The mass protests that started in Syria in March 2011 have grown into an armed conflict, and the escalating violence was followed by the imposition of additional sanctions on Syria. In summer 2013 the situation worsened as a result of a chemical attack in suburban Damascus. While some countries’ leaders called for military intervention in the Syrian conflict, Russia proposed establishing international control over Syria’s chemical weapons. The international community currently pins its hopes on the Geneva II peace conference scheduled for January 22, 2014.

The Middle East and World Energy Market

Oil-rich countries in the Middle East that boast the world’s largest hydrocarbon deposits account for almost 54 percent of proved oil reserves and 40 percent of proved natural gas reserves (the author’s estimate, based on the Annual Statistical Bulletin, OPEC, 2013, PP. 21, 22).

The region is an uncontested leader in oil production. The Middle East produces almost 33.1 percent of the global total, together with the North African Arab countries (Algeria, Egypt, Libya, and Sudan and South Sudan), this approximates 40 percent (37.7%) (the author’s estimate, based on the Annual Statistical Bulletin, OPEC, 2013, P. 30)

In terms of its natural gas production, the Middle East is ranked third, after the United States and Eastern Europe together with the CIS. The region accounts for 17.2 percent of the world’s gas production. Together with gas produced in North Africa, this amounts to 22.1 percent (estimated by the author based on the Annual Statistical Bulletin, OPEC, 2013, P. 33).

Countries in the region have limited impact on the global petroleum market. Most upstream facilities and refineries are found in Asia, North America, Western and Eastern Europe, and the CIS. The Middle East is the fifth largest producer of petroleum products, with 8.7 percent of the world’s total. Together with North African Arab countries, the region accounts for approximately one tenth of global production, or 9.7 percent (the author’s estimate, based on the Annual Statistical Bulletin, OPEC, 2013, P. 30).

Middle East countries supply almost half of all crude oil to the world market. In 2012, the region’s exports reached 45.6 percent of the total. Including Algeria, Egypt and Libya, exports exceed 50 percent (50.2 percent) of the total (the author’s estimate, based on the Annual Statistical Bulletin, OPEC, 2013, P. 49).

On the one hand, the situation in oil-exporting countries and the geopolitical developments in the region have a direct impact on both the global energy market and international financial markets. On the other hand, there are other factors impacting price changes on the global oil market.

Syria on Global Oil Market

Oil exploration started in Syria in 1933, and the first oil field was discovered in 1956. And while the first oil was recovered in 1968, Syria did not start exporting it until the mid-1980s.

As of March 1, 2013, Syrian oil reserves were estimated at 2.5 billion barrels, or less than 0.2 percent of the world’s total reserves (Crude Oil Proved Reserves. 2012. International Energy Statistics. EIA).

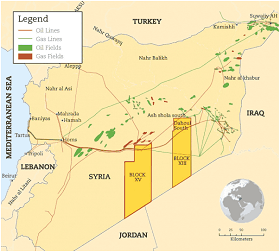

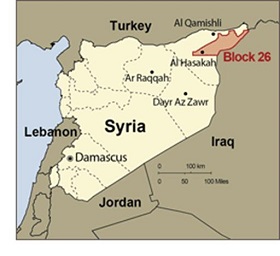

Syrian oil and gas fields are found largely in the sparsely populated eastern and north-eastern areas of the country and are connected via pipelines with densely populated Damascus, Homs and Aleppo.

There is intense fighting over the fields today, as all parties to the conflict are trying to gain control over them. The Free Syrian Army and Jabhat al-Nusra are fighting for control over the Roumeilyan fields (north-east Syria, Al-Hasakah Province) against a militant arm of the Kurdish Democratic Union Party, which held the oilfields until recently. The Al-Hasakah oilfield, although surrounded by the Free Syrian Army, is still controlled by the authorities. The Free Syrian Army has seized the Dzhebesa field, and Jabhat al-Nusra controls most of the oil wells in the eastern province of Dayr al-Zawr.

Syria has never been a prominent player on world oil markets. In 2011, it was ranked 33rd for oil production, after South Sudan and before Vietnam. While in 2011 it produced 0.4 percent of the world’s total, in 2012 the country’s share shrank to 0.25 percent (the author’s estimate, based on the Annual Statistical Bulletin, OPEC, 2013, P. 8).

In the Middle East, even prior to the armed clashes, Syria was no more significant, accounting for just 1.2 percent of the total regional recovery in 2011, and 0.75 percent in 2012 (the author’s estimate, based on the Annual Statistical Bulletin, OPEC, 2013, P. 8). But in the Eastern Mediterranean, with Lebanon, Jordan, Israel, and Palestine, Syria has remained a major oil-producing and exporting country, despite the volumes being significantly slashed as a result of the armed conflict.

Syria’s oil production in 2010 totalled 386,000 bpd. With the commencement of the domestic political crisis in 2011, oil production fell to 333,300 bpd and subsequently, in 2012, struggled to reach half the 2011 rate, or 182,000 bpd, having dropped by 45.4 percent (Annual Statistical Bulletin, OPEC, 2013. P. 30). Note that maximum production was recorded in 1995 (610,000 bpd) (‘Syria's oil and gas industry – a sector profile.’ The Syria Report). Since then, due to the lack of technological development and depleted reserves, the country has been producing less and consuming more, forcing it to pay considerable amounts for imported petroleum products. Between 2001 and 2011 production shrank by 41.2 percent (Syrian Arab Republic. Oil for 2001, Oil for 2011. Report. Statistics. International Energy Agency).

With the oil and gas sector in tatters, the country has had to import even more petroleum products. Syria has seen its imports increase more than five-fold in 2011, to 106,800 bpd up from 18,100 bpd in 2010. In 2012, petroleum product imports almost doubled, rising to 195,500 bpd (Annual Statistical Bulletin, OPEC, 2013. P. 59).

There are two refineries in Syria, currently controlled by the government, whose capacities are largely idle due to the fact that the oilfields have been seized by the rebels. The oil from occupied oilfields is refined in primitive setups.

Syrian oil exports started to dwindle even before the political crisis: in 2010, exports fell by 41.2 percent to 149,000 bpd, down from 250,000 bpd. In 2011, due to international sanctions and the growing turmoil, exports dropped a further 23.1 percent to 114,000 bpd. Syria’s share of world exports contracted from 0.4 percent in 2010 to 0.3 percent in 2011 (Annual Statistical Bulletin. OPEC, 2013. P. 49). There are no official figures for Syrian oil exports in 2012 and 2013.

Prior to the turmoil and international sanctions, 95 percent of crude exports went to EU countries, with Germany and Italy being key importers, while France, the Netherlands, Austria and Spain accounted for 32 percent (‘Over 90 percent of Syrian crude oil exports go to European countries.’ Syria Country Analysis Brief. September 16, 2011).

In April 2013, 27 EU foreign ministers allowed purchases of oil and petroleum products, supplies of equipment and machines to the oil and gas sector, and investments in the Syrian oil industry. Until recently, the rebels could only sell oil, fuel or petrol to Turkey using petrol tankers.

Opening up sales is unlikely to have any impact on the balance of demand and supply on world oil markets any time soon, in view of the serious impediments to Syrian oil sales, given the extent of destruction of the local oil infrastructure and palpable danger.

Despite its modest share of the global energy market, the Syrian oil and gas sector has remained a strategic industry for the national economy. Oil proceeds were the main source of government revenue and accounted for almost a quarter of total government expenditure (Syria Overview. The World Bank).

World Oil Prices Today

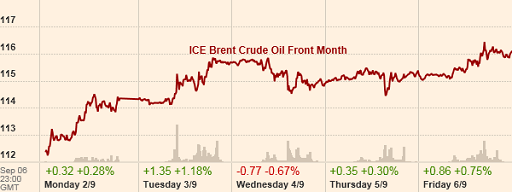

In August 2013, oil prices rose 6 percent year-on-year (‘Brent could rise to USD125 per barrel as a result of the Syrian conflict.’ RBK, 05.09.2013, Moscow). Experts link this recent rise to the news of a chemical attack in Syria on August 21, 2013. Following U.S. announcements putting a military operation in Syria firmly back on the table, global oil markets saw another uptick in prices. During the five days between September 2-6, Brent crude prices rose from US$112 to US$116.12. (Fig. 1). The same price level on the world oil market was last recorded in February 2013.

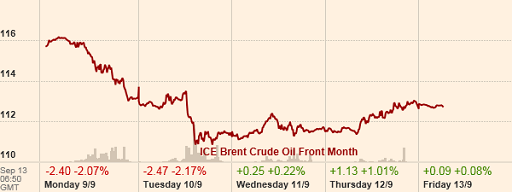

On September 9, 2013 the decision was taken to delay the U.S. Congress’ vote on military intervention in the Syrian conflict in the wake of Russia’s proposal to place Syrian chemical weapons under international control. After this, Brent crude prices dropped to US$112.87 per barrel (Fig. 2) within a week.

U.S. military intervention, if it happens, is not likely, by itself, to affect Syrian oil supplies directly. First, Syria is no longer a major supplier of oil or petroleum products to the world market; it has been importing oil instead. Second, the country’s export potential has been drastically undermined, and no recovery is expected any time soon. Third, Syria’s geographic location does not allow control over oil trade routes.

Oil producers are concerned over the unpredictable implications of U.S. military intervention, which could further exacerbate the situation in countries neighboring Syria, and result in the conflict spilling over across the region. There is a growing threat to the Suez Canal as a strategic transport route for oil supplies. Some concerns relate to social unrest in countries across the region, especially those that produce and export oil and petroleum products. Should oil supplies be disrupted elsewhere, price per barrel, experts predict, could rise to US$150 (‘SocGen predicts oil will hit between $150-$200 within a week if the U.S. attacks Syria.’ Market Pulse).

Importantly, the likelihood of upward pressure on global oil prices is further enhanced given recent developments in Libya, where ongoing attacks on oil facilities and strikes impede the recovery of oil sales. The National Oil Corporation (NOC) has, time and again, declared a force majeure situation. On October 31, 2013, it said that, due to the improved situation at the Hariga Oil Terminal, it would resume operations (‘NOC lifting of Force Majeure’). Low oil production in Nigeria and unfulfilled promises in the North Sea oilfields, discontinued oil supplies from Sudan, sanctions against Iran – all this could not but have a negative psychological impact on market players, and effectively resulted in a reduced oil supply to the world market. In October 2013, the world market was 2.9 million bpd short (Global Crude Oil and Liquid Fuels//Short-term Energy Outlook. EIA). This pressure on world oil prices also results from negative developments in Iraq: the bombing of the Kirkuk–Ceyhan oil pipeline on September 3, 2013 led to the suspension of oil deliveries from Iraq to Turkey.

Patterns of world oil prices prior to and during NATO-led operations in Libya in 2011 and U.S.-led operations in Iraq in 2003 demonstrate that, with the onset of bombing in Libya and intervention of Iraq, oil prices fell 10 and 15 percent, respectively. If we can take the past as any form of guide, in the event of external armed intervention in Syria, oil prices can be expected to drop by at least US$10 (Nick Maclean. Syria and geopolitics of oil).

In 2011, prices fell when a strategic oil reserve release was authorized. Today, the U.S. strategic reserve, accrued since 1975, stands at 695.9 million barrels, or 44 percent of the total oil reserves of the 28 member-countries of the International Energy Agency. The United States’ strategic reserve was tapped for the first time during the 1991 Gulf War, when 33.75 million barrels were sold. In 2011, 60 million barrels of strategic reserves were released, with half coming from the United States, and the other half from West European countries (Strategic Petroleum Reserve). Oil prices as a result fell by $9 in two days (Gregory Meyer & Ed Crooks. Oil markets gauge emergency Syria release. Financial Times). Significantly, despite the challenges detailed above, the global oil market is less vulnerable now than it was during the civil war in Libya, when the market lost 1.5 million bpd of quality light-grade crude.

Currently, should prices climb to $120-125 per barrel, one might expect more withdrawals from the West’s strategic oil reserves. In 2011, the announcement of a release from the strategic oil reserve kept prices low for just two weeks, after which prices continued to climb. OPEC’s actions, aimed at increasing or decreasing quotas, serve as an important lever to regulate supply on the world oil market. In September 2013, the Saudi oil minister announced that his country would do its best to maintain supply on the world oil market.

The upward trend in global oil prices will persist, irrespective of however the Syrian crisis develops, whatever geopolitical pressure strategically significant reserves put on the market. Having reviewed their 2014 forecasts, the IEA and OPEC concluded that oil demand in 2014 would be higher than in 2013, given the gradual recovery in the global economy. According to the IEA, global oil demand is expected to grow by 1.1 million bpd against 2013 levels to reach 92 million bpd (‘OPEC IEA trims estimate for 2014 global oil demand growth on Economy.’ Bloomberg. 9 Aug 2013). According to OPEC forecasts, demand in 2014 will grow to 90.8 million bpd (‘OPEC trims demand for its oil, pumps above 2014 requirements.’ Reuters. October 10, 2013).