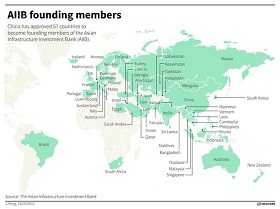

The Asian Infrastructure Investment Bank (AIIB), officially launched at a signing ceremony in Beijing on 29 June 2015, first gained major international attention on March 2015 when major European powers (including the U.K., Germany, and France) announced their decision to participate in the new bank. Russia and India, along with the more than 50 other founding members, also joined China in establishing the first Asian multilateral financial institution since the inception of the Asian Development Bank (ADB) in Manila on December 1966. The new bank’s main goals are to fulfil the gap in infrastructure funding in the economically dynamic Asian region, as well as to promote economic cooperation across the region, which has so far lacked a mechanism for integration. This article explores how its rise could help potential beneficiary nations by providing alternative sources of development funding and by fostering healthy competition among multilateral creditors.

In contrast, American and Japanese analysts, wary of growing Chinese economic influence, have warned that the AIIB would be simply a “Chinese bank of domination.” [1] Their assertion is that with its headquarters being based in Beijing, with its managing director coming from the Chinese government, and with its “questionable” commitment to good governance in the multilateral bank, the AIIB would be soon turned into a Chinese lever that could counter Western influence in the region as well as pursue its own economic agenda. True, the Asian region is suffering from a critical lack of infrastructure funding, with a projections from an ADB Institute study placing infrastructure funding needs at over 700 billion dollars per year at the moment [2]. But those who are cautious of the new bank insist that this shortage can be covered primarily by increasing the finance from existing multilateral institutions and promoting other public private partnerships (PPPs). Although these claims appear to be reasonable at a glance, they fail to consider a broader development imperative. First, the alleged risk of “Chinese domination” should be judged in comparative terms vis-à-vis the contemporary practices of other “Western-dominated” banks. Second, this negative appraisal fails to consider the dynamics of international competition, that is, how the rise of the AIIB will be subject to constraints from both Breton-Woods policymakers and the conduct of the new AIIB managers themselves. Third, the current debate on the AIIB revolves mainly around the perspective of creditors and other existing multilateral development banks; as a result, it lacks the viewpoint of borrowers. It also pays little attention to the potential impact on growth and poverty alleviation stimulated by increased infrastructure investments.

Competition and Monopoly in Development Finance

Breaking monopolies has been a central focus of modern economic policy. Indeed, both the free market economy and democratic governance function through the mechanism of competition. However, paradoxically, the current system of global development finance – managed chiefly by the Bretton-Woods institutions and other regional banks – has been monopolistic at best and dominating at worst [3]. Here, our argument is not that these institutions are managed by predatory lenders whose sole objective is to subordinate the developing world [4]; instead, we maintain that the current system has so far lacked a mechanism of competition which would ensure more choices to be made available to beneficiaries. In this sense, the rise of the AIIB presents a promising opportunity to break from the Bretton-Woods monopoly on development finance and promote a more equitable and pluralistic international economic order in the region and beyond.

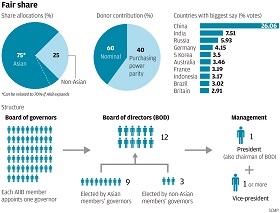

If you ask whether China will possess an overwhelming influence over the management of the AIIB, the answer would be in the affirmative. But a more appropriate question which ought to be considered here is whether the position of China in the AIIB would be unprecedentedly powerful compared to the power that the U.S., Europe and Japan hold in the Breton-Woods institutions. Indeed, after many years of lobbying by emerging economics such as China, Russia and India, the existing multilateral banks are finally undergoing a lengthy process of adjusting their voting power. It is true that China would hold a greater equity position and a larger voice in the new bank; however, this is nothing unique or unprecedented. One might say that, just because the AIIB will be headquartered in Beijing, China’s influence over the bank’s decision-making process will be overwhelmingly high. But this assertion is exaggerated if we recall that the World Bank is located just 300 meters away from the U.S. Department of Treasury and just 800 meters away from the White House in the American capital. Likewise, one might argue that the expected appointment of a former Chinese official as the AIIB head reveals China’s intention to impose its will through executive management positions. But this practice is probably what China has learned from America; since 1946, the World Bank has been headed by twelve presidents, all of them U.S. citizens [5]. The first president of the World Bank, Eugene Meyer, was the Chairman of the Federal Reserve. The second, John J. McCloy, served as U.S. Assistant Secretary of War and the fifth president Robert McNamara was even U.S. Secretary of Defense. Most recently, the tenth president Paul Wolfowitz was U.S. Deputy Secretary of Defense and the eleventh president Robert Zoellick was U.S. Deputy Secretary of State. As such, the ultimate test is whether the top executives of the new bank, as in the case of the World Bank, can perform their duties with the highest level of professionalism as well as whether they can deliver economic benefits to the beneficiaries as planned.

Enlarging the Finance-Base in the Asia-Pacific Region

While the rise of the AIIB might diminish the relative influence of the existing multilateral banks, more competition means more options for beneficiary nations. At the May 2015 meeting of the potential founding members in Singapore, it was announced that the draft articles of agreement for the AIIB would target 100 billion dollars as its initially authorized capital. It is expected that China will subscribe to the largest equity stake, while Russia and India will also be other major shareholders of the new bank. In terms of capital, the new AIIB would rank second among the existing multilateral development banks, with the ADB ranking first with its subscribed capital standing at 163 billion dollars [6]. With equity to loan conversion ratios of around 0.4, the ADB’s fund sourcing capabilities, as represented by its total current outstanding loan portfolio, amounts to 65 billion dollars [7]. For the year 2015, ADB’s allocation for public infrastructure lending stands at 11.1 billion dollars, representing roughly 80% of its overall lending allocation, with other funds being allocated for lending in the sectors of finance, public sector management, education, agriculture and natural resources [8]. Infrastructure finance in Asia is also currently being sourced from other multilateral development banks such as the World Bank and the IMF, which also have much better equity-to-loans conversion ratios of 5.44 and 3.62, respectively [9]. This allows them to deploy over 300 billion dollars in loans and other financial instruments, despite their combined equity standing of only 55 billion dollars in total.

The combined efforts of the existing development banks are therefore admittedly insufficient to fulfil the needs of investment-hungry Asia. As mentioned before, with the need for infrastructure spending in the region exceeding 700 billion dollars annually [10], the establishment of the AIIB does not by itself profess to eliminate the funding gap, but it can certainly contribute to fill a part of the shortage. More specifically, the new bank may play a larger role in fostering development finance in the region, beyond by three distinctive “multiplier” mechanisms detailed below.

First, it is expected that leading developed nations, wary of the unchecked growth of Chinese influence in Asia, will redouble efforts to secure their economic presence in the region. There are already early signs of increased funding availability (and improved lending conditions) to beneficiary nations. For instance, shortly after the announcement on April that the AIIB would be joined by more than 50 countries across the world, the ADB announced that its grant procedures would be simplified to allow swifter access to finance. The ADB also announced that it would boost its total lending and grant approvals to an unprecedented level of 20 billion dollars annually, out of which normally 16 billion dollars should be allocated to the infrastructure sector [11]. On May 2015, Japanese Prime Minister Abe also announced that a fresh 110 billion dollars would be made available by the Japanese government over the next five years, in collaboration with the ADB, for high quality infrastructure projects. As an analyst put it, the move was a “competitive slap at China’s new Asian Infrastructure Investment Bank.” [12] This increased competition in development finance in the region will certainly incentivize new and existing creditors to enlarge their funding-base and accelerate their grant procedures, driving forward the “investment race.” Indeed, the race is also joined by the BRICS New Development Bank, which is set to accelerate its own timetable for operations, while the AIIB itself is reportedly mulling ways to accelerate its capitalization program.

Second, the mechanism of international credit-rating and financial leverage will also affect the wiggle room for AIIB managers, if they wish to multiply its impact. As discussed above, achieving a higher equity-to-loan conversion ratio will enable the AIIB to give out more loans by leveraging its financial base. Nonetheless, AIIB managers need to be reminded that implementing good governance and learning from best practices are prerequisites for achieving triple AAA credit ratings. While the AIIB is taking a strong step towards the further regionalization of global development finance, the participation of major developed economies is important precisely because it increases the overall credibility and legitimacy of the AIIB. The involvement of European powers also can foster the setting of higher lending standards. At the end of the day, the AIIB will not be a new bank floating in the middle of a governance vacuum; if it wishes to optimize its long-term impact, the AIIB managers need to follow the established framework of credit-rating and other international economic conventions. This is why we are less concerned about the “Chinese-dominance” vector of the new bank. If the AIIB acts like a financial dictator, its lending power (in terms of equity-to-loan conversion ratio) will sharply decline, eroding its economic influence in the region. Furthermore, if beneficiary nations feel that the conditions offered by the AIIB are unfair, they will simply switch to the ADB or other multilateral development banks. This is yet another virtue of healthy economic competition: if China wants to realize the potential of the AIIB, it needs to be bound by the operational rules of the financial market, as well as its long-term reputation as a credible investor in the international economic arena. In this regard, it appears the Chinese are already listening to some of these concerns. Mr. Jin, the interim CEO of the AIIB, is reported to be recruiting former World Bank lawyers and officials to serve at the new bank.

Third, the increased funding for infrastructure should be guided by a coherent vision of improving living standards and economic dynamism of the greater Asian region. This is where China’s regional integration plans and the Russian-led Eurasian Economic Union project come to play an ever more important role. The press widely covered President Xi’s estimate that Chinese trade in the Silk Road Belt alone could reach 2.5 trillion dollars if proper investments are made into airports, seaports, railroads, power plants and toll roads. Given many Central Asian states will be members of the AIIB, the alignment between the Eurasian Development Bank and the AIIB will also be a point of major discussion. Overall, increased investment in infrastructure does not automatically translate into regional prosperity; a coherent integration mechanism in the region is needed to complement the lending programs of the new bank.

Conclusion

In development finance, the center of power has traditionally been nestled in the Bretton-Woods institutions where major Western powers have taken the lead so far. The promotion of an alternative financial institution such as the AIIB promotes the regionalization of development finance, which increases competition among the existing and new-coming multilateral development banks. Our conclusion is that heightened competition deters the monopolistic behaviors of major creditors and leads to the increased overall funding availability for beneficiary nations. We are skeptical about the Chinese dominance thesis since China itself will be bound by the rules of competition if it wishes to leverage its lending power. If the new bank cooperates with other development institutions, it can bring about larger benefits to the recipient nations, better-designed programs to promote sustainable development, and higher standards of living for the Asian populations. In this light, the upcoming challenges will be involve establishing productive rules of competition as well as positioning regional infrastructure and development finance within a wider framework of regional economic integration.

1. See, for example, Philip Lipscy. 2015. Who’s Afraid of the AIIB?, Foreign Affairs, 7 May 2015; Kanji Nishio. 2015. AIIBにみる中国の金融野心と参加国の策略とは [Understanding China’s financial ambition and the participating members’ strategy from the AIIB], Sankei Shinbun, 16 April 2015; Mainichi Shinbun. 2015. <アジア投資銀>拒否権、本部に理事不在…中国の思惑を反映 [AIIB: Veto for Beijing, Director Absent in the Headquarter…reflecting the will of China]. 22 May 2015.

2. Bhattacharyay, Biswa N. 2010. Estimating Demand for Infrastructure in Energy, Transport, Telecommunications, Water and Sanitation in Asia and the Pacific: 2010-2020, September 2010, ADB Institute, cited in Bryson, Jay H., and Erik Nelson. 2015. China & the Asian Infrastructure Investment Bank, Wells Fargo Special Commentary, 16 April 2015, p.3.

3. Jiji Tsushin. 2015. 中国、国際舞台で存在感=米主導金融秩序へ挑戦 –G20 [China’s presence heightens in the international arena: Challenging the American-led Financial Order –G20.], 25 April 2015.

4. On the argument that the Chinese state-banks are outperforming in African development finance compared to the Bretton-Woods institutions, see Moyo, Dambisa. 2009. Dead aid: Why aid is not working and how there is a better way for Africa. London: Macmillan.

5. The ninth president James Wolfensohn (who served during 1995-2005) was born as an Australian citizen but later became a naturalized American citizen before taking office as president of the World Bank.

6. See ADB. 2013. ADB Financial Report 2013, accessible at http://www.adb.org/sites/default/files/institutional-document/42741/adb-financial-report-2013.pdf.

7. See Syadullah, Makmum. 2015. Prospects of Asian Infrastructure Bank. Journal of Social and Development Science 155 (3), p.162. The ADB website states that its total outstanding loans are 56 billion dollars, with its un-disbursed loans in effect are 26 billion dollars. ADB. 2015. Credit Fundamentals: Asset Quality. Accessible at http://www.adb.org/site/investors/credit-fundamentals/asset-quality.

8. Ibid. See also Bryson, Jay H., and Erik Nelson. China & the Asian Infrastructure Investment Bank, p.3.

9. Syadullah, Prospects of Asian Infrastructure Bank.

10. Bhattacharyay, Estimating Demand for Infrastructure in Energy, Transport, Telecommunications, Water and Sanitation in Asia and the Pacific.

11. Iwamoto, Masaaki, and Kyoko Shimodoi. 2015. Japan Boosts Asia Infrastructure Outlays as China Champions AIIB. Bloomberg Business, 21 May 2015.

12. EM Equity. 2015. Japan Vows $110 Billion For Asian Infrastructure In A One-Upmanship To China Over The AIIB, Emerging Equity, 25 May 2015. Emphasis is added.

13. Mainichi Shinbun. 2015. <AIIB>世銀出身の8人が設立準備に協力 [AIIB: Eight Ex-World Bank Staff participate in the establishment of the AIIB.], 28 June 2015. The news reports that one of them is American analyst David Dollar, who has worked at the Brookings Institution in Washington, D.C. and has been invited by China to advise on the governance of the AIIB. Another report cites among the new recruits Natalie Lichtenstein, a former World Bank lawyer. Roach, Stephan A., Zha Daojiong, Scott Kennedy, and Patrick Chovanec. 2015. Washington’s Big China Screw-Up. Foreign Policy, 26 March 2015.

14. He, Laura. 2015. Chinese stocks rally on Silk Road details. Market Watch, 30 March 2015; Reuters. 2015. China's Xi: Trade between China and Silk Road nations to exceed $2.5 trillion. Reuters, 29 March 2015.