Liberalization of Natural Gas Exports to Help Russia Restore Positions on the European and Global Markets

In

Login if you are already registered

(no votes) |

(0 votes) |

Senior Fellow at East-West Institute, Brussels

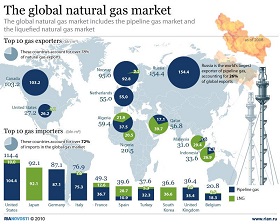

The U.S. shale revolution and global economic crisis have drastically changed Russia's natural gas market, with independent companies building up production, purchasing new assets and making new deals with Gazprom's former and current clients, all this against the backdrop of the giant's declining financials. Independent actors are also eager to obtain export licenses. Should certain conditions be met, liberalized exports would certainly serve Russia's national interests and strengthen the position of its natural gas on the European energy market and worldwide.

The U.S. shale revolution and global economic crisis have drastically changed Russia's natural gas market, with independent companies building up production, purchasing new assets and making new deals with Gazprom's former and current clients, all this against the backdrop of the giant's declining financials. Independent actors are also eager to obtain export licenses. Should certain conditions be met, liberalized exports would certainly serve Russia's national interests and strengthen the position of its natural gas on the European energy market and worldwide.

Background

The reform of the Soviet gas industry in the early 1990s gave rise to independent gas producers (IGPs) like Itera and Novatek, as well as to private, vertically integrated oil companies specializing basically in associated petroleum gas (APG).

Due to low hydrocarbon pricesin the 1990s, only Gazprom could afford large-scale gas production. Itera was mainly engaged in reselling Central Asian gas, while Novatek was a relatively minor producer. Reassessment of natural gas as a major source of export revenue became possible only after global hydrocarbon prices increased.

The reform of the Soviet gas industry in the early 1990s gave rise to independent gas producers (IGPs) like Itera and Novatek, as well as to private, vertically integrated oil companies specializing basically in associated petroleum gas (APG).

Nevertheless, the shift in leadership at Gazprom in the 2001 and the 2006 “Law on Gas Exports” [1] have drastically complicated life for independent producers, who have had no access to foreign markets and have had to suffice with domestic sales at low regulated prices. In fact, the centralization has made Gazprom the only company motivated to increase gas production for selling domestically and abroad. The IGPs appeared emasculated, with no chance of challenging Gazprom either domestically or internationally. The virtually nonexistent control over the utilization of associated gas and the lack of openings for natural gas sales at commercial prices has brought about epidemic gas flaring at production locations. As a result, oil companies lack incentives to increase their gas production.

New Energy Realities

The U.S. shale gas revolution, the global economic crisis and the APG utilization legislation have drastically changed the energy landscape both in Russia and globally. The crisis has generated a considerable drop in natural gas consumption, first of all in the European Union. Shale gas production in the United States and the emergence of new suppliers like Qatar have glutted the European and North American markets in favor of hydrocarbon importers in their negotiations with the leading exporters. In Russia this trend resulted in stagnation of domestic gas demand and disappearance of internal gas deficit.

On January 8, 2009, then prime minister Vladimir Putin signed Executive Order “On Measures to Bring down Atmospheric Pollution with Flared Petroleum Gas at Production Locations”, which set the flared APG target figure at a maximum of five percent beginning January 1, 2012 [2], with violators to be substantially fined. Despite some problems with the implementation, the Executive Order has definitely boosted APG production. In late 2012, year-on-year growth in petroleum gas production was 4.8 percent – from 68.5 billion cubic metres (bcm) in 2011 to 71.8 billion cu. m in 2012 – while nationwide production of oil and gas condensate increased only by 1.3 percent.

Expansion of Independent Gas Producers

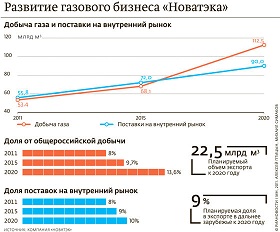

At the same time, gas companies built up their presence on the home market, to a great extent due to effective control over production costs. The share of IGPs in Russia’s gas production climbed from 9.9 percent (55 billion cu. m) in 2000 to 14.6 percent (96 billion cu. m) in 2012 [3]. Independent producers managed to build up production despite an overall output drop in 2012, which fell by 2.3 percent to 655.007 billion cu. m, as reported by Central Dispatching Department of the Fuel and Energy Complex [4].

In 2012, Novatek raised its gas production by

7.1 percent to 57.32 billion cu. m, its share in

domestic supplies growing from 14.3 to

16.3 percent

In 2012, Novatek raised its gas production by 7.1 percent to 57.32 billion cu. m, its share in domestic supplies growing from 14.3 to 16.3 percent [5]. Rosneft brought its gas production to 16.39 billion cu. m, i.e. 28.1 percent more than in the previous year. However, Rosneft’s increase in production is primarily coming from the JV with Itera [6]. In 2013, Rosneft plans to produce 41 billion cu. m jointly with TNK-BP and Itera [7]. At the same time, Gazprom has dramatically decreased its output from 513.2 bcm in 2011 to 487 bcm in 2012, as a result of a drop in foreign sales by four percent and in home sales by nine percent [8].

In 2012, Novatek and Rosneft took several significant steps to consolidate their position both within Russia as well as abroad. Two key Russian gas independents also pledged to increase their production up to 112 and 100 bcm respectively by 2020 [9].

Both Novatek and Rosneft strategies are based on the assertive merger and acquisition (M&A) policies focused on the extension of their reserves and client base, as well as on the acquisition of new “greenfield” licenses for hydrocarbon production.

At first, the most active was Novatek, a company specializing in the production of gas and condensate [10]. In late 2010, Novatek bought 25.5 percent of SeverEnergy shares (proven reserves at 1.3 trillion cubic meters of gas and 155 million tons of condensate) and 51 percent of Sibneftegaz (proven reserves at 290 bcm) [11]. In August 2011, Novatek obtained the license for the development of four gas-condensate fields in the Yamal Peninsula, and in November 2012 bought 49 percent of Northgas, another independent gas producer, for 1.375 billion dollars [12]. As of December 31, 2011, the proven reserves of Northgas were assessed at 1.7 billion barrels of oil equivalent [13].

In 2013, 40 percent of Gazprom's domestic supply contracts for 88 billion cu. m will expire, and independent producers are sure wrestle for these clients.

Novatek also purchased gas distribution company Mezhregiongaz Chelyabinsk, while Leonid Michelson and Gennady Timchenko, its shareholders, became co-owners of petrochemical holding Sibur, Russia's largest petrochemical company that at the same time became a major client of Novatek. In January 2013, the Novatek shareholders' meeting approved the agreement for providing Sibur in 2014-2033 with up to 36 million tons of light hydrocarbons and eight million tons of liquefied hydrocarbon gas (LHG) for a ceiling amount of 510 billion rubles. In December 2011, Novatek purchased 100 percent of Gazprom Mezhregiongaz Chelyabinsk to obtain access to new recipients.

Russia's top IGPs also reached major industrial consumers, such as former Gazprom clients. In August 2012, generating company E.ON Russia reported that in 2013-2027 it was going to buy from Novatek a gas volume worth 702 billion rubles [14]. The Russian branch of Fortum announced its intention to buy from Novatek gas worth 146 billion rubles during the coming 15 years [15]. In addition, Novatek has become the exclusive supplier of fertilizer producer Uralkali and signed a contract with Mosenergo for pumping 27 billion cu. m of gas in 2013-2015 [16]. The independent producer also went to the European gas market. In October 2012 Novatek started to supply German utility EnBW in the framework of a 10-year contract signed in July 2012. Total deliveries are expected to reach 20 bcm [17].

In March 2013 Rosneft closed a deal for acquiring

100 percent of the TNK-BP shares

Rosneft has also expanded its presence in the gas segment of Russia's energy market. In August 2012, the oil firm bought 51 percent of IGP Itera (production at 12.6 bcm in 2011; Rosneft recently acquired the totality of Itera’s shares), and in March 2013 it closed a deal for acquiring 100 percent of the TNK-BP shares. These assets will help Rosneft raise gas production to 41 billion cu. m as soon as 2013. Just like Novatek, Rosneft has expanded its share of the domestic market by signing two long-term contracts for gas supplied to InterRAO (875 billion cu. m in 2016-2040) and Fortum [18]. Rosneft also inherited clients of Itera and TNK-BP.

Excessive Gas Supply to Challenge Gazprom's Export Monopoly?

In 2013, 40 percent of Gazprom's domestic supply contracts for 88 billion cu. m will expire [19], and independent producers are sure wrestle for these clients. They are beating Gazprom on many accounts – plentiful reserves of highly profitable LHG and condensate in the production balance, as well as the absence of social commitments for gasification of residential areas. Besides, IGPs are less dependent on the Federal Tariffs Service that sets minimum and maximum gas prices for gas supplied to the domestic users [20]. Free from government instructions, independent producers may often offer more advantageous and flexible conditions since there the supply in Russia is abundant.

Situation in Russia: Mirror Reflection of the recent market trends in Europe?

Gazprom's export monopoly is threatened not only by the growing IGP activities but also by certain objective external factors, i.e. establishment of the EU common energy market based on the Third Energy Package.

The situation partially coincides with the development of the European gas market over the past five years, when the newcomers used dumping to unseat some traditional suppliers, for example Gazprom. Auctions launched last autumn may aggravate competition on the domestic market. Too much supply gives rise to rivalry even among the newcomers. For example, in 2016 Rosneft is going to replace Novatek as the main gas supplier for InterRAO that is now purchasing 30 percent of gas produced by Novatek. Just like in the U.S.A., harsher competition could help restore national industry, but at the same time will complicate achieving equal profitability of domestic and export prices. The absence of equal profitability should boost aspirations of independent producers to export, with Novatek and Rosneft announcing plans to sell liquefied natural gas (LPG) abroad.

Gazprom Positions in Europe in Danger?

Gazprom's export monopoly is threatened not only by the growing IGP activities but also by certain objective external factors, i.e. establishment of the EU common energy market based on the Third Energy Package. One may already see the appropriate signs in the troubled advancement of South Stream, and trends toward the fragmentation of Gazprom's assets in certain EU countries, for example in Lithuania.

In July 2011, Vilnius adopted a law on natural gas to virtually nationalize Gazprom's pipelines [21]. In fact, the law prescribes a split before October 2014 of gas transportation and distribution currently handled by Lietuvos dujos, which belongs to E.ON Rurhgas (38.9 percent) and Gazprom (37.1 percent).

Gazprom had difficulties (due to the existing EU regulations) to fully using Opal pipeline to deliver gas from Nord Stream to Germany and Czech Republic, as well as to go ahead with the South Stream. Based both on economic and purely political factors, the trend suggests a replacement of Gazprom gas with alternative deliveries of LNG, pipeline gas from Norway and, later, from the Caspian area. Hence, concentration of natural gas exports in the hands of Gazprom seems irrelevant as it may weaken Russia's positions in the European market and reduce its share in the EU gas balance.

Export Liberalization as Way Out of the Current Crisis?

Gazprom had difficulties to fully using Opal pipeline

to deliver gas from Nord Stream to Germany and

Czech Republic

Partial liberalization of exports will serve Russia's economic interests, as IGP foreign sales will not only help grab new market segments uncovered by Gazprom but also increase federal budget revenues through more export duties. At the same time, IGPs should take up some of Gazprom commitments for domestic gasification.

Independent gas producers might also contribute to the expansion of LNG deliveries to Asia. For example, the development of LNG assets is a key priority of Russian energy strategy. Moscow is planning to drive its exports from the current 9.8 million tons (four percent of world production) in 2011 [22] to 40 million tons in 2020 [23]. With its existing terminals in Sakhalin and future terminal in Vladivostok, Gazprom is likely to require assistance both from Novatek (Yamal LNG project) and Rosneft, including cooperation in exports.

The export liberalization should be carried out cautiously and gradually to avoid unnecessary competition between different producers and upstream projects. For instance, the introduction of export quotas and destination clauses, setting geographical limits for the specific export deliveries of natural gas, and general strategic and day-to-day tactical coordination between Gazprom and IGPs.

Setting up an export regulator also seems sensible. The Energy Ministry has already suggested establishing a specialized state body to distribute flows among markets [24]. Realized gradually, a strategy like that should help augment gas exports, increase budget revenues and strengthen Russia's posture on the global energy market.

The issue appears exceptionally urgent due to the current global rearrangement of key natural gas markets. New producers, such as Australia and Qatar, are on the offensive, with deliveries from East Africa, the United States, the Caspian and Eastern Mediterranean to come next. Russia should act swiftly to retain the status of a leading global energy power.

Moscow should not fear losing control over the natural gas flows, since the government will still control the export channel by setting export duties and quotas. One should also remember that one of Russia’s key IGPs – Rosneft – is a state-controlled energy company.

1. See Russian Federation Federal Law No. 117-FZ dated July 18, 2006http://www.rg.ru/2006/07/20/gaz-export-dok.html

2. Cited by ConsultantPlus legal database http://base.consultant.ru/cons/cgi/online.cgi?req=doc;base=LAW;n=137666

3. Author's assessment based on data from media (Interfax, RIA Novosti) and data from the Central Dispatching Department of Fuel and Energy Complex.

4. Data cited by http://ria.ru/economy/20130208/921879837.html#ixzz2Rwdw4iam

5. Novatek: Review of Production Results and Financial Status for 2012 http://www.novatek.ru/ru/investors/reviews/

6. Rosneft Data of February 1, 2013 http://www.rosneft.ru/news/pressrelease/01022013.html

7. See Presentation to the Address of Rosneft President Igor Sechin in New York http://www.rosneft.ru/attach/0/07/06/prezent_sechin_NY.pdf

8. See Gazprom in Figures 2008-2012: Handbook http://www.gazprom.ru/f/posts/30/948971/gazprom-reference-figures-2008-2012-rus.pdf

9. See presentation of Rosneft President Igor Sechin in New York http://www.rosneft.ru/attach/0/07/06/prezent_sechin_NY.pdf and http://www.novatek.ru/en/investors/strategy/

10. Russia's second largest gas producer independent gas company Novatek was founded in 1994.

11. See http://ria.ru/company/20101130/302744565.html

12. See http://top.rbc.ru/economics/06/11/2012/823628.shtml

13. Novatek Board Approves Purchase of 49 Percent of Northgas Shares, Interfax, November 9, 2012

14. See http://top.rbc.ru/economics/13/11/2012/824696.shtml

15. Ibid.

16. See http://investcafe.ru/blogs/36105324/posts/23953 and http://m.oilcapital.ru/company/192467.html

17. See http://www.forbes.ru/news/168514-novatek-nachal-postavki-gaza-nemetskoi-enbw

18. See http://www.1prime.ru/COMPANIES/20121205/757067004.html

19. See http://www.rbcdaily.ru/tek/opinion/562949985099114

20. See Order No. 89-e2 of the Federal Tariffs Service, dated May 4, 2012 http://www.fstrf.ru/tariffs/info_tarif/gas/organizations/281

21. http://www.rg.ru/2011/07/13/litva-anons.html

22. http://www.bp.com/extendedsectiongenericarticle.do?categoryId=9041232&contentId=7075237

23. http://pronedra.ru/gas/2013/04/12/proizvodstvo-spg/

24. http://www.vedomosti.ru/companies/news/11075381/spg_na_soglasovanie

(no votes) |

(0 votes) |