One of the recent trends that has been promulgated by the authorities in the advanced economies is friend-shoring, namely directing economic activity towards those countries that share the values and principles of the advanced world. The term friend-shoring is related to the concept of “onshoring,” i.e. the process of transferring of supply chains back home versus placing them in foreign countries. “Friend-shoring” is a concept that is wider in scope but “limits supply chain networks to allies and friendly countries”.

One of the ways to promote friend-shoring is not just though bilateral alliances, but also regional and cross-regional blocksThe use of regionalism to draw division lines across the global economy leaves out some of the key parts of the global economy that are critical to the operation of many of the global and regional production chains. This is the case in particular with China that plays a crucial role in the operation of supply chains globally, but is left out of some regional integration blocks such as the Indo-Pacific Economic Framework.

An alternative interpretation of friend-shoring may be precisely in line with the U.S. arguments: that it serves to raise the reliability of production/supply chains and account for increasing geopolitical risks in the economic sphere. It may be viewed as a second-best to the optimal scenario of free trade, but national interest considerations take precedence over abstract values such as trade liberalization. No doubt, this argumentation will also now be used by other countries and regions to rationalize the formation of more secluded and inward-oriented production chains and regional arrangements. The cumulative effect of the signal that is sent from the leading economies of the world is fragmentation.

In the end, friend-shoring may lead to further inflationary pressures that will complement the effect of rampant protectionism, sanctions and other restrictions. But the economic costs of friend-shoring will go beyond the medium-term inflationary pressures and may affect the potential growth rate of the global economy in the longer term. Most importantly, the qualitative deficiencies and imbalances in the development of the global economy will be reinforced — this concerns the “technological gap” between developed and developing economies.

The world is round so that

friendship may encircle it.

— Pierre Teilhard de Chardin

One of the recent trends that has been promulgated by the authorities in the advanced economies is friend-shoring, namely directing economic activity towards those countries that share the values and principles of the advanced world. The term friend-shoring is related to the concept of “onshoring,” i.e. the process of transferring of supply chains back home versus placing them in foreign countries. “Friend-shoring” is a concept that is wider in scope but “limits supply chain networks to allies and friendly countries”.

In recent months, this principle has been supported by the likes of US Secretary of the Treasury Janet Yellen, who declared that “working with allies and partners through friend-shoring is an important element of strengthening economic resilience while sustaining the dynamism and productivity growth that comes with economic integration.” But is friend-shoring truly a new paradigm in how economic alliances are forged and what kind of implications will it have for the future course of the global economy?

Arguably, friend-shoring is nothing new. Indeed, the Cold War period was precisely the pattern that reflected the division of the world economy on the basis of values/geopolitics rather than strictly economic considerations. This “politicization” of the world economy at the time acted as a deterrent to the growth potential and dynamism of the world economy. The 1990s seemed to turn the global system towards a less politicized and more economy-based framework, but in effect the division lines lingered for decades—the Jackson-Vanik amendment, WTO accession lasting nearly several decades for Russia, technological restrictions, etc. So, qualitatively the friend-shoring paradigm is nothing new and in many ways it renders implicit patterns of the past more explicit going forward.

One of the ways to promote friend-shoring is not just though bilateral alliances, but also regional and cross-regional blocks. In this respect, according to Yellen, ventures that improve supply chain resilience include the Indo-Pacific Economic Framework. This regional arrangement that is only starting to take off is one of the ways to sway India and other developing economies in the region. The use of regionalism to draw division lines across the global economy leaves out some of the key parts of the global economy that are critical to the operation of many of the global and regional production chains. This is the case in particular with China that plays a crucial role in the operation of supply chains globally, but is left out of some regional integration blocks such as the Indo-Pacific Economic Framework.

Indeed, regionalism always has two sides: greater openness on the inside and the risk of being more closed to other members of the international community. With friend-shoring the risks of secluded/exclusive regionalism rather than open regionalism (the principles advanced as part of the APEC framework) start to become more prevalent, with negative implications for the prospects of a more open and vibrant global economy. As argued by Raghuram G. Rajan, Professor of Finance at the University of Chicago Booth School of Business, “friend-shoring is an understandable policy if it is strictly limited to specific items directly affecting national security. Unfortunately, the term’s public reception already suggests that it will be used to cover much else”.

In this respect, there appear to be multiple channels and fields in which friend-shoring is affecting the global economic landscape. Apart from the regional, there is also an important sectoral/industrial element to friend-shoring. In particular, high-tech sectors such as semi-conductors are likely to become the focus of friend-shoring and the re-configuration of supply/production chains. In effect, technological restrictions will also take the form of barring producers from “unfriendly” countries from the formation of technological alliances and production/supply linkages. This, in turn, is likely to accentuate the “technological gap” and the imbalances in the global economy development.

Accordingly, a world economy based on friend-shoring by advanced economies may also result in a greater polarization between advanced and developing economies — a trend that has already set in quite clearly in recent years. It is also a paradigm that perpetuates the “core-periphery” pattern of the preceding centuries and decades, whereby any economy that is aspiring to be incorporated into the core will need to comply with “value conditionality”. As argued by Professor Rajan, “friend-shoring would tend to exclude the poor countries that most need global trade in order to become richer and more democratic. It will increase the risks that these countries become failed states, fertile grounds to nurture and export terrorism. The tragedy of mass emigration will become more likely as chaotic violence increases”.

An alternative interpretation of friend-shoring may be precisely in line with the U.S. arguments: that it serves to raise the reliability of production/supply chains and account for increasing geopolitical risks in the economic sphere. It may be viewed as a second-best to the optimal scenario of free trade, but national interest considerations take precedence over abstract values such as trade liberalization. No doubt, this argumentation will also now be used by other countries and regions to rationalize the formation of more secluded and inward-oriented production chains and regional arrangements. The cumulative effect of the signal that is sent from the leading economies of the world is fragmentation.

In reality, instead of the global production chains that are based on economic efficiency there will increasingly be “value chains” based on geopolitical rather than economic values. This will further lead to the fragmentation of production chains into regional, national and other more inward-oriented frameworks. In effect, friend-shoring means that rather than considerations of economic efficiency and market signals, it is going to be the principles as spelled out by policy-makers, the set of values that are shared by other countries that is going to define the circle of trading partners and value chain counterparties. This is tantamount to the creation of new division lines and a “non-economic” model for the development of the world economy. Perhaps, one of the most important points made by Professor Rajan is that friend-shoring undermines the economic inter-dependency between the likes of China and the US, which in turn increases the likelihood of geopolitical clashes between these heavy-weights on the world stage. As a result of applying friend-shoring to international policy-making, economic cooperation is increasingly likely to be replaced by geopolitical rivalry.

Furthermore, friend-shoring will involve losses, and the economic costs of basing economic policy on “moral”—rather than market—values will be borne by the consumer. The very consumer that is already grappling with the implications of record high inflation across the developed world. One of the factors that contributed to the inflationary spike was the overly accommodative monetary policy pursued by the Federal Reserve and the underestimation of inflationary risks during the monetary stimulus period. Another was the protracted period of trade restrictions and sanctions applied against some of the largest economies of the Global South such as China. As argued by political analyst Azhar Azam, “after reshoring and onshoring, friend-shoring is … a de facto and defunct American protectionist approach … launched under the veil of the new symbolism with support of the controversial legislation“.

In the end, friend-shoring may lead to further inflationary pressures that will complement the effect of rampant protectionism, sanctions and other restrictions. But the economic costs of friend-shoring will go beyond the medium-term inflationary pressures and may affect the potential growth rate of the global economy in the longer term. Most importantly, the qualitative deficiencies and imbalances in the development of the global economy will be reinforced—this concerns the “technological gap” between developed and developing economies.

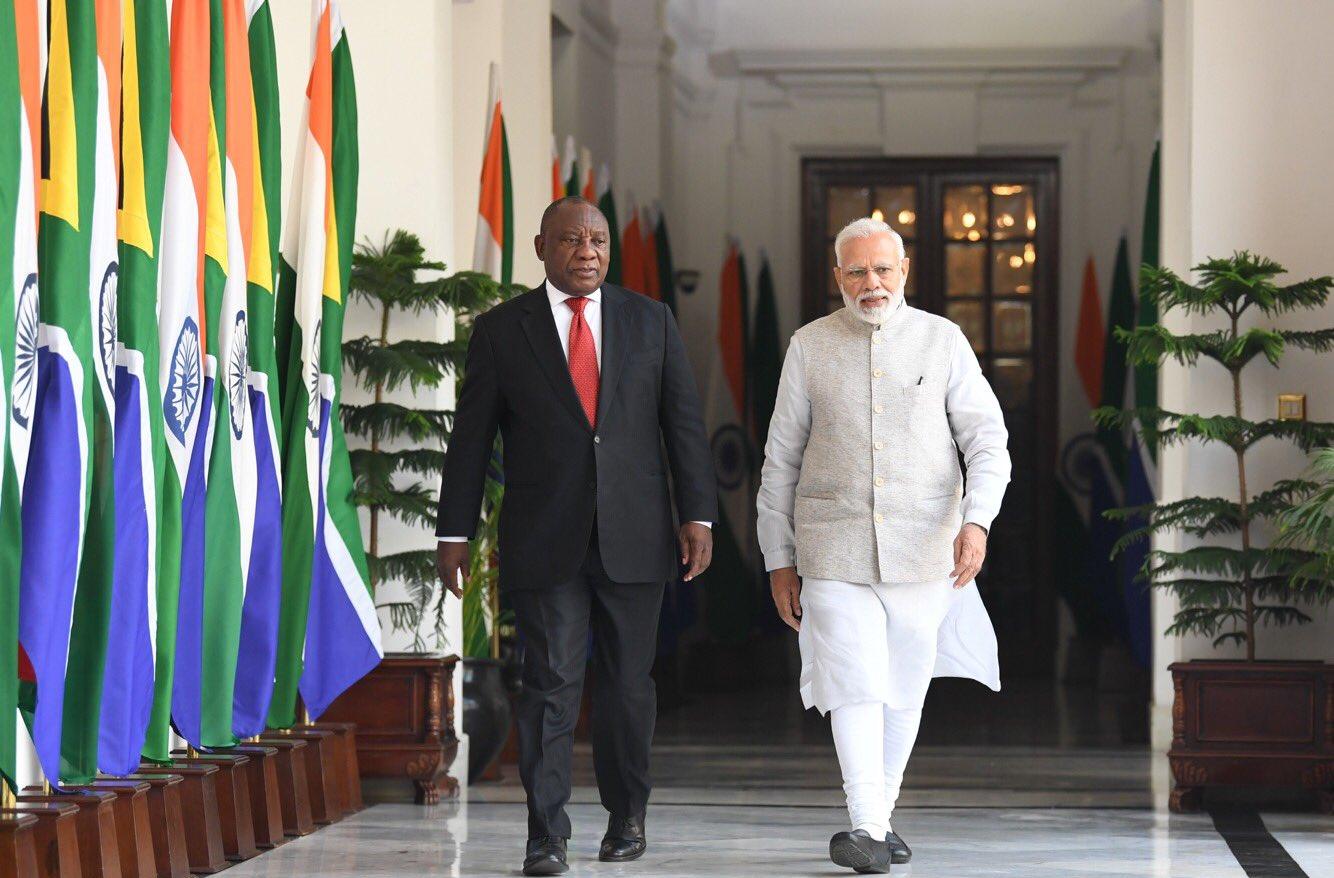

Rather than perpetuating these inequalities and imbalances, developed economies need to advance inclusive formats across all levels of the world economy. This can be done within the framework of G20 by inviting the African Union and other regional groups from the Global South as members or as partners of dialogue; this can also be done by creating task forces and engagement groups that are focused on facilitating technology transfers to developing economies. Another possible venue is the World Trade Organization (WTO) where there is substantial scope to create provisions and groupings that are to lower trade barriers to developing economies and to provide greater access to technologies. Such an inclusive approach in the midst of mounting recessionary fears for the global economy is not only advantageous economically, but it is also more responsible and moral — notably more so than the “value-based” and “moralistic” friend-shoring paradigm.