Interview

A country’s logistics performance is becoming increasingly important for its economic growth, diversification and poverty reduction. It also serves as a development indicator. In 2007, for the first time, the World Bank and Finland's Turku School of Economics launched the Logistics Performance Index to measure countries’ logistics “friendliness.” In this interview for RIAC Dr. Lauri Ojala, initiator and co-author of World Bank’s Logistics Performance Index (LPI), speaks about the Index itself, its trends and Russia’s performance.

Interview

A country’s logistics performance is becoming increasingly important for its economic growth, diversification and poverty reduction. It also serves as a development indicator. In 2007, for the first time, the World Bank and Finland's Turku School of Economics launched the Logistics Performance Index to measure countries’ logistics “friendliness.” In this interview for RIAC Dr. Lauri Ojala, initiator and co-author of World Bank’s Logistics Performance Index (LPI), speaks about the Index itself, its trends and Russia’s performance.

Interviewee: Lauri Ojala, Professor of Logistics at the Turku School of Economics, Finland

Interviewer: Maria Prosviryakova, Russian International Affairs Council

What does the Logistics Performance Index (LPI) measure?

The Logistics Performance Index (LPI) is used to measure economies’ trade logistics environment. In other words, how easy or difficult import, export and transit operations are from the perspective of companies involved in trade, freight forwarding and logistics. The main groups of respondents are freight forwarding professionals and some major logistics companies all over the world. This means that the Index is more relevant to the trade in manufactured goods rather than raw materials like crude oil or iron or coal because they are not transported via freight forwarding companies.

What major factors influence countries’ logistics performance?

The data we have collected is from a worldwide survey. The survey has two parts. The first is International LPI. It compares countries to each other and provides qualitative assessments of any particular country in six areas by its trading partners – who are logistics professionals working outside the country. These six aspects of organizing trade operations are:

- Affordability of international shipments to and from that country;

- Ease of tracking and tracing shipments (not necessarily using real-time IT solutions but knowing where the goods are if problems arise or just knowing when to expect delivery);

- Service quality, or the perceived level of competence of the people dealing with logistics operations in that particular country;

- Timeliness, which is the reliability or predictability of shipments, how likely it is that the shipment will be delivered on time;

- Customs and other border agencies;

- Infrastructure (rails, roads, ports or airports).

So, we ask questions about these six aspects of trade logistics. The questions are selected based on day-to-day experience of freight forwarding companies that are responsible for organizing all the logistics operations.

The second part is Domestic LPI, this provides both qualitative and quantitative assessments of a country by logistics professionals working within it. It includes detailed information on the logistics environment, core logistics processes, institutions, performance time and cost data.

What key trends in logistics have been identified for the 6 years since the Index was launched in 2007? Why do we see these trends?

This survey happens once every two years. We have done it 3 times and we are now preparing the 2014 report that will be launched next spring. I want to reiterate that this is a survey, not hard data. Though the respondents’ demographics are quite similar, the respondent group is different every time.

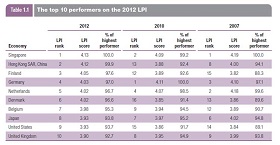

Nevertheless, one major development over the past 6 years is that the overall score for 155 countries (150 countries in the first assessment) has gone up over the period from 2007 to 2012. Although in individual countries it could have risen or fallen depending on local peculiarities, generally speaking, the operating environment has become easier as far as these six aspects are concerned.

It also means that, unless countries in the medium range of the ranking want to see their position slide, they need to keep up that good operation environment. That is why the report is called “Connecting to Compete”. You want better connections and easier and more predictable operations, because the difficulty/ease of trade depends on these aspects. Also, distribution between countries at the top and countries at the bottom has been generally stable.

How does the Logistics Performance level vary across developed and developing countries? What are the major causes of these differences?

There are distinct differences between more developed and developing countries. One thing to keep in mind is that, for large countries like Russia, the United States, China or Brazil, the Index tells us the level of logistics performance in major trade-oriented parts of those countries. In other areas of large countries the situation may be strikingly different. This is a simplification, but we treat those countries as single entities.

It is not a surprise that the European Union countries, the United States and Canada, Australia, Singapore, South Africa, Turkey and even China get high rankings. Developed countries tend to have high scores across all six dimensions, especially countries at the very top of the ranking. Countries at the lower end of the ranking perform poorly on some aspects.

What does the Logistics Performance Index’s dynamics indicate about the level of logistics performance in Russia (which ranked 95th out of 155 countries)? How does it compare with global trends?

When we look at indications from former Soviet countries or CIS countries it seems that, for a number of reasons (language, legacy), trade within those countries is relatively easier than it is with outside economies.

As for Russia, from an outsider’s perspective, it is seen as a problematic and unpredictable country in terms of organizing and planning trade operations. In Russia, for example, the customs dimension is particularly weak from an outsider’s perspective.

What could be done to improve Russia’s performance?

It is not about Russia alone – it is generally about all countries that are in the lower part of the ranking. There is no one single thing that can be done to improve the situation dramatically. Rather, several things need to be thoroughly worked on. Russia can work on the efficiency and transparency of its customs and other border agencies. It is difficult to know how procedures involving a number of agencies (not only customs.) work, how long they take or what it costs (taking both official and sometimes unofficial payments into account).

It would also help to straighten out some of the issues of Russia’s WTO membership and the parallel development of the Customs Union of Kazakhstan, Belarus and Russia. Making this all work in parallel is not easy, but it would certainly improve Russia’s overall performance in this respect.

What is the practical use of the information provided by the Index?

One of the major reasons why the World Bank wanted to start developing this indicator in the first place was to understand how easy or difficult the Baltic States are perceived as trading nations. Eventually, when we launched this indicator in much broader and in a more detailed fashion, it became a standard for many governments that follow the rankings quite closely.

Some countries like South Africa, Thailand, Indonesia, or Malaysia use the LPI as a development indicator. They are trying to keep the level they have reached. On the policy-making side, governments find it useful as a sort of argumentation or advocacy.

The World Bank and other developmental agencies, like the Asian Development Bank, the African Development Bank and others use the Index as an indicator of the development level.

Multinational companies regularly use the LPI as one of the many indicators when they are, for example, preparing feasibility studies for the return of investments or looking for locations for some of their distributions and so on.

Also, academics and researchers use the Index in a number of ways. So, there are a number of practical uses for it. Is it not a perfect indicator, but it is the only one that gives a rough idea of where a country stands in terms of logistics performance.

These are individual views of Prof. Ojala, and they do not represent any official view of The World Bank.