Why Are Oil Prices Falling, And Should Russia Rely on OPEC?

Bader Organization of the Petroleum Exporting

Countries (OPEC) Secretary-General

Abdullah al-Badri

In

Login if you are already registered

(no votes) |

(0 votes) |

PhD in Philosophy, Adviser to the director of the Russian Institute for Strategic Studies, Asia and Middle East specialist, RIAC expert

Will oil prices be able to recover after the collapse of recent months? This question will be answered by a session of the Organisation of the Petroleum Exporting Countries (OPEC) on 27 November 2014 in Vienna. Oil ministers from 12 countries will decide whether to cut output in the hope of raising oil prices or to leave things as they are. This expectation, however, seems exaggerated. OPEC today is not an organisation that can have the same decisive influence on the market that it had in the 1970s.

Will oil prices be able to recover after the collapse of recent months? This question will be answered by a session of the Organisation of the Petroleum Exporting Countries (OPEC) on 27 November 2014 in Vienna. Oil ministers from 12 countries will decide whether to cut output in the hope of raising oil prices or to leave things as they are.

This expectation, however, seems exaggerated. OPEC today is not an organisation that can have the same decisive influence on the market that it had in the 1970s.

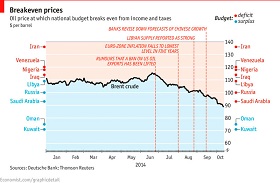

The stir surrounding the ministers’ meeting is of course understandable. Prices have never fallen so low in recent years – down to 85 dollars per barrel in October 2014 (and to 75 dollars in November 2014) from a high point of more than 100 dollars. Prices have gone down by an average of 10 dollars per barrel every month this autumn [1].

The now inevitable reduction in government budgets is taking place in an alarming situation. Foreign policy crises, wars, a surge in terrorist activity, social explosions and revolutions – all this is aggravating the situation. The fall in prices is fraught with unexpected consequences.

Conspiracy, the laws of the market, and the oil weapon

When everything is so bad, conspiracy theories are the simplest explanation. What they boil down to is the idea that the USA and its OPEC ally Saudi Arabia have taken a political decision to bring about a collapse in prices in order to weaken Russia for acting, as they see it, too independently in the international arena, especially in Syria and Ukraine.

Sami Faraj, President of the Kuwait Centre for

Strategic Studies: “There is no conspiracy, just

the laws of the market. I assure you that we are

far too wise to organise conspiracies”

The Kingdom of Saudi Arabia is first violin in the discordant OPEC orchestra, and it is also the only member of the organisation that can manipulate the levels of oil output while causing itself almost no pain and has substantial potential to increase it.

According to this theory, the scenario that marked the collapse of the Soviet Union is repeating itself. Venezuela’s President Nicolas Maduro talks these days about the fact that the USA and its allies want to “harm Russia” in a similar way [2], and Iran’s former oil minister Masoud Mir Kazemi believes that the USA and Saudi Arabia are also reckoning on damaging Iran.

“Am I the only one who thinks this, or is it really an oil war in which the USA and Saudi Arabia are taking action against Russia and Iran?” writes the well-known American political commentator Thomas Friedman. He assumes that Saudi Arabia and the USA intend to “pump Iran and Russia to death”, in other words to “bankrupt them” [3].

“There is no conspiracy, just the laws of the market. I assure you that we are far too wise to organise conspiracies,” I was told recently by Sami Faraj, President of the Kuwait Centre for Strategic Studies (Kuwait is another OPEC member-state). He believes prices will begin to rise again.

Surprises from oil exporters and Russia’s position

Nevertheless, political motives cannot be ruled out in this issue. Oil wars are not a fantasy. History records cases when the USA asked Saudi Arabia to adjust production.

There have sometimes also been requests not just to reduce prices but also to raise them. For example, at the end of the 1990s, when prices were falling, Saudi Arabia reduced its output in order to boost them. At that time the Americans had to cover the cost of their investment in oil deposits in Texas as well as in the Caspian and West Africa [4]. But the growth in the global economy also helped them to do this.

The OPEC session on 27 November 2014 may yield some more surprises. For example, it cannot be ruled out that OPEC will still suddenly raise output a little or at least declare its intention to do so in 2015.

In any case, it would suit the bureaucracy of

OPEC. When the organisation’s status is inflated

it benefits those who work for it.

But this will only have an impact if other oil producers that are not part of OPEC, for example Russia, also reduce their output. The author understands that Rosneft’s chief Igor Sechin was discussing such an idea with his foreign colleagues in the run-up to the meeting of the cartel. Russia’s Energy Minister Alexander Novak mentioned such a possibility the other day [5].

In any case, it would suit the bureaucracy of OPEC. When the organisation’s status is inflated it benefits those who work for it. Exaggerating the role of OPEC might also help the politicians in various countries who prefer to explain economic problems in terms of external plots. But we must not forget the objective circumstances, such as the dismal trends in the global economy and the lack of any industry other than oil and gas in any given country. No OPEC can put that right.

“Islamic State” terrorists have undermined the market

The main problem on the oil market today is speculation and excessive supply of oil, and possibly of gas too in the future.

The International Energy Agency (IEA) noted in an autumn 2014 study that the supply of oil was growing faster than expected, and demand was falling. The global demand for oil in September 2014 was on average 92.4 million barrels per day, while supply was in excess of 93.8 million barrels [6].

These are only the official data. Another new trend in 2014 has been the sharp growth in the amount of contraband oil, due to the fact that fighters from the terrorist group “Islamic State” have seized oil wells in Iraq and Syria [7].

The extremists, together with mafia groups, are selling the oil to neighbouring countries at giveaway prices, making their contribution to the collapse of the market. According to various reports they were earning between a million and three million dollars per day (!) from oil sales alone during the summer of 2014. There are also more alarming estimates. In October 2014 Hamid Majid Musa, Secretary-General of the Iraqi Communist Party, told your correspondent in an interview that he estimated Islamic State’s income from oil sales at five million dollars every day [8].

Kurds with “sea of oil” and Saudi Zaki Yamani’s prediction

In October 2014 Hamid Majid Musa, Secretary-

General of the Iraqi Communist Party, told your

correspondent in an interview that he

estimated Islamic State’s income from oil sales

at five million dollars every day

On top of this, instability has not prevented Iraq and Libya from pumping out oil and even increasing production. Earlier, Venezuela and Nigeria survived shocks and restored their output.

Local authorities claim that Iraq’s oil production could double in a few years: to six or even eight million barrels per day [9]. In the last 10 years Iraq’s known oil reserves have increased from 112 billion to 143 billion barrels [10]. Gas reserves are growing too, thanks to active exploitation of deposits. This was not happening under the former regime of Saddam Hussein, when international sanctions were being applied against Iraq.

New deposits are being discovered in the north of the country, in Iraqi Kurdistan, which, as the author was told by Masoud Barzani, the president of this autonomous region, “stands on a sea of oil” [11]. The Iraqi Kurds are exporting some of this oil, bypassing the central government in Baghdad.

Zaki Yamani, who headed Saudi Arabia’s oil ministry from 1962 to 1986, was warning of these prospects as much as ten years ago. He was one of the OPEC ministers who were taken hostage by the Venezuelan terrorist Carlos the Jackal in Vienna in 1975.

During my interview with him, which took place in 2003, Zaki Yamani prophesied what is now happening: “The oil era is ending. In about ten years’ time oil prices will fall, and then OPEC will cease to exist.” “The American companies that have invested in Iraq will continue to make a profit even when there are low prices, because the cost price of Iraqi oil is low. I firmly believe that the American occupation of Iraqi will directly damage Russia’s interests. Oil and gas prices will fall, and Russia will lose revenues. Russian fuel will lose its significance as a strategically reliable source of supplies,” he explained [12].

Alternatives to oil, and rising output

There is another factor which is rarely mentioned – the rising output of states which are not members of OPEC. Although this is the first time prices have fallen so disastrously, there have also been periods of falling prices previously, and every time the OPEC leadership asked Russia, the Sultanate of Oman, Mexico and Norway to reduce their output at the same time.

More often than not Moscow responded to the request reservedly, like the others, and did not reduce its output. Russia did not want to lose its markets, and was ready to compensate for the fall in prices by increasing exports in the expectation of profits when the prices rose again. This worked until recently.

Over the last decade Russia has demonstrated leadership qualities, alternating with Saudi Arabia in first and second places in the world in terms of oil production. According to the Central Dispatching Department of the Fuel Energy Complex (CDU TEK), Russia’s daily output of oil in 2012, 2013 and 2014 reached 10.5 million barrels on a stable basis [13]. That is impressive, especially after the drop in production in the 1990s [14].

If demand were high the market would possibly be able absorb these levels of production, but demand is currently falling. OPEC and the IEA cautiously admit that it might rise only in the second half of 2015 [15].

The causes of the fall in fuel prices include the global economic slowdown [16]. From now on demand will be concentrated in Asia, but things aren’t all right there either: the figures for economic growth in China (7.4% in 2014) and India (about 5.5%) have turned out lower than expected [17].

As far as America and Europe are concerned, energy-saving technologies have advanced there, and there will no longer be the same demand for petrol, fuel oil and diesel. Wind and solar power has turned out to be far from a fantasy. The share of oil in the energy consumption of the USA and other countries is declining [18]. To some extent the oil producers themselves have stimulated the search for alternatives when prices were going up.

The Americans and others have learned to extract gas from shale. The USA is also developing its own oil deposits. All this has helped to increase the USA’s oil and gas reserves. The Americans are no longer dependent on oil supplies from the Middle East. Researchers note that in 2016 the USA will import only 25% of the oil it needs, the rest coming from its own sources, whereas as recently as 2005 this proportion was 60% [19].

OPEC, which was set up in 1960, is turning into

an ineffective organisation, increasingly similar

to a consultancy

In view of these trends it would be more sensible for OPEC’s members not to reduce output now. It is also more important for them to preserve their markets than to try to raise prices.

OPEC: a retired oil consultancy specialist

Many players in OPEC will therefore advocate maintaining overall output at the previous level of 30 million barrels per day [20]. The countries that do not agree with this, however (Venezuela, Iraq, Libya and some others), will still try to change the power balance in the run-up to the session. Saudi Arabia will have the last word.

One option might be that OPEC panics and still decides on a small reduction in production in 2015. This would raise prices, but not a lot and not for long. Supply is so much in excess of demand that OPEC is not in a position to regulate this by its own efforts alone. Moreover, some members of the organisation are quietly breaking the quotas trying to conquer new markets [21]. Because of wars and sanctions, Iraq was excluded from quota regime and still benefits from this privilege [22].

OPEC, which was set up in 1960, is turning into an ineffective organisation, increasingly similar to a consultancy. It is no longer a powerful cartel, and it no longer has the oil weapon that used to intimidate consumers. OPEC is in need of reform, but is hardly capable of doing that. This organisation will not yet die, but rather will turn into a distinguished retired oil worker whose influence will remain only in people’s memories.

Under any scenario the nervousness and fluctuations on oil exchanges will remain, and this will also affect the currency markets. The speculative component will also be huge. One could, of course, advise diversification of the economy, but that is hardly relevant. So we tighten our belts and get ready for hard times.

1. Organization of the Petroleum Exporting Countries, Vienna // Monthly oil market report / http://www.opec.org/opec_web/static_files_project/media/downloads/publications/

MOMR_November_2014.pdf2. Media: Oil prices give food for thought about collusion between Riyad and Washington, RIA Novosti report, 19.11.2014. http://ria.ru/world/20141119/1034114443.html

3. Thomas Friedman // A Pump War? // The New York Times. 15.10.2014 // http://www.nytimes.com/2014/10/15/opinion/thomas-friedman-a-pump-war.html?smid

=fb-share&_r=04. Zaki Yamani: The USA does not (yet) need low oil prices. Interview by Elena Suponina with former Saudi Oil Minister Zaki Yamani, 10.06.2003, published in Vremya Novostei. // http://www.vremya.ru/2003/104/5/72569.html

5. Novak: Russia seeks opportunity to reduce oil production in order to support prices, 21.11.2014 // Reports by RIA Novosti and other news agencies. // http://ria.ru/economy/20141121/1034441540.html // http://www.forbes.ru/news/274073-rossiya-predlozhit-opek-sokratit-svoyu-dobychu-nefti-na-15-mln-tonn

6. International Energy Agency // Oil Market Report: 14 October 2014. // www.iea.org // http://www.iea.org/newsroomandevents/news/2014/october/iea-releases-oil-market-report-for-october.html // https://www.iea.org/oilmarketreport/omrpublic/

7. How ISIS works. The New York Times. 16.09.2014 // http://www.nytimes.com/interactive/2014/09/16/world/middleeast/how-isis-works.html

8. 02.10.2014. Reports by Russia Today agency, citing Arabic-language interview by Elena Suponina with Hamid Majid Musa, Secretary-General of the Iraqi Communist Party. http://arabic.ruvr.ru/2014_10_01/278055581/ // http://ria.ru/world/20141002/1026551843.html

9. See The Economist. 30.11.2011. // http://www.economist/com/iraqs-oil-and-gas-rishes

10. Iraq lifts oil reserves. Bloomberg // 04.10.2014 // http://www.bloomberg.com/news/2010-10-04/iraq-lifts-oil-reserves-estimate-overtakes-iran-update1-.html

11. Masoud Barzani: Kurdistan stands on a sea of oil. Interview by Elena Suponina with the President of Iraqi Kurdistan, published in Vremya Novostei, 21.04.2006 // http://www.vremya.ru/2006/70/5/150382.html

12. Zaki Yamani: The USA does not (yet) need low oil prices. Interview by Elena Suponina with former Saudi Oil Minister Zaki Yamani, 10.06.2003, published in Vremya Novostei. // http://www.vremya.ru/2003/104/5/72569.html

13. Russian Oil analytical magazine. Statistics, 05.11.2014 http://neftrossii.ru/statistics // http://neftrossii.ru/content/za-10-mesyacev-2014-goda-obyom-dobychi-nefti-i-gazovogo-kondensata-v-rf-vyros-na-07

14. Nikolai Baybakov: The creation of OPEC did not worry Moscow. Interview by Elena Suponina with Nikolai Baybakov, former head of USSR Gosplan, published in Vremya Novostei, 11.09.2000 // http://www.vremya.ru/2000/122/5/1071.html

15. International Energy Agency // Oil Market Report: 14 October 2014. // www.iea.org // http://www.iea.org/newsroomandevents/news/2014/october/iea-releases-oil-market-report-for-october.html // https://www.iea.org/oilmarketreport/omrpublic/

16. Organization of the Petroleum Exporting Countries, Vienna // Monthly oil market report / November / October // http://www.opec.org/opec_web/static_files_project/media/downloads/publications/

MOMR_November_2014.pdf // http://www.opec.org/opec_web/static_files_project/media/downloads/publications/

MOMR_October_2014.pdf17. Organization of the Petroleum Exporting Countries, Vienna // Monthly oil market report / November / October // http://www.opec.org/opec_web/static_files_project/media/downloads/publications/

See also Economic growth slows in China, BBC, 13.07.2013. // http://www.bbc.co.uk/russian/business/2013/07/130714_china_growth_slowdown

MOMR_November_2014.pdf // http://www.opec.org/opec_web/static_files_project/media/downloads/publications/

MOMR_October_2014.pdf18. Журнал Middle East Policy. Volume XXI Summer 2014 USA // Rachel Bronson // The United States in The Middle East: Bound by Growing Energy Demand. 173 pages, published for the Middle East Policy Council. P. 35

19. Middle East Policy. Volume XXI Summer 2014 USA // Rachel Bronson // The United States in The Middle East: Bound by Growing Energy Demand. 173 pages, published for the Middle East Policy Council. P. 35

20. International Energy Agency // Oil Market Report: 14 October 2014. // www.iea.org // http://www.iea.org/newsroomandevents/news/2014/october/iea-releases-oil-market-report-for-october.html // https://www.iea.org/oilmarketreport/omrpublic/

21. International Energy Agency // Oil Market Report: 14 October 2014. // www.iea.org // http://www.iea.org/newsroomandevents/news/2014/october/iea-releases-oil-market-report-for-october.html // https://www.iea.org/oilmarketreport/omrpublic/

22. http://www.iraq-businessnews.com/2013/08/01/opec-again-excludes-iraq-from-oil-quotas/

(no votes) |

(0 votes) |