Oil and Gas Markets to 2025 - LUKoil

In

Log in if you are already registered

While on the one side of the planet, people are ardently buying new helmets along with bright yellow ribbons for their dusty bicycles, on the other side, people are busily exchanging their iconic means of transportation for new cars. As this shift is occurring, under the breeze of economic prosperity across Asia, South America and even Africa, the global energy balance is tipping, particularly as the new economic frontiers are moving at unprecedented pace. LUKoil's 2025 report focuses on these shifts with regards to demographics, motorization, OPEC policy and rapid changes in exploration and production of hydrocarbons. This report is the first of its kind for LUKoil, allowing one to peek at the global energy landscape via the lens of a Russian oil major. As usual, I also add extra weblinks and interesting info. Hence, please feel free to comment and most importantly - enjoy!

Challenging Year, but LUKoil Moves Forward:

Last 12 months have been challenging for oil majors, mining and industrial sectors, but based on market figures LUKoil has performed well under the difficult climate matching its logo "Always Moving Forward". Moreover, in the last decade, LUKoil has shown a steady upward trend in the respected Platts Top 250 Majors Ranking, where today it ranks 11th. It is quite a remarkable rank considering that it is directly below Rosneft and near to 5th placed Gazprom. It shows that gigantomania is not key to success as efficiency still strikes true, with 10th ranked Rosneft not performing much better even though it is now the worlds biggest oil company by output. An interesting statistic shows that Rosneft only makes $729,000 per employee in contrast to Shell’s $5,000,000 per employee. Still, the upcoming year will be exciting as the recent TNK-BP acquisition by Rosneft and the subsequent "aggressive consolidation" should not only result in efficiency savings, but allow a new avenue of possibility as BP now has access to the Arctic with Rosneft. Hopefully, Rosneft's consolidation and LUKoil's upward trend will pull Russian companies back into the top 50 firms of the Financial Times Global 500, as only candidate Gazprom crashed out extravagantly this year by losing 26 places and ending up 57th due to the quickly changing European market. To add salt to the wound, Gazprom is now sandwiched between Walt Disney and McDonald's. Finally, it is worth mentioning a few words about LUKoil’s President, Vagit Alekperov, as he is an unquestionably a big figure in the oil game. He authors and edits many books which is impressive considering that he steers such a large oil company. One of the more recent books Alekperov authored is the "Oil of Russia: Past, Present & Future" (Link to Full Book).

LUKoil Report Link: "Global trends in oil & gas markets to 2025"

Oil Prices are Up, Up, and Away!

From today till 2025, the globe is set for an average annual liquid hydrocarbon consumption growth of 1.2% and by LUKoil’s estimate it will reach 105 mb/d. Even though this is a substantial rise from already record breaking figures of about 90 mb/d, oil’s overall share in global energy utilization will actually fall as housing and power generation will substitute to cleaner energy like gas. Moreover, any reductions in total consumption are predicted to be evolutionary (e.g. better engines/tires) in contrast to radical revolutionary changes (e.g. new sources of fuel) as technology is near its peak and it will now slowly tidy up the small margins for a total consumption reduction of 30% by 2025. Overall, LUKoil forecast that BRENT oil prices in US/bbl will incur a steady rise until 2025. Only exception is a possible dip in the next year or two as we recover from the global economic meltdown. By 2025 prices could hit in the region of $140 and importantly remain up to this period at above $100 per barrel, predominantly due to the liabilities of OPEC producers towards their own budget requirements.

In regards to environmentally friendlier fuel types LUKoil sees that the rapid growth is unlikely to resume, particularly insofar as biofuels which saw a boom in mid-2000s, when if one recalls euphoria was ripe. This is down to the global financial crisis and the long-lasting consequences it will leave behind. EU biofuels have high production costs and until recently have been produced with the aid of subsidies, but these cannot be maintained. As we are seeing biofuel subsidy programs are being cut and even the European Commission has proposed to lower the target level of the 1st generation of biofuels in transport from 10% to 5% total consumption (in fact, it has done so since the report was published, down to 5.5%; see link). In the largest biofuels producer the situation is far from merry, as strategically USA aimed to limit its reliance on Middle East via alternative energy, but shale has altered the game so much that it no longer needs it for security. At €0.84 per litter biofuel diesel is very expensive to produce, in contrast to standard diesel at €0.45. In all, oil will remain the main source of energy for transport with electric remaining in the low single digits alongside others sources like biofuels. However, towards the end of 2010s alternative fuels will collectively amount to a notable 10% of the overall market.

Reason 1: Motorization

The largest spur in oil demand will come from the transportation sector, where oil is the main energy source at over 90% of overall consumption. The biggest growth in transportation is unsurprisingly occurring in the developing part of the globe where figures will roughly triple from the current level. China will lead the way with the number of cars per 1000 people rising from only 40 to 200 by 2025 – amazingly this equates to a 220 million rise in vehicle numbers. At this pace China will have more vehicles either than North America or Europe. Moreover, an interesting analysis can be drawn from the GDP/vehicle statistics. The Chinese car boom begun when its GDP per capita surpassed the $5,000 threshold and it is expected to carry until ~$27,000 when many will own cars and sale figures will subdue. It is interesting because China has begun its car boom later than Europe in GDP terms and even later than North America, likewise the amount of cars per 1000 people will be lower than in the West, which shows different cultural priorities. Finally, aside from cars, trucks will make a considerable impact as will regions like Africa and wider Eurasia (e.g. India, Russia, etc.).

In effect, OECD countries will fallback in the rankings of the biggest transportation markets due to an amalgamation of a poor economic performance and demographic stagnation. USA, previously the biggest car market for over a century since Model-T Ford, has been trying to reduce its fuel consumption via new and amended policies (e.g. 1975’s CAFE or Corporate Average Fuel Economy). Under these standards fuel consumption of new cars will decrease by 20% by 2016. In addition, conventional oil will lose its share as diesel will grow at the highest rate among all oil products. It will reach a 37% share of the total oil type consumption by 2025, from 32% today. As a result of this massive shift existing refineries will need to be configured towards more diesel; incurring substantial costs. Still, Top Gear fans and Petrolheads should not fear as the internal combustion engine will not lose its dominant position as diesel engines in cars will only increase moderately with petrol accounting for more than 80% of all engines. In all, LUKoil estimates that the aggregate global car fleet will grow by an incredible 670 mln, which in turn will require an additional 9 mb/d of oil or ‘just’ one more Russia.

Reasons 2 & 3: Demographics & Urbanization

The report anticipates that the global population will balloon by 1.1 billion with major growth centres in Asia. However, for once China is not leading this category as in fact its population growth will subdue predominantly due to the one child policy (or two in rural areas), this will result in India taking over the status of the most populous nation on earth by 2020. As LUKoil sees, thanks to better medical treatment and improved socio-economic conditions Africa will also see steady growth. However, one is not certain that this is the reason and based on recent UN statistics its frightening that this region will be as populous as Asia – in particularly with relatively poor (vitally agriculturally/food wise) Nigeria which will challenge China in demographic terms by 2100. In addition, LUKoil outlines that the demographic growth will result in more urbanization as it sources Mckinsey Global Institute says which says that by 2025, 440 cities in the developing countries will contribute up to half of the global GDP and by the urban consumers will grow by 1 billion with over 50% classed as 'middle-class'. It is difficult to see how the planet will cope with these changes, especially when the currently developing countries will wish to enjoy the same standard of life as the West has enjoyed for so long, but energy will be at the front of the matter no doubt.

North America Dreamin'

The current brisk increase of shale production in North America will not cause global prices to collapse. LUKoil sees that modern prospecting tools leave a lot of room for uncertainty, which is why we ought to be cautious about the top end estimates of US’s potential. Moreover, in USA well flow rates in shale formations are characterized by high decline rates in the first year of production – generally amounting to 60-70% of the full flow rate and most wells only have data for 3-4 years of actual operations. So based on this report one cannot gauge long-term production easily or be as optimistic as some shale patrons. In addition as LUKoil references, based on 2012 poll by the leading drilling firm National Oilwell Varco, there is a serious lack of drilling crews and drilling rigs across the US which will make the top end estimates for production simply unattainable. Interestingly, this is also the reason why LUKoil believes we will not see a prevalence of shale outside USA before 2020 as there is simply not enough global expertise or machinery (only 300 rigs are manufactured per year globally, even though 1000s are needed).

As LUKoil sees, considering the list of constraint shale oil production will amount to 3.9 mb/d by 2025, with Bakken and Eagle Ford (also to lesser degree Permian) formations being the top areas for output. This figure is visibly lower than enthusiastic sums of over 2 mb/d at Bakken alone, but whichever turns out true as LUKoil sees production growth will persist for the next 5-10 years and calm thereafter. To add, neighbouring Canada will also not hold still as oil sands or high viscosity oil could generate 3.6 mb/d by 2025 – which is 1.7 mb/d more than today. However, it faces a major challenge as both logistically and environmentally extraction in harsh Canadian climate is not only difficult, but expensive. Still, if both succeed North America will make an ample leap towards self-sufficiency.

No Special Offers – Exploration & Production Costs Balloon

The preceding decade can be characterized by unprecedented growth of exploration and production costs. According to the current estimates, oil companies’ expenditures on geological exploration, development and production have more than tripled since the start of 2000s. To a great degree the increase of costs is tied to the exhaustion of conventional oil resources or those that are easily recovered. Now about 15 mb/d have a commercial production cost of over $70/bbl. In USA, shale oil projects on average need $80/bbl to become profitable. As we are moving towards more expensive basins costs will continue to rise, even from now till 2025 72% of increase in supply will be attributed to hi-tech production methods and unconventional fuels, the remaining 28% will come mainly from Saudi Arabia, Iraq and the CIS. I personally think this is a key point to remember for all those advocating that Russia uses ‘energy weaponry’ or is overcharging its customers, as prices have to be raised for gas and oil as costs are not standing still.

Off to the Sea

Oil discovery has evolved in a number of ways over the last century with traditionally land based production being slowly replaced by more tricky offshore extraction. The peak years of production, dubbed as ‘large discoveries’, of 1960s and 1970s are long gone, with new sources being more scarce and almost 70% of them are now offshore. Today, proven offshore reserves are estimated at 280 bln bbl, which amounts to 30% of global production. As an energy quiz fact about 27% of this extraction is at 300m or deeper. The Deep Water Horizon Incident (BP) in the Gulf of Mexico has also led to increasing costs, as many companies begun to review their safety measures. On top of heavy tax burdens, for instance in Angola and Nigeria, offshore drilling is raising the costs of oil noticeably. LUKoil offers a very broad estimate of between $50-90/bbl for viable offshore production, depending on region and water depth. Despite the high cost of production and operating risks, deepwater production will continue to grow, particularly post 2015 when new large fields will begin operating.

Iraqi Dream, One Must Be Dreaming

Iraq still remains the most promising region in terms of conventional oil production. However, despite its huge proven reserves of 143 bln bbl (5th biggest), production remains relatively low at 3.1 mb/d in 2012. In 2009 Iraq announced it would aim to attain 12 mb/d output by 2020, thus challenging Saudi Arabia and Russia’s top spots. It soon realised that this is unachievable and revised the figure to 9-10 mb/d, but as LUKoil sees even this figure is overly optimistic. To attain this level Iraq will need to act quicker than Saudis during their boom years of 1960s and early 1970s, or twice as fast as Russia during 2000s. Following US invasion and overthrow of Saddam, about ¼ of Iraqi output was lost in comparison to year 2000, which means it will be a major challenge with the current difficult political climate.

Europe Refines A Meltdown

As a consequence of recent energy trends the European oil refineries are in systemic crisis. USA’s reduction of gasoline imports due to shale and commissioning of highly effective oil refineries in the Middle East/Asia has filled many rooms with pessimism. The period of 2004-2008 branded by LUKoil as the ‘golden age’ of European refining, has come to an end, as booming oil demand and deficits in conversion capacities are unlikely to pick up in this region. Many refineries are now on the brink of profitability due to low utilization which is forcing many to shutdown. Since 2009 3.7 mln bbl/d of capacity has been lost via closures. Further, LUKoil sees that an additional 1-1.5 mln bbl/d worth of capacity will need to be cut as it is not needed. However, employment laws in Europe make it difficult alongside labour unions and local authorities. Things are bleak as new global producers have a logistical edge via better placed terminals and newer equipment – China alone will increase its refining capacity by 2.4 million barrels per day in just four years. As USA enters the export market excess diesel fuel will be exported to Europe, while gasoline will be moved to Latin America, in all this shift may prove to be the final nail.

‘Easy on the Gas’ – No EU Policymaker Said

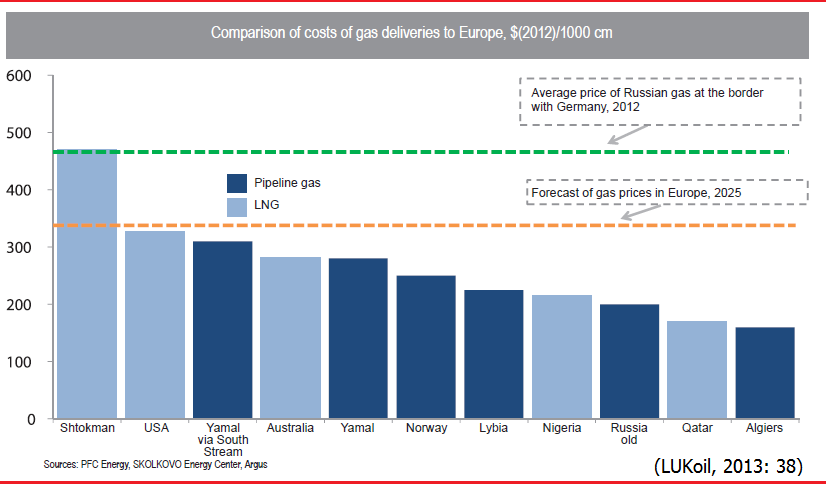

Originally natural gas was considered a by-product of oil production, but its potential and less polluting nature (fewer sulphur & nitrogen compounds than other fossil fuels) was quickly appraised. In fact, gas consumption will grow faster than oil utilization in the coming decade at an average annual consumption growth of 2.2%, with much of this growth being driven by China. LUKoil sees that for Russia this is not good news as it is yet to complete any big gas deals with China, while its traditional European market is forecasted to persist in being difficult. Although European production will actually decline and imported gas will increase, the competition is expected to heat up a lot after 2015 as more potential suppliers enter the market (e.g. Qatar). By 2020 the market will need an extra 50 bcm on top of the existing contracts as certain long-term contracts end, but supply will increase by 250 bcm in essence flooding the market and leading to old contracts to be renegotiated more robustly. Lastly, Europe’s notorious Third Energy Package is set to split gas transmission and storage from commercial activities. This will create a single trading hub as LUKoil points out for the entire area and as policymakers hope, eliminate major differences in prices, but as my older posts stress there are serious problems for certain suppliers in financially breaking-even with such setup.

Hot Subzero LNG

Over the last 10 years LNG-liquefaction capacities increased by 2.5 times around the world to 360 bcm. Major commissioning occurred in Qatar (see: QatarGas, RasGas) which will amount to 1/5 of the total and we are anticipating a possible export trend from USA. The growth in production of unconventional gas will allow the US to start exporting gas by the middle of the current decade and according to various estimates become a net exporter of gas by 2020. Major advantage of American LNG projects is the relatively low level of capital expenditures due to significant number of existing LNG import facilities that can be quickly converted for LNG exports (albeit LUKoil does not underline the huge cost). A lot will depend on the US political climate as its current weak economic footing gives a lot momentum for those that believe exporting gas will damage the domestic economy via high prices. Interestingly, USA’s natural conventional gas production will actually fall steadily, which may raise worries if the unconventional gas is actually overvalued. Also, even Russia, traditionally a pipeline supplier will enter the game with about a 1/10th share by 2025.

No section about energy is complete without China, which is why LUKoil highlights that the Asian dragon has the most favourable conditions to establish shale production and it has already begun to import relevant technologies. However, the lack of gas infrastructure and limited water resources will make gas relatively expensive in the short-medium run which will limit its production in contrast to USA. As discussed above, there is currently not enough expertise, machinery or even technological know how to propel China to full capacity. If this shale boom does occur it may fracture the Sino-Russian trading potential, but this potential remains weak as many pricing issues still remain unresolved. If current approach to pricing persists, the competitiveness of Russian gas in China seems doubtful. When LUKoil released its report, Russian gas cost ~$100 more than Turkmens and it was only somewhat competitive in contrast to expensive LNG from Australia and possible future deals all the way from Qatar.

Russia In Search of New Fields – Where Hast Thou Gone?

Russia has intermittingly changed between 1st and 2nd place with Saudi Arabia in total oil production over the recent years and hold world’s eight largest proven reserves, but maintaining oil production in Russia requires large scale use of new technologies and currently planned projects are unable to compensate the decline on brownfields. LUKoil believes that without extensive use of new technologies Russian oil output will begin to fall from 2016-2017. However, one could argue that this is the outcome of very dynamic production throughout 2000s when production grew by more than 1.5 times and exceeded 500 mln t a year. In 2008-2009 oil output started to fall, but timely tax cuts by the government helped to stabilize and even promote growth as the oil major highlights. Unfortunately, this was only a reactionary measure as Russia still relies on old Soviet fields with 90% of production occurring on formations discovered prior to 1988 – which means new fields are needed at a competitive price level (not in permafrost regions or hard to reach Arctic). By certain estimates, annual level of stock decline at old West Siberian fields reaches 11%, which leaves little time to manoeuvre.

At the same time not all is bleak as major fields like Vankor (discussed in my earlier posts), Talakan and Verkhechonsk have begun production. Also, LUKoil estimates that if the tax regime is altered to a more favourable level Russia will be able to keep production at the current rate of 500 mln t., but that is a hard political decision in a tough socio-economic environment. A clearer opportunity is to increase the recovery factor for old Russian fields, hydraulic fracturing is already commonly used, as they only attain a 20% rate – with the rest being untapped potential. In contrast, USA has been able to attain an oil recovery factor (ORF) of 43% and technologically efficient Norway an impressive 60%. This should develop an additional 4 bln t of reserves for Russia and allow it to meet the needed huge target of 3-4 Vankor’s per year to keep up its production. Interestingly, data for real reserves is still secret due to USSR's legacy, so perhaps all are wrong as Russia actually holds a carte blanche.

Concluding Remarks

LUKoil's report is quite noteworthy as it offers a lot of interesting statistics and facts throughout (page 44 even gives a neat breakdown of reserve classifications). However, at the same time, perhaps due to it being the first edition, it is quite light on content. For instance, OPEC coverage is too narrow as in fact we are seeing very different circumstances in each member. Saudi Arabia might be the biggest player, but it is not the entire group, so it would have been welcomed to see a comparison of all 12 OPEC members as this would standout in contrast to other reports of this kind. LUKoil says that Saudi Arabia needs oil to be at $78/bbl to breakeven, if one believes this figure it places Saudis in a good position as BRENT crude has not dipped below that level since the beginning of the global recession. Moreover, Saudis will aim to keep prices above $100/bbl for any contingencies, but to be honest other commonly published statistics suggest that breakeven for the biggest OPEC player is well above $100/bbl already. An interesting documentary I recommend is by VICE, which explores the SOFEX military market and stresses that expenditure on defence has risen by ~$400 billion with much of the spending in Middle East due to the Arab Spring and rulers fear of revolt. As North American output keeps rising and costs like military spending are added in, OPEC will need to raise prices by lowering supply to the market, which means as LUKoil points out its global share of output will fall from ~45% to ~35%. I will pick up on this issue in my next post which will focus on “Who Decides Global Oil Prices”.

To add as a final note, in 2013 I personally attended a dialogue with the top international energy experts. During this meeting Vitally Bashuev (В.В. Бушуев, General Director of Energy Strategy Institute) made a presentation about forecast-research outlining that most leading outlooks tend to be very accurate for the first 2 years and then quickly wither. Moreover, he highlighted that it is near to impossible to make accurate decade-long forecasts, which is why we ought to take these long-term ‘outlooks’ with a pinch of salt, beyond the next few years. Nevertheless, one looks forward to the 2nd edition next year.

Special Thanks to Alexander Teslya for suggesting this topic.

Igor Ossipov

M.A. University of Kent & Higher School of Economics, Oil/Diesel Broker and RIAC Blogger.