Modesty is Gold, Audacity is Silver in Russian Business –A turbulent story of BP in Russia

In

Log in if you are already registered

Today’s global business faces a pressing call for incorporating social responsibility into a calculus of strategic profit making. Although good corporate citizenship has become one of universal criteria to access the overall success of any global firm, market share, along with profitability, remains as the most fundamental measure of global business performance and development. Business systems are conventionally designed to expand the market share in any given market, and failure to do so may result in a corporate devolution. However, Russia happens to be one of the places where many elements of the conventional (Western) business thinking need to face a radical revision.

Photo: Super.com supercom.org/why-russia-chose-bp-as-a-partner/433060/

Particularly in Russian energy sector, market share may not be an appropriate indicator of business success for international companies. For example, despite their tremendous initial success and increasing market share, the TNK-BP (a joint venture of Russian company TNK and an international major BP) has shown stagnated performance during the recent years. Today it even confronts with a fatal internal fragmentation and a crisis of business retreat. Analyzing the turbulent case of the TNK-BP, this article explores how BP should integrate market and nonmarket strategies in building a commercial future in Russian energy market, while shifting its thinking away from the conventional success measures. The case also presents extensive implications for other competitors in the same realm, as well as for any international company that is aiming to enter Russian market of strategic importance.

In sum, the main purpose of this article is to provide:

- A brief summary of the TNK-BP joint venture development that is often studied, referred, and analyzed as a salient case of how a large multinational company can make an epic success and failure in Russian market.

- A strategic analysis of how to creatively combine economic and political aspects of business development in Russian business environment.

- A proposal of integrating market and nonmarket strategies to exploit economic opportunities while containing political risks and uncertainties in Russia.

Today, Russia is awakening from a decade-long economic nightmare and returning as global energy super power. Yet historically, foreign ties and technologies have been a key factor in advancing Russian energy market, especially amid and after turbulent events. After the 1917 Revolution and the 1991 implosion of the USSR, Russian government had no choice but offering concessions to foreign companies. For example, Production Sharing Agreements (PSAs) were widely practiced in the 1990s with major foreign majors.[1] Taking advantage of the rapidly evolving business opportunities, BP has spearheaded to enter Russian energy market since the 1990s. After a series of success and failure, BP established a joint venture with Russian company TNK.[2] The TNK-BP added 11 percent to its proven oil and gas reserves and 15 percent to its overall production. Overnight TNK-BP became the largest of BP’ six profit centers worldwide where 25% of BP’s global production was from TNK-BP; As of 2012 BP had reportedly made over $19 billion in dividends from its investment in TNK-BP, and TNK-BP remains a major source of profits.[3] However, BP recently suffered from a growing conflict between its strategy and interests of Russian counterparts, resulting in a series of crises that acutely demonstrated inherent instability of partnerships in Russia.

Then, how can BP be successful in Russia and establish a benchmark for other international companies? To gain a better understanding of BP’s epic successes and failures, it is imperative to creatively combine economic and political aspects. First, there is a notable trend in Russian energy market, namely, increasing energy demand abroad and decreasing energy supply at home. While increasing demand in Russian energy market mainly comes from its rising neighbors such as China and India, Japan has also started to aggressively search for energy suppliers after the catastrophic nuclear incident of 2011. Russian interest is to swiftly respond to these rising demands and to convert its rich natural resource endowments into tangible financial assets, which can be strategically utilized to bolster political stability and economic dynamism within Russia. But on the supply side, a majority of production facilities within Russia are becoming outdated and infrastructural decay is also widespread.[4] While Russian giant firms are largely reluctant to make new investments, production level is expected to slow down and eventually even decrease. Therefore, Russia needs both of new technologies and replacement of decaying old facilities. This twofold trend of increasing external demand and decreasing internal supply provides a widening opportunity for BP, as well as other international companies.

However, a picture of promising future becomes gloomy in light of endemic political risks. State interventions into Russian economy have augmented to an unprecedented magnitude particularly after Mr. Vladimir Putin was sworn into presidency in the early 2000s.[5] President Putin’s grand strategy is twofold; on the one hand, Russia must produce and sell its oil and gas as soon as possible before alternative energy resources, such as shale gas, develop and disrupt current high prices.[6] On the other hand, Russia is also cautious of providing extensive energy sources to other increasingly assertive powers such as China and India.[7] A Russian major Yukos faced a fatal destruction when it planned to export large amount of energy supplies to China, which triggered emotional reactions from Kremlin.[8] Although recent Russia saw a rapid concentration of power from regional governments to Moscow, there is also an endemic issue of multiple regulators and interagency conflicts that prolong production schedules thus raise commercial uncertainty. As promising market opportunities ahead, these political factors are expected to stand on BP’s way to success and prosperity.

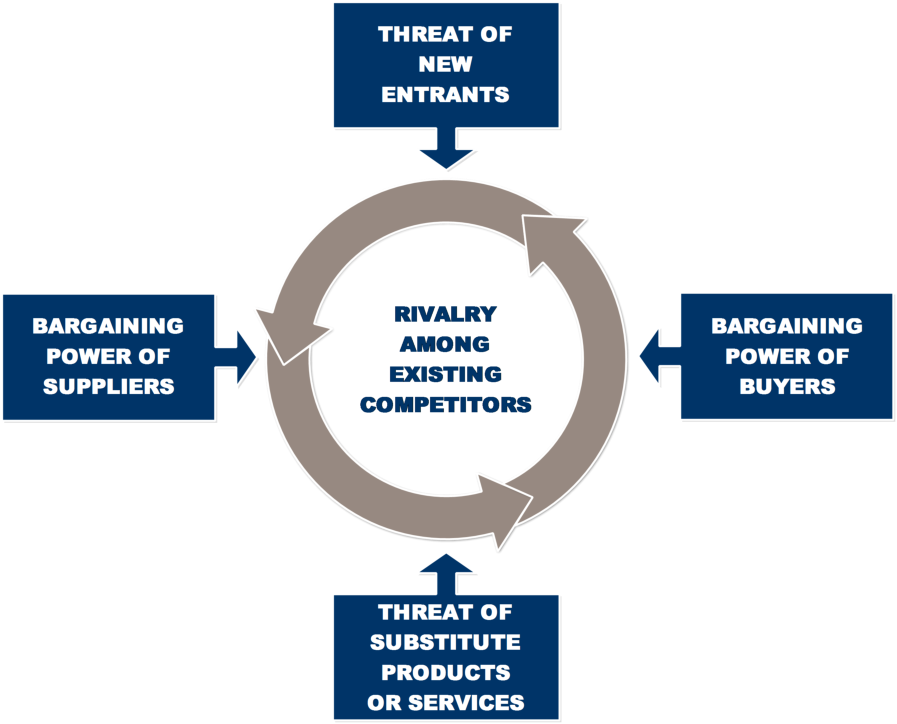

To effectively contain these risks and exploit widening market opportunities, BP should employ an integrated strategy. Here I jointly utilize several business analyses framework to address the issue. First, I use the well-known Porter’s 5 Forces analysis[9] to identify the prime threat to BP’s profitability in the Russian energy industry.

Photo: http://masonmyers.com/

1. Rivalry among existing firms

As Russian domestic firms are reluctant to make new investments and to renew their techniques, new oil and gas fields in Russia are not fully explored and rivalry among existing firms does not pose a dire threat to the profitability of BP.

2. Threat of new entry

The threat of new entry also remains limited possibility. From the experiences of the TNK-BP, BP has cultivated a vast amount of nonmarket assets and it can exploit the first mover’s advantage. As a trend, other major international firms are also hesitant or incompetent to enter Russian market.

3. Bargaining power of buyers

Third, bargaining power of buyers is limited. The inelastic nature of demand in energy supplies put buyers in disadvantageous position while the increasing demand worldwide further deteriorates buyers’ negotiating position.

4. Threat of substitute

In a longer term, possible substitute can develop and change the landscape of bargaining powers. Although this makes a good threat to BP’s profitability, this possibility is limited in the short run, since it takes time to establish new markets.

5. Bargaining power of suppliers

Finally, bargaining power of suppliers marks the largest threat to BP both in short and long run. There are many possible inputs in energy market such as human resources and machineries, but of the most importance is the access to natural resources and BP should not underestimate its large potential threat.

Now, I have identified that bargaining power of supplier and threat of substitutes consist the first and second rank threat to BP’s profitability. There are several ways to counter these threats. For example, involving wealthy European buyers and other influential customers in business process can enhance BP’s position in Russia, since the growing interdependence makes Russia more vulnerable to the voices of customers. To counter the threat of substitute, mutual interest to quickly exploit natural resource and generate revenue must be also emphasized when BP approaches to Moscow. This strategy is difficult to be imitated by others since other major international firms do not have a luxury of nonmakrket assets that can accelerate the business process. Lastly but not least, BP should also involve more of Russian scholars in their business process, since these academic personalities consist a large force of resistance to change and innovation in Russia.

Next, these market strategies should be combined with nonmarket perspectives. Here I present a brief analysis of Barron’s 4Is.[10] Barron’s 4Is are proposed to analyze four most important elements of nonmarket strategy, namely, Issues (threats to or opportunities for profit), Institutions (ultimate decision-makers and their procedures), Interests (goals, hopes, fears of other actors), and Information (what it takes to make decision). As we have come through, various regulatory issues stand in BP’s way to success, and the Executive office (particularly president Putin) remains as the ultimate decision maker. The decision maker is interested in advancing national interests, limiting potential great powers, and also realizing social stability. Regarding the natural resources, these officials make decision building on various reports and researches that explain, assess, and predict possibilities of technological improvements and market trends.

Photo: http://www.rhi.com.sg/

Integrating various aspects that we have considered, one part of integrated strategy can be focusing on less politically contested areas of the value chain. Exploration has been a key strength of BP and Russia is unable or unwilling to fulfill the growing gap. Also, refining is fairy profitable and less politically contested part; it can be a sustainable source of revenue. Production and sale entail overwhelming uncertainties since these two phases coincide with critical interests of Russian foreign and economic policy. Such defensive strategy of selectivity may prevent failure but cannot win success. Therefore, I also propose a more offensive integrated strategy. BP’s chief mistake was to regard the Russian joint-venture as a sustainable revenue source. International firms usually think in a framework of product portfolio management,[11] and BP indeed regarded Russian oil and gas as a product of high growth and low market share. Therefore, it was natural for them to think a greater expansion in Russian market share. Although TNK-BP remains a prominent asset, BP should not be over-optimistic about its position in Russia and should reduce its dependence on TNK-BP. In other words, I propose BP to maintain self-restriction on its market share in Russia, otherwise, BP might face a fatal intervention that happened to many Russian and foreign companies. TNK-BP has generated tremendous revenue and BP should utilize this large amount of cash flow to both modestly explore Russian market as well as to reinvest globally and diversity its production.

Hence, as conclusion I argue that BP has a commercial future in Russia when it employs a creatively integrated strategy of selectivity in the value chain, diversification in a global scale, and self-restrained market share expansion. All in all, who gets what in terms of what? On the one hand, Russian government (Kremlin) gets a quicker development of oil and gas fields/ efficient technologies in terms of providing access of natural resources to BP and of honoring contracts (or at least not obstructing them). On the other hand, BP gets oil and gas exploration and production revenue in terms of providing its technical expertise and longer-term investment commitment, and of aligning with Russian foreign policy objectives. A good lesson we can extract from the BP case is that, a larger market share in Russia does not always imply the growing business strength. While Russian energy market remains one of the most profitable fields worldwide, international companies should learn how to put self-constraint on their ever-growing profit appetite. Conventionally, profit sustainability comes from enlarged operations with a higher market share; in Russia, this is not the rule. The most fundamental principle is that business is not about making profit; it is all about keep making profit. And if any international company aims to thrive in Russian market, modesty is gold and audacity is silver.

[1] Yergin, Daniel. The quest: Energy, security, and the remaking of the modern world. Penguin, 2011.

[2] Gustafson, Thane. Wheel of Fortune: The Battle for Oil and Power in Russia. Harvard University Press, 2012.

[3] Ibid.

[4] Aslund, Anders. Russia's capitalist revolution: why market reform succeeded and democracy failed. Peterson Institute, 2007.

[5] Bremmer, Ian. "The end of the free market: who wins the war between states and corporations?." European View 9.2 (2010): 249-252.

[6] Goldman, Marshall I. Petrostate: Putin, power, and the new Russia. Oxford University Press, 2008.

[7] Mankoff, Jeffrey. Russian foreign policy: the return of great power politics. Rowman & Littlefield, 2009.

[8] Carbonell, Brenden Marino. "Cornering the Kremlin: Defending Yukos and TNK-BP from Strategic Expropriation by the Russian State." U. Pa. J. Bus. L. 12 (2009): 257.

[9] Porter, Michael E. "Competitive strategies: Techniques for analyzing industries and competitors." The Free Pres, New York (1980).

[10] Baron, David R. "Integrated Strategy." California management review 37.2 (1995): 47.

[11] Cooper, Robert G., Scott J. Edgett, and Elko J. Kleinschmidt. "New product portfolio management: practices and performance." Journal of product innovation management 16.4 (1999): 333-351.