Monitoring of Mutual Investments in CIS Countries 2017

| Topic: | Global governance |

| Region: | Post-Soviet space |

| Year: | 2017 |

| Publisher: | EDB Centre for Integration Studies |

| Authors / Editors: | Yuri Kvashnin, Aleksey Kuznetsov, Karina Gemueva, A.A. Makarova, A.A. Nevskaya, Anna Chetverikova |

| ISBN: | 978-5-906157-38-6 |

Description

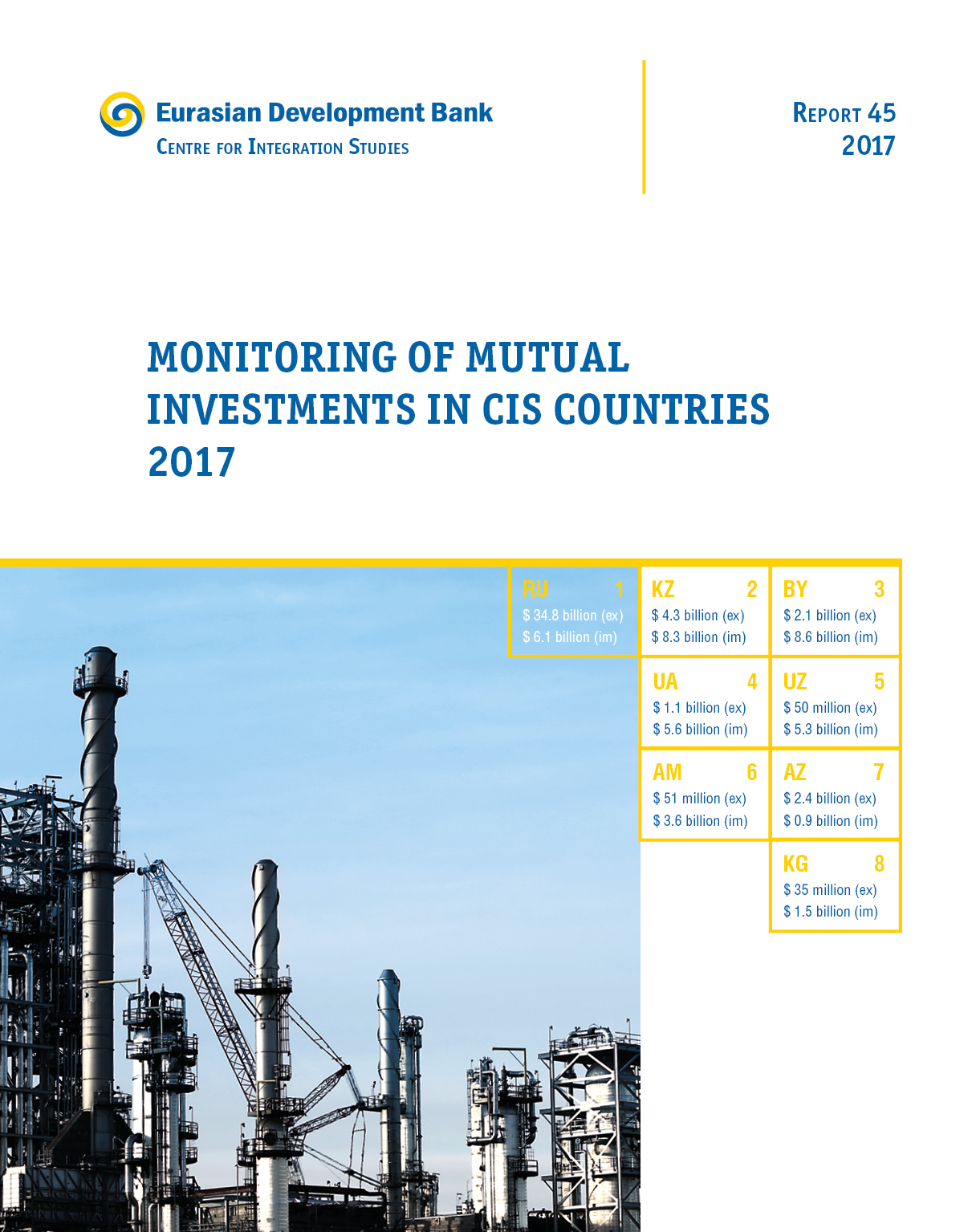

According to the eighth report of a years-long research project, after three years of decline (2013–2015), mutual FDI of the EAEU member states grew by 15.9% reaching US $26.8 billion, mutual CIS and Georgia FDI stock increased by 7.9% to $45.1 billion.

The largest capital exporters within the EAEU are Russian companies, which account for over 78% of FDI exports. Kazakhstan ranks the second (13.5%), Belarus comes the third (7.8%), while Armenia and Kyrgyzstan are significantly falling behind the largest EAEU economies.

There is a new development observed in the region – Russia does not only invest in other EAEU economies, but has also started receiving an increasing amount of investment from neighbouring countries, with the FDI stock from other EAEU countries reaching US $5 billion. However, Belarus and Kazakhstan remain the major FDI recipients, with their FDI stock standing at US $8.6 billion and US $8.2 billion respectively as at end-2016.

Where do Russia’s EAEU neighbours invest? The Russian Chemical sector ranks the first, accounting for 35.1% of the FDI inflows from the EAEU member states as at end-2016. The Russian Agriculture and Food Products sector comes the second (15.8%). FDI is also significant in Transportation (14.2%) and Tourism (14%).

Russian companies increased their FDI in all the EAEU economies. As at the start of 2017, Belarus was a leading recipient of Russian FDI (US $8.5 billion), followed by Kazakhstan (US $8.2 billion), Armenia (US $3.4 billion), and Kyrgyzstan (US $0.9 billion). Oil and Gas sector accounts for over half of Russian FDI in the EAEU economies. FDI in the Non-Ferrous Metals, Communication and IT, and Finance also figure prominently.

After the first full year of its membership in the EAEU, Kyrgyzstan registered an increase of its FDI inflow from the EAEU member states by 11% or up to US $1.5 billion as at end-2016, of which from Russia – by 21% or up to US $0.9 billion as at end-2016. Experts of the EDB Centre for Integration Studies expect that Kyrgyzstan’s membership in the EAEU will help the country improve its investment image. They forecast further growth of direct investments originating from Russia and Kazakhstan.

According to EDB Centre for Integration Studies analysts, future changes in mutual CIS FDI will be determined by investment activity within the Eurasian Economic Union. When mutual investments declined in 2013-2015, the rate of decline in the EAEU was considerably lower than in other post-Soviet states. When investments soared in 2016, the rate of growth in the EAEU was twice as high (16% vs. 8%).

Table of Contents

Acronyms and abbreviations

Summary

Introduction

1. Mutual direct investments in the CIS at the end of 2016

1.1. General Description of the MIM CIS Database

1.2. Distinguishing Features of Russian Direct Investments in CIS Countries.

1.3. EAEU Investors’ Priorities: New Integration Project vs. CIS

1.4. Continued Incremental Growth of FDI Originating from Azerbaijan

1.5. Ukraine: FDI Exports and Imports Down for the Fourth Year in a Row.. .

1.6. Role of Other CIS Countries in Mutual FDI

2. Mutual direct investments in EAEU member states

2.1. Investments between EAEU Member States: Reasons for Rapid Growth

2.2. Belarus: Stable FDI Stock Levels

2.3. Kazakhstan: First Signs of FDI Recovery

2.4. Russia: Reasons for Its Attractiveness to EAEU Investors

2.5. Armenia and Kyrgyzstan: Record-Breaking FDI Indicators

Conclusion

References

Electronic versions

Poll conducted

-

In your opinion, what are the US long-term goals for Russia?

U.S. wants to establish partnership relations with Russia on condition that it meets the U.S. requirements 33 (31%) U.S. wants to deter Russia’s military and political activity 30 (28%) U.S. wants to dissolve Russia 24 (22%) U.S. wants to establish alliance relations with Russia under the US conditions to rival China 21 (19%)