The current instability of the Chinese Stock Market is likely to become the leading headline in finance this year. The “Chinese economic miracle” has continued unabated for some 35 years now, and the stable, double-digit economic growth had to come to an end at some point. And while the slowdown is now in full swing, its 7.4 per cent GDP growth rate in 2014 is the stuff that dreams are made of for the remaining G20 countries.

The current instability of the Chinese Stock Market is likely to become the leading headline in finance this year. The “Chinese economic miracle” has continued unabated for some 35 years now, and the stable, double-digit economic growth had to come to an end at some point. And while the slowdown is now in full swing, its 7.4 per cent GDP growth rate in 2014 is the stuff that dreams are made of for the remaining G20 countries.

There are many reasons behind the Chinese Stock Market’s current woes. Some are fundamental in nature and are beyond the scope of stock exchange regulations and allowing economic agents access to the market. Others are amenable to change and thus can be corrected in short time.

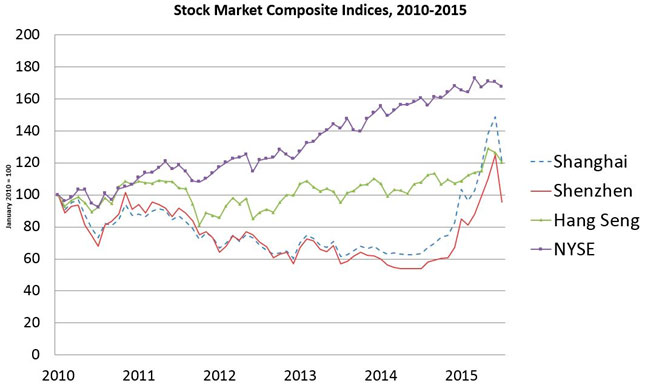

The crisis hit its peak when the Shanghai, Shenzhen and other major Chinese stock exchanges suffered a correction after they had enjoyed a 150 per cent growth in their capitalization over the previous 12 months. At a time in 2014 when the Chinese economy was growing at its slowest rate for 25 years, security prices on Chinese exchanges surged – the result of speculation and the reluctance of regulators to restrict market access for certain parties. And the correction was a big one: in July 2015, the leading Chinese stock exchanges fell by 30 per cent, more than $3 trillion in monetary terms.

This volatility can be explained in a number of ways. Today, the majority of investors in China are not professionals. Recently published data reveal the extent of the problem: 90 per cent of all people who engage in margin trading on the stock exchanges do not have financial education; 60 per cent do not even have a university degree. Savings rates in Asian countries are traditionally high, but there are no safe havens for Chinese money today: interest on deposits is low and the real estate market is suffering. Consequently, the stock market has become the last and only resort for those looking to invest. It was only a matter of time before the market overheated. The dynamics of stock indexes confirms this (see Table 1).

The transformation of millions of Chinese citizens into financial brokers was a forced move that exposed the fallibility of the Chinese market model, which somewhat bizarrely combines rigid state regulation with islands of economic freedom. After the global crisis of 2008, the measures taken by the Chinese government to liberalize the national economy were wholly inconsistent. The “fourth generation” of leaders of the People’s Republic of China (General Secretary Hu Jintao and Premier Wen Jiabao) chose to avoid radical reforms, preferring instead to ride the wave of the boom period that followed the country’s accession to the WTO in 2001.

The expansion of Beijing’s foreign trade narrowed sharply after 2008. This is why the fifth generation of Chinese leaders under General Secretary Xi Jinping and Premier Li Keqiang, who came to power in 2012–2013, were forced to act more decisively. The goal was to transform the economic structure of the country, to move away from exports as the main driver of the economy and towards domestic demand, the production of hi-tech goods and the development of the services industry. Thus, China is now undergoing a period of structural transformation. And it would have been overly optimistic to expect that all would go smoothly. The slowdown is being called the Chinese version of the post-crisis New Normal policy, which implies qualitative development, efficient growth and avoiding the policy of “GDP growth at any cost”.

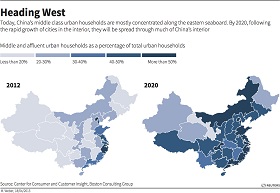

The switch to an economy based on innovative development is taking place in the very specific conditions of the Chinese political and economic model. This means that there is no opposition party and the country lacks market institutions and transparency in its economic decisions. What is does have is corruption, cronyism, underdeveloped industries and regions where hundreds of millions of people live in poverty. Other reasons for China’s “transition” to a new economic structure include its massive corporate debt ($16.1 trillion), the dire state of its provincial budgets, the overcapacity of 19 of the 29 major industries, the outflow of foreign investments, declining foreign trade and a debilitating real estate crisis. It has become commonplace for the general public and the authorities to be at loggerheads over economic issues. The country’s growing middle class is calling for more rights, and the Chinese authorities are having trouble ignoring it.

The external environment is also unfavourable for China, with continuing tensions over territorial disputes in the South China Sea and negotiations on the U.S.-led Trans-Pacific Partnership (TPP) almost complete. The TPP will cover 40 per cent of the world’s economy and it is intended to restrict the access of Chinese goods to neighbouring markets.

The decisive actions taken by the Chinese government in June and July 2015 have steadied the situation on the stock markets. The key measures taken include: banning state corporations and private stakeholders from selling their share; having the People’s Bank of China reduce its rates and reserve requirements; implementing a temporary ban on IPOs; and increasing China Securities Finance (CSF) support to $80 billion (CSF is a state institution that provides margin financing to brokers). Expert estimates suggest that the Chinese authorities spent $480 billion bailing the stock market out. The volatility of the market remains however, and it is unlikely to disappear before the end of the year. And this is assuming the measures mentioned above are implemented in full, and that they are accepted by the market entities.

Today, economic growth in China accounts for up to 30 per cent of economic growth around the world. The current crisis will have a negative effect on various sectors of the global economy, including the trade and currency markets. But we are getting a little ahead of ourselves here, as China’s stock market only plays a minor role in attracting investments. This function is performed very successfully by Chinese banks, which have in recent years become some of the largest on the planet (as of the end of 2014, five of the world’s top 10 banks were Chinese).

The summer of volatility on the Chinese stock markets in 2015 has cast a shadow on the Beijing Consensus as an economic model for developing countries to realise economic growth and the “junior” partners of rich Western states to elevate their status. If the actions of the Chinese authorities prove unsuccessful, then liberal theory and its underlying economic policy will enjoy another boom in popularity.