Shale Gas in Europe: A possible threat for Russia?

In

Log in if you are already registered

Author: Agnese Boscolo Meneguolo, Research Intern at RIAC, Graduate Student of the Joint Program of Luigi Bocconi University and MGIMO University

In a world characterised by a growing energy demand and by the simultaneous need to decarbonise the overall energy system, which is struggling for a sustainable, affordable and secure energy supply, the Shale Gas revolution in the USA, raises the interest towards this unconventional fossil fuel among the other gas importing countries. Europe, in particular, with its one-quarter primary energy consumption constituted by natural gas, is one of the most interested countries in new energy opportunities. Diversify European energy supply is one of the main goal that the just born Energy Union is trying to face, in order to decrease import dependency and related security supply risks. Europe relies for more than 25% on Russian gas, which could be considered the principal energy partner of the EU. At the same time EU is for Russia the main natural gas costumer, playing a decisive role in Russia export policies – 71% of Russian gas exports go to the European market[1]. Because of that, shale gas technologies could be for Russia a possible threat.

But is it a real threat for Russian economy? Would it impact negatively Russia export? Is it a concrete solution for European energy issues? In this article we are going to analyse deeper the real possibility of shale gas in Europe as well as the possible consequences on Russian economy.

1. Europe Gas Import

According to the Eurogas Statistical Report 2014[2], gas in Europe is the second energy resource with a share of 23.1%, coming directly after oil, which remains the largest component of primary energy consumption with a 33.1% share, and followed by the category “other renewables”, including biomass, wind, solar and geothermal energy was up slightly on the previous year from 9.5% to 10.0%. The following figure shows more in detail, which European countries rely most on natural gas, given an overall average of 23,1%:

(Figure 1).

(Figure 1).

Despite the increasing consumption of natural gas, due to the fact that it contributes to the reduction of greenhouse gas emissions in the short to medium term, for the last two decades, the production from conventional reservoirs of gas has steadily declined. The EU’s natural gas import dependency has risen up to 67% in 2011 and is projected to continue increasing, putting the EU in greater direct competition with global demand for natural gas. Moreover, some Member States, especially in east European countries, rely on a single supplier and often on a single supply route for 80-100% of their gas consumption, usually a single pipeline connected to Russia, as it could be seen in the following map reporting the pipeline system in Europe.

(Figure 2).

From the supply side instead, it could be seen how Russia plays a central role in delivering natural gas to Europe.

(Figure 3).

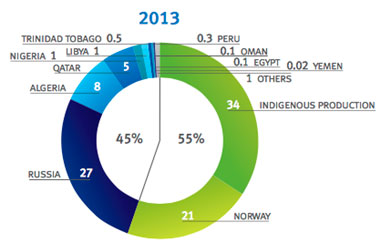

In 2013, the EU imported 305 billion cubic metres (bcm) of natural gas – 66% of its consumption. Russia supplied 27% of EU gas imports by volume, Norway 21%, North Africa and Middle East countries cover the rest.

(Figure 4).

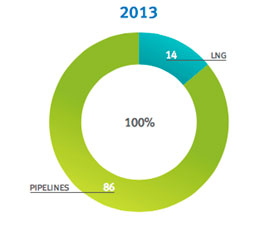

The EU's dependence on gas imports is expected to increase with declining indigenous production of conventional gas. For this reason EU Member States have started to diversify gas suppliers and supply routes, building, for example, LNG import terminals, that could represent an alternative, even if not as affordable as natural gas from pipelines.

(Figure 5)

(Figure 5)

2. Shale Gas in Europe

Although extracting Shale Gas is generally more difficult than extracting conventional sources (extraction in shale industry requires the drilling of additional wells and advanced techniques such as hydraulic fracturing), Shale gas is considered to be the unconventional fossil fuel with the greatest potential for development in Europe, compared to tight oil and coalbed methane. A preliminary assessment estimates that the technically recoverable potential of shale gas in the EU is around 799 trillion cubic meters. According to the EIA[3] reserves of Shale Gas in the world are located as follow:

(Figure 6)

(Figure 6)

As it could be noticed Europe has several basins in its territories, in particular in France, Norway, Netherlands and Poland.

(Figure 7)

(Figure 7)

European shale gas reserves are not negligible although their entity is not comparable with the one in the major countries of the world. In order to go on with our analysis it is necessary to understand the legal framework that Europe developed around the Shale Gas industry.

3. EU legal framework

EU has already done some steps towards the development of the Shale Gas industry. After several events concerning gas prices and payments between Ukraine and Russia that has raised concerns about the security of EU gas supply, in March 2014 European Council requested the Commission to develop a European energy security strategy[4], published in May 2014. According to this Communication, shale gas 'could partially compensate for declining conventional gas production provided issues of public acceptance and environmental impact are adequately addressed'. Moreover, after this statement, the EU Commission elaborated also a specific Communication regarding Shale Gas[5]. In the Communication the Commission agreed to develop a framework for safe and secure unconventional hydrocarbon extraction. The main objective that the Commission underlines is ‘to diversify energy supplies and improve competitiveness can be safely and effectively taken up in those Member states that choose to do so’. In particular, the European Commission has decided to deliver the decision of developing the Shale Gas industry to each Member States, without imposing a restricting legislation but publishing non-binding guidelines, that would intervene only to ensure adequate environmental protection.

4. Environmental concerns

Until now, shale gas has been the subject of several environmental concerns that have been the main reasons for the slow development of this unconventional fossil fuel. Shale gas extraction indeed is generally more invasive compared to conventional gas fields because it requires more intensive well stimulation technique in wider on-shore areas. Moreover, 25-90% injected fracturing fluids are expected to remain underground, with potential risks of contamination of soil and aquifers that, especially in Europe, are an important source of drinking water. These risks could be mitigated by careful selection at the moment of drilling and proper insulation of the well.

However, this is not the only environmental concern. Shale gas would also impact water demand, raised by an intensive use of water during the fracturing process that can be recycled and reutilised at low rate and expensive water management plans. Moreover, shale gas processes could also lead to risk of induced seismicity.

Public opinion has been strongly influenced by those concerns, widen by asymmetry of information between operators and people, who tend to oppose development according to the well known “Not in My Backyard effect”. Because of that the EU Commission with the Recommendation 2014/70/EU invites Member States to elaborate legislation according to the following main objectives:

a strategic environmental assessment is carried out prior to granting licenses for hydrocarbon exploration and/or production which are expected to lead to operations involving high-volume hydraulic fracturing

a site specific risk characterisation and assessment is carried out. It would inter alia identify risks of underground exposure pathways such as induced fractures, existing faults or abandoned wells;

the public is informed of the composition of the fluid used for hydraulic fracturing on a well by well basis as well as on waste water composition, baseline data and monitoring results.

the well is properly insulated from the surrounding geological formations, in particular to avoid contamination of groundwater;

venting (release of gases into the atmosphere) is limited to most exceptional operational safety cases, flaring (controlled burning of gases) is minimised, and gas is captured for its subsequent use (e.g. on-site or through pipelines).

It is also recommended that Member States ensure that companies apply best available techniques (BAT), where applicable and good industry practices to prevent, manage and reduce the impacts and risks associated with exploration and production projects. Moreover, in order to strengthen the scientific/technological knowledge base, the Commission launched a European Science and Technology Network on Unconventional Hydrocarbon Extraction in July 2014.

On the other hand it has also to be underline that shale gas could have also positive environmental impact. Greenhouse gas emissions from shale gas production in Europe could lower the emissions from coal-based electricity generation.

5. Member States

Until now in Europe there has been no commercial production of shale gas. Several States have undertaken different approaches in adopting the EU legislation. In particular, countries that seem more positive and have already done some steps towards the shale gas industry are Spain and Poland. In Spain, for example about 70 exploration permits (for different types of hydrocarbons) have been issued, and a further 75 await authorisation, according to the Spanish Oil and Gas Association (ACIEP). Also Poland has already started drilling and government decided to make the gas exploration free of taxes until 2020. However, Poland is also subject of a legal proceedings, on the grounds that the new law infringes the environmental impact assessment (EIA) directive by allowing drilling at depths of up to 5 000 metres without having assessed the potential environmental impact. This fact could slower the shale gas industry development. Another country that has to be analysed is France, which has, with Poland, the major resources. The French government, differently from other countries, banned fracking in 2011 and cancelled exploration licences. President François Hollande has promised to maintain the fracking ban as long as he is in office. Also in the Netherlands, shale gas exploration has been suspended while a study on its environmental and social effects is carried out.

How it could be seen from this brief analysis, the potentialities of shale gas, although it is promoted by the EU, have to fight with several Member States, which have as major concern the possible negative impact of this industry in the environment.

6. Conclusions

Until now in Europe there has been no commercial production of shale gas and the impact that it would have in the European area is at date still debated. While it is almost clear that it would not cover the whole gas demand making EU a self-sufficient natural gas area, its partial impact on the EU energy situation could still be of some extent.

First of all, considering the direct price effect on European gas markets is likely to remain moderate, especially if compared to what happened in the US, due to two different geology, higher environmental standards, and a less developed drilling services industry. Secondly, shale gas activities also have the potential to bring direct or indirect economic benefits to EU Member States through investments in infrastructure, direct and indirect employment opportunities, and public income via taxes, fees and royalties. Under certain conditions, shale gas also has the potential to bring climate benefits if it substitutes more carbon intensive fossil fuels and does not replace renewable energy sources. This could not be the cheapest way to reduce gas emission but could still be considered a positive drawback of the implementation and development of shale gas.

However, given the high cost of technologies, tax breaks or other government incentives would be needed to support indigenous shale gas production. But it is clear that shale gas will not be competitive with conventional gas supplied by exporting countries pipeline. Shale gas will not be produced commercially in the short term, despite some projects already implemented, due to the time needed for exploration and licensing. Therefore, the EU will continue to depend on imports of natural gas, and Russia will remain an important supplier despite all diversification efforts. Energy security analysts believe that Russian gas will continue to dominate European markets, as long as suppliers are chosen on the basis of price, and not out of political considerations.

Even if Russian gas remains important, diversification of suppliers is considered as essential, as it can lead to lower prices and reduce the possibility of using energy supplies as a political weapon. This is the reason why in Europe shale gas is still debated, and why also other diversification strategies have already been implemented, for example through the construction of several LNG terminals.

Only one thing is certain: Shale gas development in Europe will be more evolution than revolution.

[4] Brussels, 28.5.2014 COM(2014) 330 final; http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52014DC0330&from=EN

[5] Brussels, 17.3.2014 COM(2014) 23 final/2; http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52014DC0023R(01)&from=EN