metals, Machine Tools. |

| Ukraine | Machinery, Iron Steel, Vehicles, Articles of Iron Steel, Hand Tools, Machine Tools, Optical Medical Instruments, Electrical Machinery, Aircraft Spacecrafts parts, Aluminum articles |

Source: ITC Trade Map

India exports a range of engineering products to the members of INSTC countries (Table 3).

Table 5: India’s engineering products imported from INSTC members countries

| Countries | Engineering products imported by India (2016) |

|---|---|

| Iran | Iron and steel, Aluminium and articles thereof, Zinc and articles thereof, Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof, Articles of iron or steel, Lead and articles thereof, Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical, Copper and articles thereof, Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television, Vehicles other than railway or tramway rolling stock, and parts and accessories thereof, Tools, implements, cutlery, spoons and forks, of base metal; parts thereof of base metal |

| Russia | Iron and steel, Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof, Copper and articles thereof, Nickel and articles thereof, Aircraft, spacecraft, and parts thereof, Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television, Aluminium and articles thereof, Ships, boats and floating structures, Articles of iron or steel, Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical |

| Armenia | Copper and articles thereof, Lead and articles thereof, Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television, Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof |

| Azerbaijan |

Lead and articles thereof, Zinc and articles thereof, Aluminium and articles thereof, Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof |

| Belarus | Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television, Vehicles other than railway or tramway rolling stock, and parts and accessories thereof, Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof, Iron and steel, Tools, implements, cutlery, spoons and forks, of base metal; parts thereof of base metal, Articles of iron or steel |

| Bulgaria | Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television, Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof, Iron and steel, Aluminium and articles thereof, Ships, boats and floating structures, Arms and ammunition; parts and accessories thereof, Zinc and articles thereof, Copper and articles thereof |

| Kazakhstan | Iron and steel, Zinc and articles thereof, Other base metals; cermets; articles thereof, Copper and articles thereof, Articles of iron or steel |

| Kyrgyzstan | Aluminium and articles thereof, Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof |

| Oman | Aluminium and articles thereof, Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof, Iron and steel, Articles of iron or steel, Nickel and articles thereof, Vehicles other than railway or tramway rolling stock, and parts and accessories thereof, Zinc and articles thereof, Lead and articles thereof, Electrical machinery and equipment |

| Syria | Articles of iron or steel |

| Tajikistan | Aluminium and articles thereof, Iron and steel |

| Turkey | Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof, Iron and steel, Ships, boats and floating structures, Electrical machinery and equipment, Vehicles other than railway or tramway rolling stock, and parts and accessories thereof, Articles of iron or steel, Aluminium and articles thereof, Copper and articles thereof, Aircraft, spacecraft, and parts thereof, Zinc and articles thereof, Tools, implements, cutlery, spoons and forks, of base metal; parts thereof of base metal, Lead and articles thereof |

| Ukraine | Iron and steel, Electrical machinery and equipment, Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof, Ships, boats and floating structures, Articles of iron or steel, Railway or tramway locomotives, rolling stock and parts thereof; railway or tramway track fixtures, Aircraft, spacecraft, and parts thereof |

XI. Current status and potential for INSTC member countries in India

India imported engineering goods worth USD 1,468 million in 2016 from the members of INSTC (including Bulgaria which has an observer status). India’s import data reflect a significant decline in imports of engineering products from INSTC member countries compared to import of over USD 1,869 million in 2014 (Table 4). This could occur because of general global slowdown in demand for imports and some technical issues such as UN sanctions on Iran some logistical challenges. However, potential seems huge considering recent initiatives by the INSTC member countries to improve connectivity and logistics.

At the country level, there are three countries, namely Russia, Tajikistan, and Oman in whose share of India in their total export is nearly two percent or more.

Table 4: India's Import from the Members of International North-South Transport Corridor (INSTC)

(Value in thousand USD)

| Country | Product label | India's imports | Member country’s global exports | Share of India in country's total exports (%) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | ||

|

Russian Federation |

All products |

4207629 | 4527091 | 4782005 | 497833529 | 343907652 | 285491052 | 0.8 | 1.3 | 1.7 |

|

Engineering Products (HS Code 72 to 94) |

955368 |

1180177 |

670651 |

62,729,592 | 54,758,329 | 45,513,679 | 1.5 | 2.2 | 1.5 | |

|

Iran, Islamic Republic of |

All products |

11246347 | 6225321 | 8253715 | 68104098 | 41255011 | 46346916 | 16.5 | 15.1 | 17.8 |

|

Engineering Products (HS Code 72 to 94) |

48442 | 4535 | 31972 | 68104098 | 41255011 | 46346916 | 0.1 | 0.0 | 0.1 | |

|

Belarus |

All products |

198,927 | 162,150 | 136,269 | 36,080,537 | 26,660,395 | 23,413,988 | 0.6 | 0.6 | 0.6 |

|

Engineering Products (HS Code 72 to 94) |

7,696 | 4,116 | 7,835 | 8,426,611 | 5,829,889 | 6,340,574 | 0.1 | 0.1 | 0.1 | |

|

Republic of Kazakhstan |

All products |

924,993 | 337,545 | 320,361 | 79,458,749 | 45,954,426 | 36,775,323 | 1.2 | 0.7 | 0.9 |

|

Engineering Products (HS Code 72 to 94) |

38,897 | 29,593 | 41,295 | 8,734,092 | 6,673,663 | 6,875,883 | 0.4 | 0.4 | 0.6 | |

|

Republic of Tajikistan |

All products |

3,619 | 9,875 | 14,689 | 896,822 | 928,097 | 744,434 | 0.4 | 1.1 | 2.0 |

|

Engineering Products (HS Code 72 to 94) |

143 | 9 | 8,482 | 333,032 | 353,911 | 278,594 | 0.0 | 0.0 | 3.0 | |

|

Sultanate of Oman |

All products |

1819510 | 1567250 | 1,300,263 | 50,718,324 | 31926531 | 24454713 | 3.6 | 4.9 | 5.3 |

|

Engineering Products (HS Code 72 to 94) |

251153 | 240694 | 309749 | 2495148 | 6793631 | 4813252 | 10.1 | 3.5 | 6.4 | |

|

Republic of Armenia |

All products |

1,856 | 14,453 | 1,339 | 1,490,190 | 1,482,667 | 1,775,573 | 0.1 | 1.0 | 0.1 |

|

Engineering Products (HS Code 72 to 94) |

715 | 111 | 773 | 355,178 | 283,617 | 290,631 | 0.2 | 0.0 | 0.3 | |

|

Republic of Azerbaijan |

All products |

422225 | 82110 | 280718 | 21751737 | 11,326,841 | 12636624 | 1.9 | 0.7 | 2.2 |

|

Engineering Products (HS Code 72 to 94) |

192 | 135 | 662 | 240,909 | 207,761 | 269,117 | 0.1 | 0.1 | 0.2 | |

|

Syrian Arab Republic |

All products |

86,750 | 35,828 | 35,695 | 1,107,309 | 844,021 | 731,525 | 7.8 | 4.2 | 4.9 |

|

Engineering Products (HS Code 72 to 94) |

1 | 37 | 3 | 99,081 | 66,567 | 47,976 | 0.0 | 0.1 | 0.0 | |

|

Republic of Ukraine |

All products |

2195127 | 1802262 | 1955996 | 53913302 | 38127040 | 36838979 | 4.1 | 4.7 | 5.3 |

|

Engineering Products (HS Code 72 to 94) |

246793 | 167188 | 72464 | 23130275 | 14,646,509 | 12713932 | 1.1 | 1.1 | 0.6 | |

|

Republic of Turkey |

All products |

1347562 | 989334 | 1129743 | 157610158 | 143850376 | 142606247 | 0.9 | 0.7 | 0.8 |

|

Engineering Products (HS Code 72 to 94) |

264837 | 196764 | 274564 | 68453821 | 60454045 | 61131365 | 0.4 | 0.3 | 0.4 | |

|

Republic of Kyrgyzstan |

All products |

486 | 1,582 | 1,808 | 1,883,733 | 1,441,468 | 1,423,028 | 0.0 | 0.1 | 0.1 |

|

Engineering Products (HS Code 72 to 94) |

184 | 284 | 182 | 210,604 | 228,194 | 207,067 | 0.1 | 0.1 | 0.1 | |

|

Republic of Bulgaria <p>(Observer status) |

All products |

108594 | 88595 | 121651 | 29386540 | 25778746 | 26087706 | 0.4 | 0.3 | 0.5 |

|

Engineering Products (HS Code 72 to 94) |

55388 | 42490 | 49906 | 11509012 | 10332943 | 9979315 | 0.5 | 0.4 | 0.5 | |

|

India's total export to INTUC members |

All products |

22563625 | 15843396 | 18334252 | 1000235028 | 713483271 | 639326108 | 2.3 | 2.2 | 2.9 |

|

Engineering Products (HS Code 72 to 94) |

1869809 | 1866133 | 1468538 | 254821453 | 201884070 | 194808301 | 0.7 | 0.9 | 0.8 | |

Source: ITC Trade Map

India’s share in exports of engineering products by INSTC member countries is quite low, as engineering goods worth USD 195 billion were exported by these countries in 2016. In the preceding years (2014 and 2015), total engineering exports by these countries were much higher at USD 255 billion and USD 202 billion respectively. Going by the engineering export data of these countries, one can argue that there is a huge potential as complementarities do exists in India’s import and their exports.

It is expected that with the INSTC fully coming into operation, exports from these countries to India could get a significant boost. Even a target of three percent could potentially provide a huge boost to export from these countries, and could result in a fourfold increase over the current level.

The INSTC certainly presents an opportunity to India to boost its engineering exports to member countries and beyond.

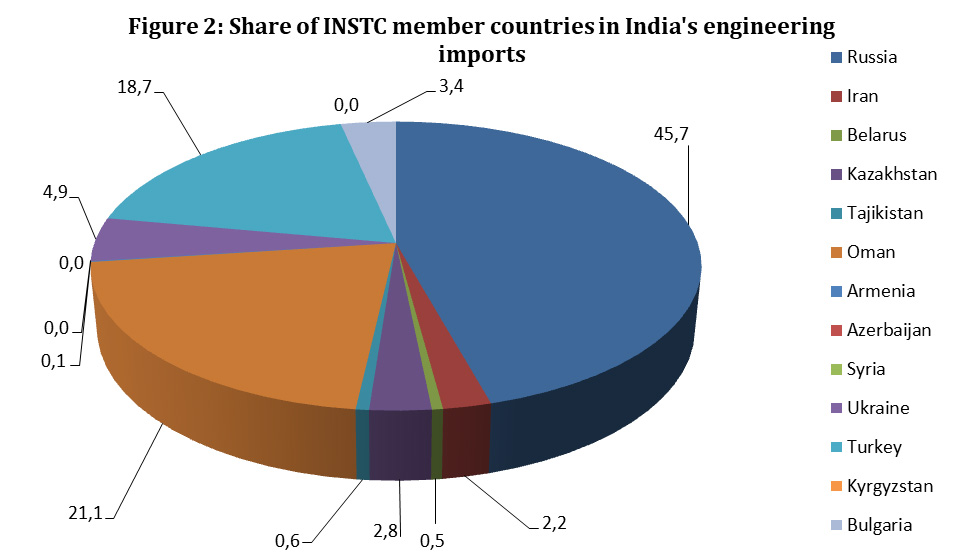

XII. Distribution of India’s engineering imports from INSTC member countries

Presently amongst INSTC member countries, most of India’s imports of engineering products are concentrated in five countries. Russia accounts for nearly 46 percent of India’s total engineering imports from the INSTC member countries. It is followed by Oman (21%) and Tajikistan (19%). Kazakhstan and Ukraine are other countries with significant share. These together account for about 92 percent of India’s total import of engineering products from the INSTC corridors (Figure 2).

Figure 2: Share of INSTC member countries in India's engineering

XIII. Major items of import by India from INSTC member countries

India exports a range of engineering products to the members of INSTC countries (Table 5).

XIV. Could there be a future convergence between India’s INSTC and China’s OBOR?

China’s OBOR, formally announced by Chinese President Xi Jinping in a speech at Nazarbayev University in Kazakhstan on September 7, 2013, is a much publicized initiative compared to India’s INSTC. OBOR is, arguably, China’s most ambitious initiative seeking to reshape its engagement with its neighbors, and with the Eurasian land mass. It aims to connect some 60 countries across Asia, Africa and Europe to boost trade and economic ties along its traditional maritime route.

In contrast, INSTC, also a very ambitious project, will connect the India Ocean and Persian Gulf with the Caspian Sea through Iran and then onwards to St. Petersburg in Russia and Northern Europe. At the moment, there are 13 countries who have officially agreed to become part of the INSTC. Some of these countries, such as Kyrgyzstan, Uzbekistan, Turkmenistan, among others, are also part of China OBOR. It could be expected that several other countries in the central part of Europe could join the project. Bulgaria, presently having an observer status, could join soon.

Operationalization of INSTC on the one hand and OBOR on the other could probably help South Asia integrate more effectively to the global trading system.

A close look at the map, combining the two (OBOR and INSTC), suggest good potential and scope for their convergence. While China’s OBOR connects Shanghai and Almaty in Kazakhstan, extension of INSTC connects Almaty through Bandar Abbas in Iran. Similarly, extension of INSTC’s north-west route (connecting Iran, Turkmenistan and Kazakhstan) could converge to connect OBOR’s Shanghai-Almaty route.

Map 2: INSTC and Other Transport Corridors

Source: Institute for Defense Studies and Analyses, New Delhi http://www.idsa.in/system/files/issuebrief/instc.msroy180815.jpg

Since connectivity is critical for promotion of trade, one can expect that with better understanding, improving political relations and broadening of scope of the two initiatives, countries in Asia and Europe will emerge better integrated and attain a position towards fuller exploitation of trade and business opportunities. Such a development can certainly make INSTC and other similar transport networks economically viable and sustainable.

This paper is a modified version of the article published in ‘Indian Engineering Exports’ magazine, September 2017 issue. This has been prepared by Suresh P Singh and Manila Sharma of EEPC India’s Policy Division. Views are personal.

1. A study conducted by the Federation of Freight Forwarders’ Associations in India (FFFAI) found the route is 30% cheaper and 40% shorter than the current traditional route.

(votes: 4, rating: 4) |

(4 votes) |

Working Paper No. 29 / 2016

Russia–India Strategic Partnership: Have We Hit a Plateau?